The Art of the Offer: 5 Killer Strategies to Get Your Bid Accepted in Australia’s Competitive Market

Welcome back to the front lines of the property battlefield. If you’re here, you’ve likely felt the sting. You’ve scrolled through thousands of real estate for sale listings, fallen in love with a property, attended the open inspection, and dared to dream. Then, you put in a strong offer, only to be told you were “close, but no cigar.” You’ve been outbid, outmanoeuvred, or simply left wondering what you could have done differently. The feeling is a potent cocktail of frustration and disappointment, especially in the relentless pace of the real estate Australia market.

- The Art of the Offer: 5 Killer Strategies to Get Your Bid Accepted in Australia’s Competitive Market

- Strategy 1: The Pre-emptive Strike (The “Bully Offer”)

- Strategy 2: The Financial Fortress (Beyond Pre-Approval)

- Strategy 2: The Financial Fortress (Beyond Pre-Approval)

- Strategy 3: The Human Connection (Winning Hearts and Minds)

- Strategy 4: The Clean & Unconditional Offer (Removing All Obstacles)

- Strategy 5: The Data-Driven Price (Know Your Numbers, Not Just Your Emotions)

- Your Daily Market Pulse: Live Information & Sources

- Conclusion: From Bidder to Homeowner

From the bustling streets of real estate Sydney to the vibrant neighbourhoods of Melbourne real estate, and across the sun-drenched landscapes of real estate Brisbane and Perth real estate, the story is the same. Competition is fierce. Buyers are educated, cashed-up, and ready to pounce. In this environment, simply offering the asking price is often just the ticket to enter the race, not win it.

But what if I told you that the highest offer doesn’t always win? What if there was an art to crafting an offer so compelling, so irresistible, that it makes the seller and their real estate agent stop and take notice, even if another bid is a few thousand dollars higher?

For years, I’ve analysed the transactions, spoken with the nation’s top real estate agents—from major players like Ray White Real Estate to boutique local experts like Turner Real Estate in Adelaide or Holdsworth Real Estate in the Sydney suburbs—and I’ve distilled the winning formula. It’s not about luck; it’s about strategy. It’s about presenting yourself not just as a number on a page, but as the perfect buyer for that property.

Today, we’re moving beyond the basics. We’re diving deep into five powerful, actionable strategies that will transform your offer from a simple bid into a strategic masterpiece. Whether you’re a first-home buyer, an experienced upgrader, or delving into real estate investing, these tactics will give you the decisive edge you need. Let’s get your offer accepted.

Strategy 1: The Pre-emptive Strike (The “Bully Offer”)

In a market where properties are scheduled for a four-week auction campaign, waiting for the big day can be agonising. You watch as more and more potential buyers tour the home, the agent’s list of interested parties grows, and your chances of a bidding war skyrocket. The pre-emptive offer, often called a “bully offer,” is your move to disrupt this entire process.

What Exactly is a Bully Offer?

