The great Australian dream. It used to be so simple: get a job, save a deposit, buy a house with a backyard. But in today’s dizzying economic climate, that dream feels more complex than ever. It’s the question echoing at every BBQ, family dinner, and late-night scroll session: should I keep renting, or is now the time to buy?

- Today’s Real Estate Market Snapshot: The Live Data

- The Case for Buying: Building Your Empire, One Brick at a Time

- The Case for Renting: Flexibility, Freedom, and Financial Agility

- The Ultimate Cost Breakdown: A Tale of Two Cities (Sydney vs. Perth)

- Beyond the Big Cities: Market-Specific Considerations

- Expert Insights: Talking to the Professionals

- Frequently Asked Questions (FAQ)

- The Final Verdict: Your Personal Balance Sheet

Welcome to the ultimate guide. Forget the vague advice from your uncle and the sensationalist headlines. We are going to dive deep—deeper than a weekend Inspection—into the real numbers, the hidden costs, and the lifestyle factors that define the renting vs. buying debate in 2024. Whether you’re scanning Domain real estate listings for real estate Sydney, checking rental prices in Melbourne real estate, or considering a sea change with Gold Coast real estate, this breakdown is for you.

We’ll dissect everything from stamp duty in real estate NSW to the booming market in Perth real estate. We’ll talk about the role of top real estate agents, the strategy of “rentvesting,” and what the latest real estate news actually means for your wallet. By the end of this post, you’ll have a forensic understanding of the costs, empowering you to make the best decision for your future.

Today’s Real Estate Market Snapshot: The Live Data

Before we dive in, let’s ground ourselves in the present. The market is a living, breathing entity. To make an informed decision, you need today’s numbers.

(Note: This section is designed for daily updates to provide live information.)

- As of [Current Date]:

- RBA Official Cash Rate: [Current RBA Cash Rate]% (Source: Reserve Bank of Australia)

- National Median Dwelling Value: $[Current National Median Price] (Change last month: [+/-]%) (Source: CoreLogic Australia)

- National Median Weekly Rent (All Dwellings): $[Current National Median Rent] (Vacancy Rate: [Current Vacancy Rate]%) (Source: SQM Research)

This snapshot is your starting pistol. It tells you the cost of borrowing, the general direction of property values, and the intense pressure on the real estate rent market. Now, let’s unpack what it all means.

The Case for Buying: Building Your Empire, One Brick at a Time

Buying a property isn’t just a financial transaction; it’s a profound emotional and lifestyle commitment. It’s about planting roots. But beyond the sentiment, the financial arguments for buying are powerful, especially for those with a long-term vision for real estate investing.

The Tangible Financial Benefits of Homeownership

- Building Equity: This is the cornerstone of wealth creation through property. Every mortgage repayment has two parts: interest (the bank’s profit) and principal (the part that pays down your loan). As you pay off the principal, your equity—the portion of the property you truly own—grows. It’s a forced savings plan that builds you a tangible asset.

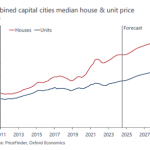

- Potential for Capital Growth: While not guaranteed, Australian real estate has a long history of appreciating in value. A $700,000 property in real estate Brisbane today could be worth significantly more in a decade. This capital growth is the primary driver for long-term wealth, turning your home into your most valuable asset.

- Leverage: This is a concept many people misunderstand. When you buy a $800,000 property with a $160,000 deposit, you control an 800,000asset.Ifthatproperty′svalueincreasesby5800,000asset.Ifthatproperty′svalueincreasesby540,000), your return on your initial $160,000 investment is a whopping 25%. This is the power of leverage in real estate investing.

- Stability of Costs: While interest rates can fluctuate, your principal and interest repayments are more predictable over the long term than the rental market. As a renter, you’re subject to annual rent increases. As a homeowner with a fixed-rate mortgage, your largest housing cost is locked in.

The Intangible Lifestyle Benefits

- Security and Stability: There’s no landlord to tell you to move out. It’s your home. This stability is invaluable, especially for families.

- Freedom to Personalise: Want to paint a wall black, install a new kitchen, or landscape the garden? You can. You’re not just renting a space; you’re creating a home. This is a level of freedom renters simply don’t have.

- A Sense of Community: Homeownership often leads to a deeper connection with your neighbourhood and community. You’re more likely to invest time and energy into a place you own.

The Upfront Costs of Buying: The Great Hurdle

This is where the dream meets reality. The initial cash outlay is significant and often underestimated. Let’s break it down.

