The Australian and New Zealand property markets are never far from the headlines. Whether you’re a first-home buyer, seasoned investor, or simply keeping an eye on real estate news, you’ve probably seen the question everywhere: Is the housing market going to crash? In this comprehensive guide, I’ll break down the facts, debunk the myths, and provide you with live daily information and expert insights. We’ll look at the latest data, city-by-city trends, and what it all means for buyers, sellers, renters, and investors. If you’re searching for real estate for sale, real estate rentals, or commercial property, this is your essential 2025 market outlook.

- H2: Live Daily Market Information – Your Real Estate Dashboard

- H2: Crash or Correction? Understanding the Difference

- H2: The Five Key Drivers of the Housing Market

- H2: What the Latest Data Tells Us

- H2: City-by-City Market Insights

- H2: Commercial Property – Where the Real Stress Is

- H2: Red Flags to Watch For

- H2: What This Means for Buyers, Sellers, Investors, and Renters

- H2: Final Thoughts

H2: Live Daily Market Information – Your Real Estate Dashboard

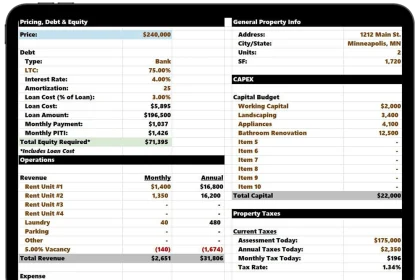

To truly understand the real estate market, you need to look beyond the headlines and focus on the data that moves the market. Here are the most important live and regularly updated sources you should bookmark:

- Reserve Bank of Australia (RBA) Cash Rate: RBA Cash Rate

- RBA Interest Rate Decisions: RBA Interest Rate Decisions

- Australian Prudential Regulation Authority (APRA) Mortgage Data: APRA Property Exposures

- Australian Bureau of Statistics (ABS) CPI and Labour Force: ABS CPI, ABS Labour Force

- ABS Building Approvals: ABS Building Approvals

- CoreLogic Home Value Index: CoreLogic Home Value Index

- PropTrack Home Price Index: PropTrack Home Price Index

- Domain Auction Results: Domain Auction Results

- REA Insights: REA Insights

- SQM Research Vacancy Rates and Rents: SQM Vacancy Rates, SQM Weekly Rents

- SQM Total Listings: SQM Total Listings

- SQM Distressed Listings: SQM Distressed Listings

- New Zealand Data: RBNZ OCR Decisions, REINZ Data

How to use this dashboard:

Check the RBA cash rate and policy statements for the latest on interest rates. Scan the ABS for unemployment and inflation data. Review CoreLogic and PropTrack for monthly price trends in real estate Sydney, Melbourne real estate, real estate Brisbane, and other capitals. Use SQM for rental and vacancy rates, and Domain real estate for auction results. These sources provide the real-time pulse of the market, not just opinions.

H2: Crash or Correction? Understanding the Difference

It’s important to distinguish between a market crash and a market correction. A crash is a rapid, widespread, double-digit fall in prices, often triggered by a credit crunch, mass unemployment, or a sudden economic shock. A correction, on the other hand, is a more gradual adjustment—typically a single-digit to low double-digit decline in certain regions or property types.

Current data does not support a crash scenario for real estate Australia or real estate NZ. Instead, we’re seeing a patchwork of corrections, with some cities and segments holding up better than others. The fundamentals—employment, supply, migration, and lending standards—are not showing the kind of stress that would trigger a 2008-style collapse.

H2: The Five Key Drivers of the Housing Market

H3: 1. Employment and Wages

Jobs are the foundation of the property market. When employment is strong, people can service their mortgages, and demand for real estate for sale and real estate rentals remains robust. The ABS Labour Force data is the best place to track this. As of October 2025, unemployment is rising slightly but remains well below crisis levels.

H3: 2. Credit and Interest Rates

The RBA’s cash rate directly impacts borrowing costs. Higher rates reduce borrowing capacity, which can cool demand for real estate for sale, especially in high-priced markets like real estate Sydney and Melbourne real estate. However, banks’ lending standards remain tight, and most borrowers are still assessed with a 3% buffer above current rates, as per APRA guidelines.

