“The best way to predict the future is to invent it.” – Alan Kay

The real estate industry stands at the forefront of a technological revolution that is fundamentally reshaping how properties are bought, sold, managed, and valued. In 2026, artificial intelligence has evolved from a buzzword into an essential infrastructure that powers every aspect of real estate operations. From individual homebuyers searching for their dream property to institutional investors managing billion-dollar portfolios, AI technology is delivering unprecedented efficiency, accuracy, and insight into one of the world’s oldest industries.

- Understanding AI’s Role in Modern Real Estate Operations

- Revolutionary Changes in Property Valuation Methods

- Transforming Property Search and Discovery

- Immersive Virtual Property Experiences

- Predictive Analytics Powering Investment Decisions

- AI-Driven Customer Service and Lead Management

- Smart Building Management and Predictive Maintenance

- Streamlining Transactions and Document Processing

- Integration of Blockchain Technology

- Watch: AI Transforming Real Estate in 2026

- Challenges and Ethical Considerations

- The Future Beyond 2026

- Conclusion: Navigating the AI-Powered Real Estate Landscape

- Sources and References

This transformation represents more than incremental improvement. AI is enabling capabilities that were impossible just years ago, creating new business models, democratizing access to sophisticated analysis tools, and fundamentally changing the competitive landscape. Understanding these changes is no longer optional for real estate professionals, investors, or consumers who want to succeed in this rapidly evolving market.

Understanding AI’s Role in Modern Real Estate Operations

Artificial intelligence in real estate encompasses a broad range of technologies including machine learning algorithms, natural language processing, computer vision, predictive analytics, and neural networks. These systems process massive datasets to identify patterns, make predictions, automate decisions, and provide insights that would be impossible for humans to derive manually.

The applications span the entire real estate value chain. AI powers property search platforms that understand natural language queries and deliver personalized recommendations. Valuation models analyze millions of comparable sales, economic indicators, and property characteristics to generate instant appraisals. Chatbots handle customer inquiries 24/7, qualifying leads and scheduling appointments without human intervention. Predictive maintenance systems monitor building equipment to prevent failures before they occur.

What makes 2026 a pivotal year is the maturation and widespread adoption of these technologies. Early experimental implementations have given way to proven, scalable solutions that deliver measurable return on investment. The competitive advantage now lies not in whether firms use AI, but in how effectively they integrate these tools into their operations and strategy.

Revolutionary Changes in Property Valuation Methods

Property valuation has historically relied on comparative market analysis, where appraisers evaluate recently sold properties with similar characteristics to estimate value. This process is time-consuming, subjective, and prone to significant errors. Studies have shown that traditional appraisals contain substantial errors in over 33 percent of cases, creating problems for buyers, sellers, and lenders alike.

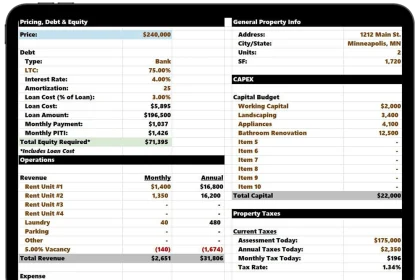

AI-powered Automated Valuation Models have transformed this landscape. These systems ingest enormous datasets including millions of historical transactions, property characteristics, tax assessments, neighborhood demographics, school ratings, crime statistics, proximity to amenities, transportation access, and economic indicators. Machine learning algorithms identify complex relationships between these variables and property values, generating valuations that are both faster and more accurate than traditional methods.

Leading platforms like HouseCanary, Homesage.ai, and Zillow’s Zestimate now provide instant valuations for virtually every property in their coverage areas. These systems update continuously as new data becomes available, reflecting market changes in real time rather than relying on months-old comparable sales. The median error rates have dropped to approximately 2.8 percent for properties in well-documented markets, representing a substantial improvement over traditional appraisal accuracy.

Computer vision technology adds another dimension to AI valuations. Systems can analyze photographs and video tours to assess property condition, finish quality, landscaping, and curb appeal. These visual assessments complement traditional data points, providing a more comprehensive valuation picture. Some advanced systems even detect renovation potential, identifying properties where strategic improvements could generate outsized returns.