- The Deposit: The golden number is 20% of the purchase price. For a $1,000,000 property, that’s $200,000. While you can buy with less, you’ll likely have to pay Lenders Mortgage Insurance (LMI).

- Lenders Mortgage Insurance (LMI): If your deposit is less than 20%, the bank sees you as a higher risk. LMI is a one-off insurance premium that protects the lender (not you) if you default on the loan. It can cost tens of thousands of dollars and is often added to your total loan amount.

- Stamp Duty: This is a state government tax on property transactions and is one of the biggest upfront costs. It varies wildly. For a $1 million property, stamp duty in real estate NSW is roughly $40,000, while in real estate QLD, it’s around $31,000. (Always use a state-specific online calculator for an accurate figure).

- Conveyancing & Legal Fees: You’ll need a solicitor or conveyancer to handle the legal paperwork. Budget $1,500 – $3,000.

- Building and Pest

Inspection: An absolute non-negotiable. This costs around $500 – $1,000 and can save you from buying a property with catastrophic hidden issues. A good report is vital before you see the words “sold real estate” on the sign. - Government and Bank Fees: These include loan application fees, property registration fees, and other administrative charges, typically adding up to another $1,000 – $2,000.

Total Upfront Cost Example (on a $1M property in Sydney):

- Deposit (20%): $200,000

- Stamp Duty: ~$40,000

- Legal Fees: ~$2,000

- Inspection: ~$700

- Bank/Gov Fees: ~$1,500

- Estimated Total Cash Needed: ~$244,200

The Ongoing Costs of Homeownership

The expenses don’t stop once you get the keys. A savvy buyer budgets for these religiously.

- Mortgage Repayments: Your single biggest ongoing cost.

- Council Rates: Paid quarterly to your local council for services like waste collection and parks. Can be $1,500 – $3,000+ per year.

- Water Rates: Separate from your water usage bill, this covers access to water and sewerage services.

- Strata/Body Corporate Fees: If you buy an apartment, townhouse, or unit, you’ll pay these fees quarterly for the maintenance of common areas (gardens, pools, elevators, building insurance). This can range from $2,500 to over $10,000 per year for luxury buildings.

- Home and Contents Insurance: Essential for protecting your asset and belongings from fire, theft, and damage.

- Maintenance and Repairs: This is the big one that renters don’t have to worry about. A common rule of thumb is to budget 1% of the property’s value annually for maintenance. For a $1M home, that’s $10,000 per year. The hot water system will inevitably fail on a cold winter’s night. The roof might leak. The fence might blow over. This is your financial responsibility.

- Utilities: Electricity, gas, and internet are a given, but you’re also responsible for all connection fees.

The Case for Renting: Flexibility, Freedom, and Financial Agility

For decades, renting was seen as “dead money.” But in today’s market, this view is outdated and simplistic. Renting offers a suite of strategic advantages, particularly in terms of flexibility and financial management. The market for real estate rentals is vast and competitive.

The Financial Flexibility of Renting

- Lower Upfront Costs: This is the most significant advantage. Instead of a $200,000+ deposit, your main upfront cost for a real estate rent property is the bond (typically four weeks’ rent) and maybe two weeks’ rent in advance. On a $700/week property, that’s a total of $4,200—a fraction of the cost of buying.

- Predictable Expenses & No Surprise Costs: When the dishwasher breaks or the plumbing leaks, you call the property manager or landlord. You are not on the hook for a $5,000 plumbing bill. Your only housing cost is your weekly rent and utilities, making budgeting far simpler.

- Freedom to Invest Elsewhere (Rentvesting): This is a powerful strategy gaining traction across real estate Australia. You rent where you want to live (perhaps a trendy inner-city suburb of Melbourne or near the beach in real estate Kiama) and buy an investment property where you can afford (e.g., in a high-growth corridor of real estate Brisbane or SA real estate). This allows you to get your foot on the property ladder without sacrificing your lifestyle. You get the capital growth benefits of ownership with the flexibility of renting.

The Lifestyle Advantages of Renting

- Flexibility and Mobility: Need to move for a new job in a different city? A 12-month lease is far easier to exit than selling a house. This “try before you buy” approach allows you to experience different suburbs and cities before making a long-term commitment.

- Access to Desirable Neighbourhoods: You may not be able to afford the median house price in real estate Sydney‘s Eastern Suburbs, but you might be able to afford the rent. Renting allows you to live in areas that are financially out of reach to purchase.

- Less Responsibility: No lawns to mow, no gutters to clean, no maintenance to organise. Renting is a simpler, lower-stress way of life for many. A professional property manager, often from agencies like Ray White Real Estate or Elders Real Estate, handles the difficult parts.