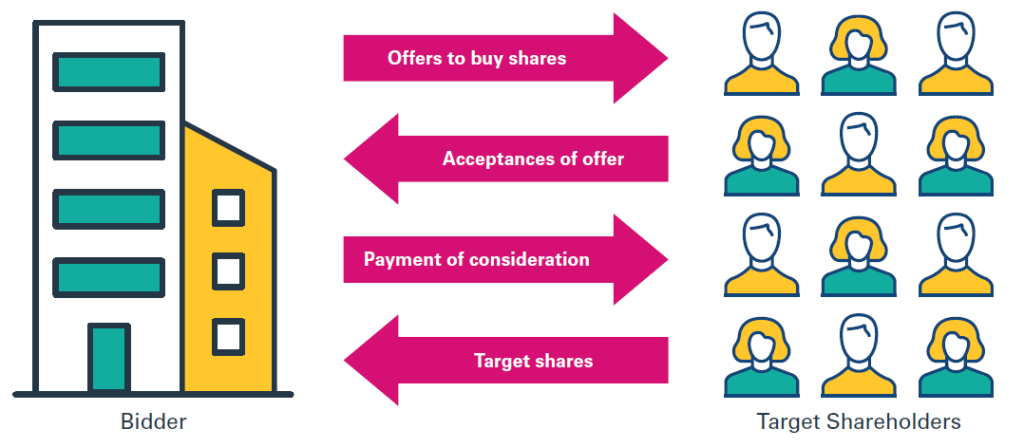

A bully offer is an unsolicited, unconditional, and typically very strong offer made on a property before its scheduled auction or sale date. The goal is simple: to present an offer so compelling that the vendor feels it would be too risky to turn it down and proceed to auction. You are essentially telling them, “Here is a fantastic, certain outcome. Take it now, or gamble on getting a better one in a few weeks.”

This isn’t just about price. A true bully offer is a complete package designed for maximum psychological impact:

- A Standout Price: It must be significantly above the initial price guide to make the vendor seriously consider forgoing the auction.

- Unconditional Terms: This is crucial. It means your finance is rock-solid (more on this in Strategy 2), and you’re waiving conditions like a cooling-off period or a “subject to building and pest” clause (after having done your due diligence beforehand, of course).

- A Signed Contract and a Cheque: You don’t just say you’ll offer; you present the signed contract of sale with a deposit cheque attached. This shows you are not a time-waster. You are ready to transact now.

- A Strict Deadline: The offer is typically valid for a very short period, often just 24-48 hours. This applies pressure and prevents the selling agent from using your offer to shop around for higher bids from other potential buyers.

This strategy is particularly effective in markets like real estate NSW and real estate Victoria, where auction culture is dominant. A skilled real estate agent will always advise their client on the merits of such an offer, weighing the certainty of your bid against the potential, but uncertain, upside of an auction.

When Does it Work, and When Does it Backfire?

Timing and context are everything. A bully offer works best when:

- The Vendor is Nervous: They might be worried about the auction, need a quick sale for personal reasons, or simply be risk-averse.

- Interest is Moderate: If the agent has had a few groups through but isn’t being swamped, they know the auction isn’t a guaranteed runaway success. Your strong, certain offer becomes incredibly attractive.

- You’ve Done Your Homework: You know the true market value and are confident your offer is both aggressive and sensible. You’re not just throwing money away; you’re paying a premium for certainty.

It can backfire if:

- The Property is a “Unicorn”: For that one-of-a-kind property with massive emotional appeal in a sought-after suburb like those in

real estate Kiamaorreal estate Margaret River, the agent is likely confident they can start a bidding war. Your bully offer might just become the new “floor” price they use to motivate other buyers. - Your Offer is Too Weak: A lowball “bully” offer is an oxymoron. It will be dismissed and may even offend the vendor, damaging your credibility.

Working with an experienced buyer’s agent or one of the top real estate agents who understands the local market, perhaps from a trusted name like Professionals Real Estate or a local legend like Kevin Hicks Real Estate in the Goulburn Valley, can provide invaluable insight into whether a pre-emptive strike is the right move.

Strategy 2: The Financial Fortress (Beyond Pre-Approval)

In a competitive offer situation, the vendor and their agent are assessing one primary thing: risk. Every condition you add to your offer is a potential exit ramp for you and a potential point of failure for their sale. The buyer who presents the least risk is often the most attractive, even if their offer isn’t the absolute highest. Building a “Financial Fortress” is about eliminating any doubt in the seller’s mind about your ability to complete the purchase.

Pre-Approval is the Bare Minimum; Unconditional is the Gold Standard

(H3) Pre-Approval is the Bare Minimum; Unconditional is the Gold Standard

Nearly every serious buyer has a pre-approval letter from their bank. It’s the entry ticket. But a pre-approval is not a guarantee of finance; it’s an indication that the bank is likely to lend you the money, subject to their own valuation of the property and a final check of your circumstances.

To truly stand out, you need to go a step further.

- Seek Unconditional Finance Approval: Work closely with your mortgage broker or lender to get as close to a full, unconditional approval as possible before you even make an offer. This involves providing the lender with the contract of sale for the specific property you’re targeting. They can then conduct their valuation and give you the green light. Being able to confidently strike out the “subject to finance” clause is perhaps the single most powerful move you can make.

