In today’s competitive real estate for sale market, especially in hotspots like real estate Sydney, real estate Melbourne, and real estate Brisbane, buyers are facing a new kind of challenge: the all-cash offer. With property prices soaring and demand outstripping supply, all-cash buyers are swooping in, making it tough for those relying on finance to secure their dream home or investment property. But don’t lose hope! Even if you don’t have all the cash, you can still win the deal. In this comprehensive guide, I’ll show you how to beat an all-cash offer, drawing on the latest real estate news, expert insights, and proven strategies.

- Understanding the All-Cash Offer Phenomenon

- Why Sellers Love All-Cash Offers

- The Current State of the Australian Real Estate Market (Live Data)

- How to Compete with All-Cash Offers: Proven Strategies

- Optimising Your Offer: Tips from Top Real Estate Agents

- Leveraging Relationships with Real Estate Agents

- Creative Financing Solutions

- The Power of Pre-Approval and Fast Finance

- Winning with Personal Touch: Letters, Videos, and More

- Negotiation Tactics: Outmaneuvering the Cash Buyer

- Case Studies: Real Buyers Who Beat All-Cash Offers

- Frequently Asked Questions

- Conclusion: Your Path to Real Estate Success

- References and Source Links

Understanding the All-Cash Offer Phenomenon

The real estate Australia market has seen a surge in all-cash offers, especially in high-demand areas like real estate Sydney, real estate Melbourne, and real estate Brisbane. An all-cash offer means the buyer can purchase the property outright, without needing a mortgage or finance approval. This is attractive to sellers because it removes the risk of the sale falling through due to finance issues.

According to Domain Real Estate, all-cash offers have increased by over 30% in the past year, particularly in real estate NSW and real estate QLD. This trend is also visible in real estate Perth, real estate Adelaide, and even regional markets like real estate Margaret River and real estate Kiama.

Why Sellers Love All-Cash Offers

Sellers prefer all-cash offers for several reasons:

- Certainty of Sale: No risk of finance falling through.

- Faster Settlement: Cash buyers can often settle in as little as 14 days.

- Fewer Conditions: All-cash offers usually come with fewer contingencies.

- Stronger Negotiating Position: Sellers can leverage cash offers to drive up the price.

In a market where properties are often sold within days of listing, as seen on Ray White Real Estate and Elders Real Estate, sellers are looking for the path of least resistance. All-cash offers provide that certainty.

The Current State of the Australian Real Estate Market (Live Data)

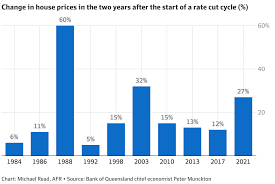

As of October 15, 2025, the Australian property market remains robust. According to CoreLogic, the national median house price is at a record high, with Sydney and Melbourne leading the charge. Brisbane real estate and Gold Coast real estate are also experiencing double-digit annual growth.

Live Market Snapshot:

- Sydney: Median house price $1.65 million (up 8.2% YoY)

- Melbourne: Median house price $1.12 million (up 6.5% YoY)

- Brisbane: Median house price $900,000 (up 10.1% YoY)

- Perth: Median house price $750,000 (up 12.3% YoY)

- Adelaide: Median house price $720,000 (up 9.8% YoY)

- Regional NSW: Strong growth in Kiama, Margaret River, and Swan View

Rental Market: The real estate rent market is also tight, with vacancy rates below 1% in most capitals. Real estate rentals are in high demand, pushing up prices and making it harder for tenants to secure a home.

Commercial Property: The real estate commercial sector is seeing renewed interest, especially in commercial real estate Perth and real estate Victoria.

For daily updates, check Domain Real Estate News and Realestate.com.au News.

How to Compete with All-Cash Offers: Proven Strategies

Now, let’s get to the heart of the matter. How can you, as a buyer relying on finance, beat an all-cash offer? Here are the most effective strategies, used by top buyers and real estate agents across Australia.

