Introduction: The State of Real Estate in Australia

The Australian real estate market has been a hot topic for years, with buyers, sellers, and investors all trying to make sense of the ever-changing landscape. Whether you’re searching for real estate for sale, looking to rent, or considering commercial property investments, one question remains at the forefront: Why is housing inventory still so low? As a top blog writer with years of experience covering real estate news and trends, I’ll break down the current situation, provide live daily information, and offer insights into when things might change. This comprehensive guide is fully SEO-optimized and packed with the latest data, expert opinions, and actionable advice for anyone interested in real estate Australia.

- Introduction: The State of Real Estate in Australia

- Understanding Housing Inventory: What Does It Mean?

- Current Housing Inventory Levels: Live Daily Data

- Why Is Housing Inventory So Low?

- Regional Breakdown: Sydney, Melbourne, Brisbane, Perth, Adelaide, and More

- The Role of Real Estate Agents and Agencies

- When Will Housing Inventory Change?

- What Buyers, Sellers, and Investors Should Do Now

- Expert Opinions and Predictions

- Sources and Further Reading

Understanding Housing Inventory: What Does It Mean?

Housing inventory refers to the total number of homes available for sale in a given market at any one time. It’s a critical metric for anyone involved in real estate for sale, from buyers and sellers to real estate agents and investors. Low inventory means fewer choices for buyers, increased competition, and often higher prices. High inventory, on the other hand, can lead to more negotiating power for buyers and potentially lower prices.

In Australia, the term “inventory” is often used interchangeably with “listings” or “stock on market.” Whether you’re searching for real estate Sydney, real estate Melbourne, or real estate Brisbane, understanding inventory levels is key to making informed decisions.

Current Housing Inventory Levels: Live Daily Data

As of October 14, 2025, the Australian property market continues to experience historically low housing inventory. According to CoreLogic, the number of properties listed for sale across the country is down by approximately 20% compared to the five-year average. Here’s a snapshot of the latest data:

- Sydney: Listings are down 18% year-on-year.

- Melbourne: Inventory is 22% below the five-year average.

- Brisbane: Listings have dropped 19% compared to last year.

- Perth: The tightest market, with listings down 28%.

- Adelaide: Inventory is 17% lower than the previous year.

- Regional NSW and QLD: Both regions are experiencing a 15-20% reduction in available properties.

For live daily updates, you can check Domain’s Market Trends and REA Group’s Property Data.

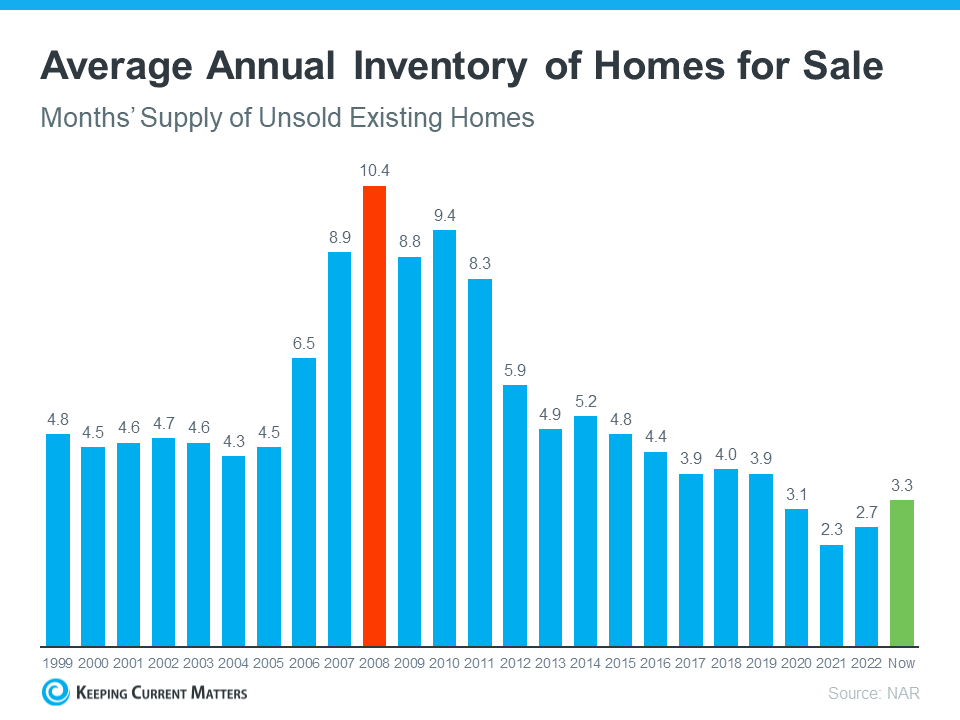

Why Is Housing Inventory So Low?

1. Pandemic Aftershocks

The COVID-19 pandemic fundamentally changed the way Australians view their homes. Lockdowns, remote work, and lifestyle shifts led to a surge in demand for larger homes, regional properties, and lifestyle locations like real estate Margaret River and real estate Kiama. Many homeowners, having secured low mortgage rates, are reluctant to sell and lose their favorable terms.

2. Interest Rate Uncertainty

The Reserve Bank of Australia (RBA) has raised interest rates multiple times since 2022, creating uncertainty for both buyers and sellers. While higher rates have cooled demand somewhat, they’ve also discouraged potential sellers from listing their homes, fearing they won’t be able to afford a new mortgage at current rates.