- Have Your Deposit Ready: Don’t just say you have the 10% deposit; prove it. Have the funds in a readily accessible account. When you make the offer, you can even provide a bank statement (with sensitive details redacted) as evidence. This demonstrates preparedness and seriousness.

This level of financial readiness is a non-negotiable for serious players in the commercial real estate world, and residential buyers should adopt the same mindset. Whether it’s a warehouse in commercial real estate Perth or a family home in real estate Adelaide, certainty of funds is king.

Leverage Your Team: The Power Broker and Solicitor

Your professional team can be a powerful asset. When the selling agent calls your mortgage broker to verify your financial position, you want them to be met with overwhelming confidence. A good broker will not just confirm your approval; they will “sell” you as a buyer, stating that you are a low-risk, highly qualified applicant and that the funds are as good as in the bank.

Similarly, having your solicitor or conveyancer review the contract of sale before you make an offer allows you to bid with confidence. They can identify any red flags and give you the all-clear to sign on the dotted line without needing a lengthy review period, further cleaning up your offer. This is a standard practice for anyone serious about real estate investing and should be for every homebuyer.

Strategy 2: The Financial Fortress (Beyond Pre-Approval)

In a competitive offer situation, the vendor and their agent are assessing one primary thing: risk. Every condition you add to your offer is a potential exit ramp for you and a potential point of failure for their sale. The buyer who presents the least risk is often the most attractive, even if their offer isn’t the absolute highest. Building a “Financial Fortress” is about eliminating any doubt in the seller’s mind about your ability to complete the purchase.

Pre-Approval is the Bare Minimum; Unconditional is the Gold Standard

(H3) Pre-Approval is the Bare Minimum; Unconditional is the Gold Standard

Nearly every serious buyer has a pre-approval letter from their bank. It’s the entry ticket. But a pre-approval is not a guarantee of finance; it’s an indication that the bank is likely to lend you the money, subject to their own valuation of the property and a final check of your circumstances.

To truly stand out, you need to go a step further.

- Seek Unconditional Finance Approval: Work closely with your mortgage broker or lender to get as close to a full, unconditional approval as possible before you even make an offer. This involves providing the lender with the contract of sale for the specific property you’re targeting. They can then conduct their valuation and give you the green light. Being able to confidently strike out the “subject to finance” clause is perhaps the single most powerful move you can make.

- Have Your Deposit Ready: Don’t just say you have the 10% deposit; prove it. Have the funds in a readily accessible account. When you make the offer, you can even provide a bank statement (with sensitive details redacted) as evidence. This demonstrates preparedness and seriousness.

This level of financial readiness is a non-negotiable for serious players in the commercial real estate world, and residential buyers should adopt the same mindset. Whether it’s a warehouse in commercial real estate Perth or a family home in real estate Adelaide, certainty of funds is king.

Leverage Your Team: The Power Broker and Solicitor

Your professional team can be a powerful asset. When the selling agent calls your mortgage broker to verify your financial position, you want them to be met with overwhelming confidence. A good broker will not just confirm your approval; they will “sell” you as a buyer, stating that you are a low-risk, highly qualified applicant and that the funds are as good as in the bank.

Similarly, having your solicitor or conveyancer review the contract of sale before you make an offer allows you to bid with confidence. They can identify any red flags and give you the all-clear to sign on the dotted line without needing a lengthy review period, further cleaning up your offer. This is a standard practice for anyone serious about real estate investing and should be for every homebuyer.

Strategy 3: The Human Connection (Winning Hearts and Minds)

Real estate is a transaction, but it’s a deeply emotional one. People are selling their homes, not just a collection of bricks and mortar. They’re selling the place where their children took their first steps, where they celebrated milestones, and where they built a life. Tapping into this emotional element can be your secret weapon.