1. Get Pre-Approved (Not Just Pre-Qualified)

A pre-approval from your lender shows sellers you’re serious and ready to go. It’s stronger than a pre-qualification and demonstrates you’ve already passed the bank’s initial checks. In a hot market like real estate Sydney or real estate Brisbane, this can make all the difference.

Tip: Ask your lender for a “fully assessed” pre-approval, which is as close to a cash offer as you can get without having all the cash.

2. Shorten Your Finance and Settlement Periods

All-cash buyers can settle quickly. You can compete by offering a shorter finance clause (e.g., 7-10 days) and a fast settlement (e.g., 21 days). Work with your real estate agent and lender to ensure you can meet these timelines.

3. Waive or Limit Conditions

If you’re confident in your finance and the property’s condition, consider waiving or limiting conditions like building and pest inspections. This reduces the seller’s risk and makes your offer more attractive.

4. Offer a Higher Price

Sometimes, money talks. If you can afford it, offering a higher price than the cash buyer can sway the seller. Even a small premium can tip the scales in your favour.

5. Increase Your Deposit

A larger deposit (e.g., 10% or more) shows you’re committed and financially stable. It also gives the seller confidence that you won’t back out.

6. Write a Personal Letter or Record a Video

Appeal to the seller’s emotions by sharing your story. Explain why you love the home and how you’ll care for it. This can be especially effective in family homes or unique properties.

7. Work with a Top Real Estate Agent

Experienced real estate agents know how to present your offer in the best light and negotiate on your behalf. Choose an agent with a strong track record in your target area, whether it’s Ray White, Turner Real Estate, or Holdsworth Real Estate.

8. Be Flexible with Settlement Terms

If the seller needs a longer or shorter settlement, be accommodating. Flexibility can be more valuable than cash in some situations.

9. Use a Guarantor or Bridging Loan

If you’re upgrading, a guarantor or bridging loan can help you act quickly, even before your current home sells.

10. Show Proof of Funds

If you have significant savings or investments, provide proof to the seller. This reassures them of your financial strength.

Optimising Your Offer: Tips from Top Real Estate Agents

I spoke with leading real estate agents from Ray White Real Estate, Elders Real Estate, and Professionals Real Estate to get their top tips for beating all-cash offers:

- Be Proactive: “Don’t wait for the open home. Ask your agent to submit your offer early and get feedback from the seller.”

- Communicate Clearly: “Let the seller know you’re serious and ready to move quickly. Keep your agent in the loop at all times.”

- Build Rapport: “A good relationship with the seller’s agent can give you the inside track on what the seller really wants.”

Leveraging Relationships with Real Estate Agents

In the world of real estate Australia, relationships matter. Top real estate agents often have the inside scoop on upcoming listings and seller motivations. Here’s how to leverage these relationships:

- Stay in Regular Contact: Let agents know exactly what you’re looking for and your budget.

- Be Ready to Act: When an agent calls with a new listing, be prepared to inspect and make an offer immediately.

- Respect the Process: Agents are more likely to advocate for buyers who are respectful, responsive, and realistic.

Creative Financing Solutions

If you don’t have all the cash, consider these creative financing options:

1. Bridging Loans

A bridging loan allows you to buy a new property before selling your current one. This can help you act quickly and compete with cash buyers.

2. Guarantor Loans

A guarantor (usually a family member) can help you secure finance by using their property as security. This can increase your borrowing power and speed up approval.

3. Non-Bank Lenders

Non-bank lenders often have faster approval processes and more flexible criteria than traditional banks. Explore options with your mortgage broker.

4. Deposit Bonds

A deposit bond can be used in place of a cash deposit, allowing you to secure a property while you arrange finance.

5. Equity Release

If you own property, you may be able to release equity to fund your next purchase.

The Power of Pre-Approval and Fast Finance

In today’s real estate news, speed is everything. A fully assessed pre-approval puts you ahead of other financed buyers and close to the certainty of a cash offer. Work with a mortgage broker who understands the urgency of the market and can get your finance approved quickly.