H3: 3. Housing Supply and Construction

The supply of new homes is critical. The ABS Building Approvals data shows that approvals have dropped, and many builders are struggling with higher costs. This means less new stock is coming to market, especially in land-constrained areas like real estate Sydney, real estate Brisbane, and real estate Perth.

H3: 4. Population Growth and Migration

Australia’s population is growing again, with strong migration inflows. This is especially true in real estate NSW, real estate Victoria, and real estate QLD. More people means more demand for both real estate for sale and real estate rentals, supporting prices even as interest rates rise.

H3: 5. Market Sentiment and Listings

Sentiment drives short-term moves. If sellers flood the market and buyers retreat, prices can fall quickly. But as of now, SQM Research shows that listings remain tight in many cities, and Domain real estate auction clearance rates are holding up, especially in premium suburbs.

H2: What the Latest Data Tells Us

H3: Employment Remains Resilient

The latest ABS Labour Force figures show a slight uptick in unemployment, but not enough to trigger widespread mortgage stress. Most real estate agents and property managers report that forced sales remain rare, and mortgage arrears are only rising off a very low base (APRA data).

H3: Interest Rates May Have Peaked

The RBA has signaled that further rate hikes are unlikely unless inflation surprises to the upside. This has stabilized borrowing capacity and improved sentiment among buyers, especially those looking for real estate for sale in real estate Sydney, Melbourne real estate, and real estate Brisbane.

H3: Supply is Tight, Especially for Rentals

Vacancy rates are at record lows in many cities, according to SQM Research. This is driving up rents and supporting yields for real estate investing. In some areas, such as real estate Perth and real estate Adelaide, the rental market is so tight that properties are being leased after a single inspection.

H3: Price Growth is Patchy

According to the CoreLogic Home Value Index and PropTrack Home Price Index, prices are still rising in some cities and segments, while others are flat or slightly down. Real estate Sydney and Melbourne real estate have seen modest corrections in some outer suburbs, but premium areas remain resilient. Real estate Brisbane, real estate Perth, and real estate Adelaide are still seeing growth, especially for detached homes.

H2: City-by-City Market Insights

H3: Real Estate Sydney (NSW)

Sydney remains Australia’s most expensive market, with strong demand in premium suburbs and limited new supply. Real estate agents report that well-presented homes are still attracting multiple offers, especially in the eastern suburbs and lower north shore. However, affordability is stretched in the outer west, and some areas are seeing longer days on market. For the latest, check Domain real estate Sydney.

Keywords: real estate nsw, real estate sydney, real estate for sale, real estate rentals, domain real estate.

H3: Melbourne Real Estate (VIC)

Melbourne’s market is more balanced, with inner-city apartments lagging but family homes in the east and southeast still in demand. Migration is picking up, and the return of international students is supporting the rental market. For up-to-date trends, see CoreLogic Melbourne.

Keywords: melbourne real estate, real estate victoria, estate.

H3: Real Estate Brisbane and Gold Coast Real Estate (QLD)

Brisbane and the Gold Coast continue to benefit from interstate migration and lifestyle buyers. Vacancy rates are extremely low, and real estate agents report strong competition for both sales and rentals. Infrastructure projects ahead of the Olympics are also boosting confidence. For the latest, check SQM Brisbane.

Keywords: real estate qld, real estate brisbane, gold coast real estate.

H3: Perth Real Estate (WA)

Perth is one of the strongest markets in Australia right now, with population growth, low stock, and high rental yields. Real estate Perth is attracting investors from the eastern states, and commercial real estate Perth is also seeing renewed interest. For more, see SQM Perth.

Keywords: perth real estate, real estate perth, commercial real estate perth, commerce, real estate commercial.

H3: Real Estate Adelaide (SA)

Adelaide remains a standout for affordability and tight supply. Family homes are in high demand, and vacancy rates are among the lowest in the country. For the latest, check Domain Adelaide.

Keywords: real estate adelaide, sa real estate.