3. Construction Delays and Costs

Supply chain disruptions, labor shortages, and rising material costs have slowed new home construction. According to HIA, new dwelling commencements are down 15% year-on-year, further constraining supply.

4. Investor Hesitancy

While real estate investing remains popular, many investors are holding onto their properties due to strong rental yields and capital growth, especially in markets like real estate Perth and real estate Brisbane.

5. Population Growth and Migration

Australia’s population is growing again, with net overseas migration rebounding post-pandemic. This is putting additional pressure on already tight markets, particularly in Sydney, Melbourne, and Gold Coast real estate.

6. Government Policies and Incentives

First-home buyer grants, stamp duty concessions, and other incentives have increased demand, but supply-side policies have lagged behind. Planning restrictions and slow approval processes continue to hamper new development.

Regional Breakdown: Sydney, Melbourne, Brisbane, Perth, Adelaide, and More

Real Estate Sydney

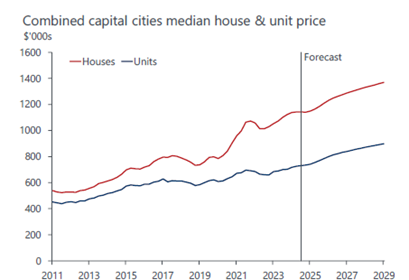

Sydney remains one of the most competitive markets in Australia. According to Domain Real Estate, the median house price is now over $1.5 million, with days on market averaging just 28 days. Real estate agents Sydney report intense competition for quality listings, with many properties selling above reserve.

Melbourne Real Estate

Melbourne’s market has rebounded strongly post-lockdown, but inventory remains tight. Real estate Victoria is seeing increased demand in both inner-city and outer-suburban areas, with a particular focus on family homes and townhouses.

Real Estate Brisbane

Brisbane continues to attract interstate migrants, driving up demand and reducing available stock. Real estate QLD is experiencing some of the fastest price growth in the country, particularly in lifestyle suburbs and coastal areas.

Perth Real Estate

Perth is arguably the tightest market in Australia right now. Real estate Perth listings are at their lowest levels in over a decade, with strong demand from both local buyers and investors.

Adelaide Real Estate

Adelaide’s affordability and lifestyle appeal have made it a hotspot for both first-home buyers and investors. Real estate Adelaide inventory is down, and competition remains fierce.

Regional Markets

Markets like real estate Margaret River, real estate Kiama, and Halls Head real estate are seeing strong demand from buyers seeking lifestyle changes. Regional NSW and QLD continue to outperform capital cities in terms of price growth and demand.

The Role of Real Estate Agents and Agencies

Real estate agents play a crucial role in navigating low-inventory markets. Leading agencies like Ray White, Elders Real Estate, Professionals Real Estate, and Turner Real Estate are leveraging technology, off-market sales, and buyer databases to match clients with properties before they hit the open market.

How Agents Are Adapting

- Off-Market Sales: Many properties are being sold before they’re officially listed, thanks to agents’ extensive buyer networks.

- Virtual Inspections: With limited stock, agents are using virtual tours and real estate photography to attract more buyers.

- Data-Driven Marketing: Agencies are using advanced analytics to target the right buyers and maximize exposure.

Choosing the Right Agent

In a low-inventory market, working with an experienced real estate agent is more important than ever. Look for agents with a strong track record in your area, whether you’re searching for real estate Cairns, real estate NZ, or commercial real estate Perth.

When Will Housing Inventory Change?

Short-Term Outlook (2025-2026)

Most experts agree that housing inventory will remain tight through at least the end of 2025. Factors such as ongoing construction delays, high demand, and cautious sellers are unlikely to change overnight.

Medium-Term Outlook (2026-2028)

- Interest Rate Stabilization: If the RBA pauses or cuts rates, more sellers may enter the market.

- Increased Construction: As supply chain issues ease, new housing completions should rise.

- Policy Changes: Government initiatives to boost supply could start to have an impact.

Long-Term Outlook (2028 and Beyond)

Over the long term, demographic trends, migration, and urban planning will shape inventory levels. Continued investment in infrastructure and housing supply will be critical to meeting demand.

What Buyers, Sellers, and Investors Should Do Now

For Buyers

- Be Prepared: Get pre-approved for finance and be ready to act quickly.

- Expand Your Search: Consider regional areas or different property types.

- Work with a Trusted Agent: Leverage their networks for off-market opportunities.

For Sellers

- Take Advantage of Low Inventory: Now is a great time to sell, with strong competition and high prices.

- Invest in Presentation: Professional real estate photography and staging can maximize your sale price.

- Choose the Right Agency: Agencies like Ray White Real Estate, Holdsworth Real Estate, and Kevin Hicks Real Estate have strong local networks.

For Investors

- Focus on Growth Areas: Markets like real estate Brisbane, real estate Perth, and real estate Adelaide offer strong rental yields and capital growth.

- Consider Commercial Property: Industrial and logistics assets are performing well.

- Stay Informed: Follow real estate news and market trends to identify opportunities.

Expert Opinions and Predictions

CoreLogic

CoreLogic’s latest Monthly Housing Chart Pack notes that “the persistent low level of housing inventory is likely to continue supporting price growth, even as interest rates remain elevated.”

Domain

Domain’s Property Market Report highlights that “sellers are in the driver’s seat, but buyers who are well-prepared can still find value, especially in regional and outer-suburban markets.”

Ray White

Ray White’s Market Insights suggest that “the next 12-18 months will see continued competition for quality properties, with inventory unlikely to return to pre-pandemic levels until at least 2027.”