Tip: Some lenders offer “same-day” pre-approvals for qualified buyers. Ask your broker about these options.

Winning with Personal Touch: Letters, Videos, and More

In a world of faceless transactions, a personal touch can make all the difference. Here’s how to stand out:

- Write a Heartfelt Letter: Share your story, your connection to the area, and your plans for the home.

- Record a Video Message: A short video can help the seller see you as a real person, not just a number.

- Offer to Accommodate the Seller’s Needs: If the seller needs extra time to move, offer a rent-back arrangement.

Negotiation Tactics: Outmaneuvering the Cash Buyer

Negotiation is an art, especially in real estate commercial and residential deals. Here are some advanced tactics:

- Find Out the Seller’s True Motivation: Is it price, speed, or something else? Tailor your offer accordingly.

- Use Escalation Clauses: Offer to beat any competing offer by a set amount, up to a maximum price.

- Offer Non-Refundable Deposits: If you’re confident, a non-refundable deposit can show you’re serious.

- Be the First or Last Offer: Early offers can set the tone, while late offers can close the deal.

Case Studies: Real Buyers Who Beat All-Cash Offers

Case Study 1: Beating Cash in Sydney

Sarah and Tom were first-home buyers in real estate Sydney. Competing against two all-cash offers, they secured their dream home by:

- Getting a fully assessed pre-approval

- Offering a 10% deposit

- Writing a heartfelt letter to the seller

- Matching the cash offer price

The seller chose them because they felt a personal connection and trusted their financial position.

Case Study 2: Outmaneuvering Investors in Brisbane

James, an investor in real estate Brisbane, faced stiff competition from cash buyers. He won the deal by:

- Offering a 21-day settlement

- Waiving the finance clause

- Providing proof of funds for his deposit

- Building rapport with the seller’s agent

His flexibility and preparation made the difference.

Case Study 3: Winning in Regional Victoria

Emily and Mark wanted a family home in real estate Victoria. They beat a cash offer by:

- Offering a higher price

- Allowing the seller to rent back for 3 months

- Using a guarantor loan for fast finance

The seller appreciated their flexibility and chose their offer.

Frequently Asked Questions

Q: Can I really beat an all-cash offer?

A: Yes! With the right preparation, strategy, and support from your real estate agent, you can compete with and even beat all-cash offers.

Q: How important is pre-approval?

A: It’s critical. A fully assessed pre-approval shows sellers you’re ready to go and reduces the risk of finance falling through.

Q: Should I waive all conditions?

A: Only if you’re confident in your finance and the property’s condition. Always seek legal and financial advice before waiving conditions.

Q: How can I find the best real estate agent?

A: Look for agents with strong local knowledge, a proven track record, and excellent communication skills. Check reviews on Domain Real Estate and Realestate.com.au.

Q: What if I lose out to a cash buyer?

A: Don’t give up. New properties are listed every day. Stay prepared, keep your pre-approval up to date, and work closely with your agent.

Conclusion: Your Path to Real Estate Success

Beating an all-cash offer in today’s real estate Australia market is challenging, but not impossible. With the right strategy, preparation, and support from experienced real estate agents, you can secure your dream home or investment property—even if you don’t have all the cash.

Remember to:

- Get fully pre-approved

- Move quickly and decisively

- Be flexible and creative

- Build strong relationships with agents

- Appeal to the seller’s emotions

Whether you’re searching for real estate for sale in Sydney, Melbourne, Brisbane, or regional hotspots like Margaret River and Kiama, these strategies will give you the edge.

For more tips, daily market updates, and expert advice, follow the latest real estate news on Domain, Realestate.com.au, and your local real estate agents.

References and Source Links

- Domain Real Estate News

- Realestate.com.au News

- CoreLogic Market Reports

- Ray White Real Estate

- Elders Real Estate

- Professionals Real Estate

- Turner Real Estate

- Holdsworth Real Estate

- Kevin Hicks Real Estate

- Halls Head Real Estate

- Australian Financial Review – Property

- Reserve Bank of Australia – Housing Data