H3: Regional Markets: Cairns, Margaret River, Kiama, Swan View, Halls Head

Regional markets like real estate Cairns, real estate Margaret River, real estate Kiama, Swan View, and Halls Head Real Estate are seeing strong demand from lifestyle buyers and investors. These areas offer attractive yields and a slower pace of life, but can be more volatile in downturns. Always check local employment and tourism trends.

Keywords: real estate cairns, real estate margaret river, real estate kiama, Swan View, Halls Head Real Estate.

H3: New Zealand Snapshot

The New Zealand market has cooled after a strong run, but prices are stabilizing in Auckland, Wellington, and Christchurch. The Reserve Bank of New Zealand is holding rates steady, and migration is picking up. For the latest, see REINZ.

H2: Commercial Property – Where the Real Stress Is

While residential real estate Australia is holding up, commercial property is facing more challenges. Offices, especially in CBDs, are under pressure from remote work and rising vacancies. Retail is mixed, with essentials-focused centres performing better than discretionary strips. Industrial and logistics remain strong, but are sensitive to financing costs.

If you’re considering real estate commercial or commercial property, focus on tenant quality, lease terms, and the ability to re-lease space. For commercial real estate Perth and other capitals, check recent sales and leasing activity on REA Commercial.

H2: Red Flags to Watch For

A true market crash would require several red flags to flash at once:

- A sharp, sustained rise in unemployment (above 6-7% for multiple quarters)

- A spike in mortgage arrears and forced sales (APRA data)

- A flood of new listings and falling auction clearance rates (SQM Listings, Domain Auction Results)

- Policy mistakes, such as aggressive rate hikes into a recession

- Oversupply from a sudden surge in building completions (unlikely given current approvals slump)

As of October 2025, none of these are flashing red. The market is adjusting, not collapsing.

H2: What This Means for Buyers, Sellers, Investors, and Renters

H3: Buyers

If you’re looking for real estate for sale, now is a time for careful research and negotiation. Get pre-approved with a buffer for higher rates, and focus on properties with genuine seller motivation. Use data from CoreLogic, PropTrack, and Domain real estate to inform your offers. Don’t skip building and pest inspections—especially for apartments and older homes.

Keywords: real estate for sale, inspection, real estate agents, real estate agent.

H3: Sellers

For sellers, presentation and pricing are everything. Professional real estate photography, minor repairs, and flexible inspection times can make a big difference. Choose a reputable agency—Ray White real estate, Elders Real Estate, Professionals Real Estate, Holdsworth Real Estate, Kevin Hicks Real Estate, Turner Real Estate, Halls Head Real Estate—and compare their marketing strategies. Feature your listing on real estate au and Domain real estate for maximum exposure.

Keywords: sold real estate, ray white, ray white real estate, professionals real estate, elders real estate, holdsworth real estate, kevin hicks real estate, turner real estate, Halls Head Real Estate, real estate photography.

H3: Investors

For real estate investing, focus on cash flow, yield, and quality. High-yield suburbs with low vacancy rates are attractive, but always check for building defects, strata health, and insurance costs. Diversify between houses and units, and consider professional property manager services. For commercial property, scrutinize tenant covenants and lease expiries.

Keywords: real estate investing, property manager, real estate commercial, commercial property.

H3: Renters

Renters face a competitive market, especially in real estate Sydney, Melbourne real estate, and real estate Brisbane. Be ready with your documents, references, and a cover letter. Set alerts on real estate rentals across real estate au and Domain. Consider offering a longer lease for more security.

Keywords: rent, real estate rent, real estate rentals, property manager.

H2: Final Thoughts

The Australian and New Zealand property markets are complex, resilient, and driven by real data—not just headlines. While some areas are correcting, the fundamentals do not point to a crash. By using the live data sources and expert insights above, you can make smarter decisions—whether you’re buying, selling, renting, or investing. Stay informed, stay flexible, and remember: in real estate, knowledge is your greatest asset.

If you want more real estate news, market updates, and expert tips, subscribe to our newsletter or follow us for the latest insights. And if you’re ready to take the next step, connect with a trusted real estate agent or property manager in your area today.