The “Dear Seller” Letter: Your Personal Pitch

While some agents may discourage it, a well-written, heartfelt letter can tip the scales in a close contest. This isn’t a sob story; it’s a genuine connection. The letter should accompany your offer and briefly:

- Introduce Yourself and Your Family: “We are the Smith family, with two young children, and we’ve been searching for the perfect home in this community.”

- Explain What You Love About Their Home: Be specific. Don’t just say it’s a nice house. Mention the beautiful jacaranda tree in the backyard where you can imagine your kids playing, or how the open-plan kitchen is perfect for your love of family cooking. This shows you’ve paid attention and appreciate the care they’ve put into it.

- Paint a Picture of Your Future: “We can already see ourselves hosting Christmas lunch in that dining room and creating memories here for years to come, just as you have.”

- Reassure Them: Briefly mention your stable financial position and your commitment to a smooth, hassle-free settlement.

This humanises you. If a vendor has two near-identical offers on the table, are they going to choose the faceless investor from a real estate Broke syndicate or the young family who clearly loves their home as much as they did? The answer is often the latter. This tactic is particularly potent in community-focused areas, from Swan View in WA to the tight-knit suburbs of real estate SA.

Building Rapport with the Real Estate Agent

Remember, the real estate agent is the gatekeeper and the vendor’s most trusted advisor. Your relationship with them matters immensely. Throughout the process:

- Be Professional and Personable: At the open

inspection, be polite, ask intelligent questions, and show genuine interest. - Communicate Clearly: Be responsive to their calls and emails. Make their job easy.

- Be Honest: Don’t play games. If they ask for your best offer, give it to them. Agents have long memories, and a reputation for being a straightforward, reliable buyer will serve you well, not just on this property but potentially on future ones they list.

A good agent, like those at Elders Real Estate or a local specialist in Gold Coast real estate, wants a clean, simple transaction. If they know you are organised, reliable, and pleasant to deal with, they will advocate for your offer to the vendor. They will present you as the “path of least resistance.”

Strategy 4: The Clean & Unconditional Offer (Removing All Obstacles)

This strategy dovetails with the others but focuses on the contractual terms of your offer. The goal is to strip away every possible condition and contingency, presenting the vendor with a simple, unambiguous “yes.” This is about removing their cognitive load and making your offer the easiest one to accept.

Understanding “Subject To” Clauses and When to Waive Them

A standard contract is often filled with “subject to” clauses, which are conditions that must be met for the sale to proceed. The most common are:

- Subject to Finance: As discussed, this is the big one. Removing it is a massive advantage.

- Subject to Building and Pest Inspection: This allows you to back out if the inspection reveals significant problems. To make a clean offer, you should arrange for a building and pest

inspectionto be done before you submit your bid. It’s a small upfront cost (a few hundred dollars) for a huge strategic advantage. - Subject to the Sale of Another Property: This is one of the weakest positions a buyer can be in. If your purchase depends on you selling your current home, you are unlikely to win in a competitive scenario. It’s far better to secure bridging finance or, if possible, sell your existing property first.

By presenting an offer free of these conditions, you are giving the vendor a “done deal.” A sold real estate sign is practically guaranteed the moment they sign.

Flexibility is Your Superpower: Settlement Dates and Deposits

Don’t assume the standard 30 or 60-day settlement period is what the vendor wants. Have your agent ask a simple question: “What settlement terms would be ideal for your client?”

- A Longer Settlement: They may have not found their next home and would love a 90 or 120-day settlement. If you can offer this, it could be worth more to them than an extra $5,000. This is especially true if they are looking for

real estate rentalsto move into temporarily, and a longer settlement gives them more time to secure a place. - A Shorter Settlement: Conversely, they may have already bought elsewhere and need the funds quickly. Offering a 21-day settlement could be the deciding factor.

- Deposit Release: In some situations, offering to release the deposit to the vendor before settlement (with the appropriate legal protections in place) can be a powerful incentive, as it gives them access to funds to use for their own property purchase.

Being the most flexible and accommodating buyer can make your offer shine. This requires a proactive property manager or solicitor on your team who can ensure the terms are legally sound.