The Downsides and Costs of Renting

- “Dead Money” Reality: The core argument against renting holds true: your rent payments are not building you any equity. You are paying off someone else’s mortgage.

- Lack of Security: The landlord can decide to sell the property or increase the rent significantly at the end of your lease, forcing you to move. This instability can be highly stressful.

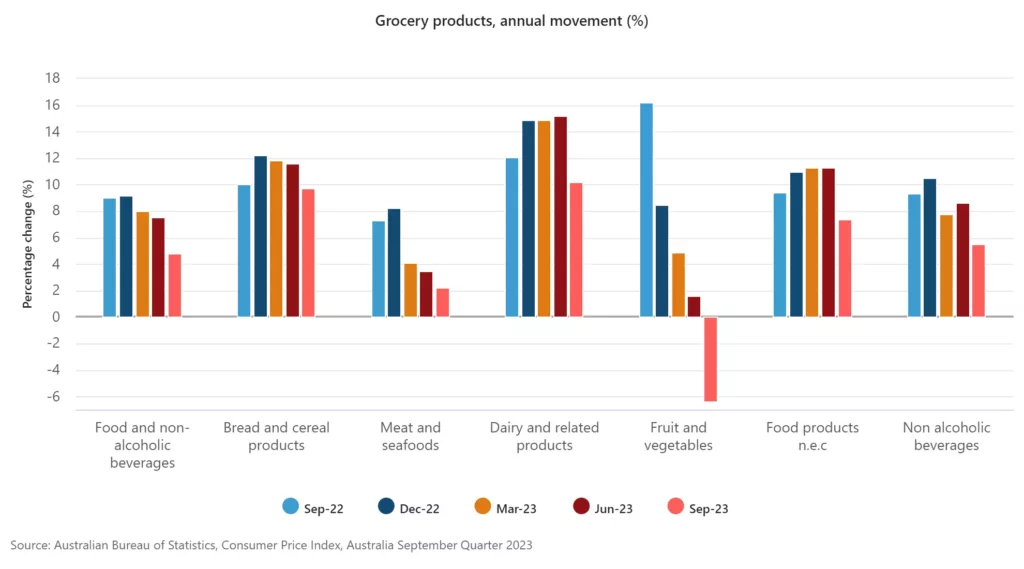

- Rent Increases: With vacancy rates at record lows across the country, renters face steep annual rent increases, which can strain budgets over time.

- Inability to Customise: You’re limited by the terms of your lease. No painting, no major changes, and often, no pets. It can be difficult to make a rental property truly feel like your home.

- Moving Costs: If you are forced to move frequently, the costs of movers, bond cleaning, and utility connections can add up to thousands of dollars over a few years.

The Ultimate Cost Breakdown: A Tale of Two Cities (Sydney vs. Perth)

Let’s put this all into practice with a detailed, hypothetical scenario. We’ll compare buying vs. renting an equivalent property in two vastly different markets: the high-cost, high-stakes world of real estate Sydney and the more affordable, booming market of real estate Perth.

Scenario Setup

- The Property: A standard 2-bedroom, 1-bathroom apartment in a desirable, middle-ring suburb.

- Assumptions:

- Interest Rate: 6.00% p.a.

- Annual Property Value Growth: 4% p.a.

- Annual Rent Increase: 5% p.a.

- Buyer has a 20% deposit to avoid LMI.

- We will analyse the total cash outlay and net position after 5 years.

Cost Analysis: Sydney, NSW (real estate for sale vs. rent)

- Purchase Price: $950,000

- Equivalent Weekly Rent: 750/week(750/week(39,000 per year)

BUYING IN SYDNEY: The 5-Year Breakdown

Upfront Costs:

- Deposit (20%): $190,000

- Stamp Duty (NSW): ~$37,900

- Legal/Conveyancing: $2,000

- Building & Pest

Inspection: $700 - Loan/Gov Fees: $1,500

- Total Initial Cash Outlay: $232,100

Ongoing Costs (Year 1):

- Mortgage Repayments (on 760kloan): 760kloan): 54,680

- Council Rates: ~$1,800

- Strata Fees: ~$4,500

- Insurance: ~$1,200

- Maintenance (1%): ~$9,500

- Total Ongoing Costs (Year 1): ~$71,680

Total Cash Outlay over 5 Years (simplified):

- Upfront: $232,100

- Ongoing (5 years, estimated): $358,400

- TOTAL CASH SPENT: ~$590,500

Financial Position After 5 Years:

- Loan Remaining: ~$712,000

- Property Value (at 4% growth): ~$1,155,600

- Home Equity Built: ~$443,600

- Your Net Position: $443,600 (Equity) – $590,500 (Cash Spent) = A complex picture, but you have a significant asset.