Strategy 5: The Data-Driven Price (Know Your Numbers, Not Just Your Emotions)

Emotion will fuel your desire, but data must guide your hand. In the heat of the moment, it’s easy to get swept up in FOMO (Fear Of Missing Out) and pay far more than a property is worth. A strategic offer is not just strong; it’s smart. It’s grounded in a deep understanding of the market value.

Becoming the Local Market Expert

Before you even think about offering, you need to immerse yourself in the data for your target suburb.

- Analyse Recent Sales: Don’t just look at what properties are listed for; look at what they have actually

sold real estatefor. Use platforms likeDomain Real Estateandrealestate.com.auto track recent comparable sales. Your agent can provide you with a detailed Comparative Market Analysis (CMA). - Track Days on Market: How quickly are properties selling? If homes in

real estate Cairnsare selling in 7 days, the market is hotter than in a suburb where they are sitting for 45 days. - Understand the Agent’s Quoting Strategy: In some states, price guides are notoriously conservative. Look at the agent’s or agency’s (e.g.,

Ray White) recent sales. Do their properties typically sell for 10%, 15%, or 20% above the top of the guide? This historical data is a powerful predictor. - Read the

Real Estate News: Stay informed about broader trends. Is the RBA likely to change rates? Are there local infrastructure projects (like a new train line nearHalls Head Real Estatelistings) that could impact values? This macro-view provides context for your micro-decision.

Crafting Your Offer with “Odd Numbers”

This is a subtle but effective psychological tactic. When most buyers think about making an offer, they use round numbers: $850,000 or $900,000. When you make an offer, use a specific, non-round number, like $853,500 or $902,000.

Why?

- It Implies You’re at Your Absolute Limit: An offer of $900,000 sounds like a starting point for negotiation. An offer of $902,000 suggests you have meticulously calculated every last dollar you can afford. It signals to the agent that this is likely your final and best offer.

- It Can Win by a Small Margin: In a “best and final” offer scenario, you could potentially beat a competing offer of $900,000 by just $2,000, a tiny price to pay for your dream home.

This data-driven approach, combined with a touch of psychology, ensures you’re not just bidding high, you’re bidding smart. It’s the hallmark of a professional approach, whether you’re buying a home or investing in commercial property.

Your Daily Market Pulse: Live Information & Sources

The market is a living, breathing entity. To be successful, you must have your finger on its pulse. Here are the key metrics to watch daily and weekly, along with sources to keep you informed.

- Official Cash Rate: The Reserve Bank of Australia’s cash rate is the single biggest influencer of mortgage rates. A stable or falling rate can increase buyer confidence, while a rising rate can cool the market.

- Live Source: Reserve Bank of Australia – Cash Rate Target

- Auction Clearance Rates: This is your weekly sentiment check, especially in major markets like

real estate SydneyandMelbourne real estate. A clearance rate above 70% indicates a strong seller’s market. Below 60% suggests conditions are favouring buyers.- Live Source: Domain Auction Results & CoreLogic Weekly Auction Market Review

- Property Price Indices: Track the movement of property values across capital cities and regional areas. This provides the big-picture context for your local market.

Staying on top of this data will empower you to make informed, strategic decisions. It’s the difference between reacting to the market and anticipating it.

Conclusion: From Bidder to Homeowner

Winning in a competitive real estate market is not a game of chance. It is the culmination of meticulous preparation, financial discipline, emotional intelligence, and strategic execution. It’s about moving beyond the passive role of a hopeful bidder and becoming the proactive, undeniable choice for the seller.

By implementing these five strategies—the pre-emptive strike, building a financial fortress, forging a human connection, presenting a clean offer, and grounding your price in hard data—you fundamentally change the game. You are no longer just another number in the agent’s database. You are the serious, organised, low-risk, and compelling buyer they want to work with.

The journey to securing your dream property, whether it’s in real estate QLD, real estate NZ, or anywhere in between, starts long before you sign the contract. It begins with the decision to be the most prepared person in the room. Now, go forth and craft an offer they simply can’t refuse.