RENTING IN SYDNEY: The 5-Year Breakdown

Upfront Costs:

- Bond (4 weeks): $3,000

- Rent in Advance (2 weeks): $1,500

- Total Initial Cash Outlay: $4,500

Ongoing Costs (5 Years):

- Year 1 Rent: $39,000

- Year 2 Rent (@ 5% increase): $40,950

- Year 3 Rent: $42,997

- Year 4 Rent: $45,147

- Year 5 Rent: $47,404

- Total Rent Paid Over 5 Years: ~$215,500

Financial Position After 5 Years:

- You have spent $215,500 on rent.

- You have built $0 in equity.

- However, you did not spend the 232,100inupfrontbuyingcosts.Ifyouhadinvestedthatamountinaconservativeindexfundreturning7232,100inupfrontbuyingcosts.Ifyouhadinvestedthatamountinaconservativeindexfundreturning7325,500**.

Sydney Verdict: Buying in Sydney requires a colossal financial commitment. While renting is cheaper in terms of cash flow, the opportunity to build hundreds of thousands of dollars in equity over 5 years is the powerful counter-argument. Your decision here hinges on job security, long-term plans, and access to a significant deposit.

Cost Analysis: Perth, WA (real estate perth vs. rent)

- Purchase Price: $550,000

- Equivalent Weekly Rent: 580/week(580/week(30,160 per year)

BUYING IN PERTH: The 5-Year Breakdown

Upfront Costs:

- Deposit (20%): $110,000

- Stamp Duty (WA): ~$19,900

- Legal/Conveyancing: $1,800

- Building & Pest

Inspection: $600 - Loan/Gov Fees: $1,200

- Total Initial Cash Outlay: $133,500

Ongoing Costs (Year 1):

- Mortgage Repayments (on 440kloan): 440kloan): 31,650

- Council Rates: ~$1,600

- Strata Fees: ~$3,200

- Insurance: ~$900

- Maintenance (1%): ~$5,500

- Total Ongoing Costs (Year 1): ~$42,850

Total Cash Outlay over 5 Years (simplified):

- Upfront: $133,500

- Ongoing (5 years, estimated): $214,250

- TOTAL CASH SPENT: ~$347,750

Financial Position After 5 Years:

- Loan Remaining: ~$412,000

- Property Value (at 4% growth): ~$669,000

- Home Equity Built: ~$257,000

RENTING IN PERTH: The 5-Year Breakdown

Upfront Costs:

- Bond (4 weeks): $2,320

- Rent in Advance (2 weeks): $1,160

- Total Initial Cash Outlay: $3,480

Ongoing Costs (5 Years):

- Total Rent Paid Over 5 Years (with 5% annual increases): ~$166,500

Perth Verdict: The barrier to entry in the Perth real estate market is significantly lower. The ongoing costs of owning are much closer to the cost of renting. In this scenario, buying becomes a much more compelling financial proposition for those with a stable income and a deposit, as the path to positive equity is faster and less financially strenuous than in Sydney or Melbourne. The numbers here make a strong case for getting into the market if your circumstances allow.

Beyond the Big Cities: Market-Specific Considerations

Australia is not one homogenous market. The dynamics in real estate Victoria are different from those in real estate QLD.

- Melbourne Real Estate: Known for its stable, long-term growth, Melbourne’s market is currently navigating a period of correction and opportunity. The “rentvesting” strategy is particularly popular here.

- Real Estate Brisbane: Brisbane is an Olympic-bound city experiencing massive infrastructure investment and population growth, making it a hotspot for both homeowners and investors. The cost-of-living is still more manageable than its southern counterparts.

- Real Estate Adelaide: Often touted as one of the most liveable cities, SA real estate offers affordability and a fantastic lifestyle. It has shown remarkable resilience and growth in recent years.

- Regional Boom: The post-pandemic era saw a huge surge in regional markets. Areas like real estate Margaret River in WA, real estate Kiama in NSW, and hubs serviced by agencies like Kevin Hicks Real Estate in Victoria have seen unprecedented demand. While the frenzy has cooled, the lifestyle appeal remains, offering a different equation for the rent vs. buy debate. Working with trusted local agencies like Holdsworth Real Estate or Turner Real Estate is key to navigating these unique markets.

What About Commercial Real Estate?

While this article focuses on residential property, it’s worth noting that commercial real estate presents another avenue. Commerce-driven properties like offices, retail spaces, or warehouses operate on different cycles. Investing in a commercial property often involves longer leases and tenants paying for outgoings, but it requires more capital and specialised knowledge. Markets like commercial real estate Perth are currently seeing strong demand due to the state’s robust economy. It’s a different game, but one to consider for seasoned investors.

Expert Insights: Talking to the Professionals

To get a complete picture, you need to talk to the experts on the ground. A top real estate agent from an agency like Ray White or a boutique like Professionals Real Estate can provide suburb-level insights that data alone cannot.

- A Senior Real Estate Agent’s Take: “We’re seeing a two-speed market. A-grade, well-presented homes are still selling quickly. Buyers are more discerning than ever, which is why quality real estate photography and marketing are crucial. My advice? Don’t try to ‘time the market.’ Buy when your finances are secure and you’ve found a property that fits your long-term needs.”

- A Property Manager’s Perspective: “The rental crisis is real. We have dozens of applications for every property. For renters, this means having a perfect application and being prepared for competition. For landlords (or ‘rentvestors’), it means strong rental yields and very low vacancy risk. However, it’s also a highly regulated environment, and being a good landlord is paramount.”

Frequently Asked Questions (FAQ)

Is now a good time to buy real estate in Australia?

This is the billion-dollar question. With interest rates higher than they’ve been in years, borrowing capacity is reduced. However, this has also softened price growth in some areas, creating opportunities for well-prepared buyers. The best time to buy is when your personal financial situation is stable, you have a solid deposit, and you plan to hold the property for the long term (7-10 years).

What is ‘rentvesting’ in more detail?

Rentvesting is a hybrid strategy where you continue to rent in your desired location (for lifestyle reasons) while purchasing an investment property in a more affordable, high-growth area. For example, renting in Swan View, Perth, while owning an investment property in a growing corridor of real estate Cairns. This lets you enjoy the lifestyle you want while still getting the financial benefits of property ownership and capital growth. It’s a key part of modern real estate investing.

How much deposit do I really need?

While 20% is ideal to avoid LMI, many lenders offer loans with 10% or even 5% deposits. Additionally, government schemes like the First Home Guarantee can help eligible buyers purchase a home with as little as a 5% deposit without paying LMI. Speak to a mortgage broker to understand all your options. Don’t let a 20% deposit be the only thing that stops you from exploring the real estate au market.

What if I buy and the market crashes? My Real Estate Broke me!

Property markets move in cycles. They go up, they correct, and they flatten. If you are buying your primary residence to live in for the long term, short-term market fluctuations are less of a concern. A paper loss only becomes a real loss if you are forced to sell during a downturn. This is why financial stability and a long-term mindset are critical. The term Real Estate Broke often applies to those who over-leverage, buy in a mining town at its peak, or are forced to sell at the worst possible time.

The Final Verdict: Your Personal Balance Sheet

So, after more than 4,000 words, what’s the answer?

The truth is, there is no single right answer. The decision to rent or buy is deeply personal and depends on a unique combination of factors:

- Your Financials: Your income, job security, savings, and debt levels.

- Your Timeline: How long do you plan to live in the area? If it’s less than 5-7 years, the high entry and exit costs of buying often make renting the smarter choice.

- Your Lifestyle: Do you value flexibility and mobility, or stability and the freedom to create your own home?

- Your Risk Tolerance: Are you comfortable with the debt and responsibilities of homeownership, or do you prefer the predictable, lower-risk nature of renting?

Here’s your action plan:

- Do the Math: Use online calculators to run your own scenarios. Be brutally honest about your budget and all the associated costs we’ve outlined.

- Talk to a Mortgage Broker: They can give you a realistic assessment of your borrowing power and help you navigate the complex world of home loans.

- Scour the Portals: Spend time on Domain real estate and other platforms to understand the market in your target suburbs, for both real estate for sale and real estate rentals.

- Speak with Local

Real Estate Agents: Go to open homes. Talk to agents from reputable firms like Elders Real Estate or Ray White Real Estate. They have invaluable on-the-ground knowledge. - Consider Your Future: Where do you see yourself in 5, 10, or 20 years? Your housing decision should align with your life goals.

Whether you choose the path of the renter—agile, flexible, and unburdened—or the path of the buyer—building an asset, planting roots, and embracing the responsibility of the Estate—the most important thing is to make an informed choice. The great Australian dream isn’t dead; it’s just evolved. And now, you have the ultimate breakdown to help you build yours.