The impact extends beyond residential real estate. Commercial property valuation benefits similarly from AI analysis of lease terms, tenant quality, cash flow projections, market absorption rates, and cap rate trends. Investment trusts and institutional investors increasingly rely on these automated systems to value large portfolios efficiently and consistently.

For consumers, AI valuation tools provide transparency and negotiating power. Buyers can quickly assess whether asking prices align with market data. Sellers gain realistic expectations before listing. The democratization of valuation expertise levels the playing field between sophisticated institutional players and individual consumers.

Transforming Property Search and Discovery

The traditional property search process involved scrolling through hundreds of listings, most of which failed to match buyer preferences. This inefficient approach wasted time for both buyers and agents while often missing suitable properties due to search parameter limitations or poor listing descriptions.

AI-powered search platforms have revolutionized this experience through intelligent recommendation engines that learn from user behavior. These systems track which listings users view, how long they examine each property, which features generate interest, and which characteristics lead to property tours or offers. Machine learning algorithms analyze these behavioral signals to understand preferences better than buyers might articulate themselves.

Natural language processing enables conversational search interfaces. Instead of filling out forms with checkboxes and drop-down menus, users can describe what they want in plain language. Statements like “I need a quiet neighborhood with good schools, walking distance to parks, and a large backyard for my dogs” get processed by AI systems that understand the intent and translate it into relevant search parameters.

Recommendation engines go beyond matching explicit criteria. They identify patterns in user preferences and surface properties that share characteristics with listings that generated interest, even if those properties don’t match all stated requirements. This discovery capability helps buyers find homes they might not have considered but actually fit their needs better than properties matching their initial search criteria.

Visual search capabilities allow users to upload photos of homes they like, and AI systems identify similar properties in the market based on architectural style, exterior appearance, interior design, and other visual characteristics. This image-based search complements text queries, providing another avenue for property discovery.

Voice-activated search through smart speakers and mobile devices makes property research even more convenient. Users can inquire about new listings, schedule tours, and get property information through spoken queries while cooking dinner, commuting, or relaxing at home. The friction in property search continues to decline as AI makes the process more natural and accessible.

For real estate agents, these AI tools provide valuable lead intelligence. Systems track which properties generate interest, how serious prospects appear based on their search behavior, and what characteristics matter most to specific buyers. This information allows agents to curate personalized property recommendations rather than sending generic listing emails.

Immersive Virtual Property Experiences

The COVID-19 pandemic accelerated adoption of virtual property tours, but the technology available in 2026 far surpasses the simple 360-degree photos that initially gained popularity. Modern virtual tour platforms combine multiple technologies including 3D laser scanning, photogrammetry, artificial intelligence, and augmented reality to create experiences that rival in-person visits.

Companies like Matterport lead this space with systems that use specialized cameras and LiDAR sensors to capture precise 3D models of properties. AI algorithms process the raw capture data to create detailed digital twins that users can navigate freely, examining every room, closet, and outdoor space from any angle. The level of detail allows users to measure dimensions, assess ceiling heights, and evaluate sight lines with accuracy impossible in traditional photographs.

Computer vision AI enhances these tours with automatic object recognition and tagging. The system identifies and labels appliances, fixtures, architectural features, and materials, providing information overlays that appear when users explore the space. Buyers can click on a kitchen countertop to learn it’s granite, select a light fixture to see the brand and model, or examine flooring to understand its composition.

Virtual staging powered by AI has become a cost-effective alternative to physical staging. Systems can furnish empty rooms digitally, showing buyers how spaces could look with furniture and decor. Unlike static staged photos, AI staging can generate multiple design options, allowing viewers to see contemporary, traditional, modern, or any other style applied to the same space. Some platforms even personalize staging based on user preferences detected through their browsing behavior.

Augmented reality applications extend virtual tours into the physical world. Buyers visiting properties can use smartphone or tablet cameras to overlay information onto what they see. Point the device at a wall, and AR displays what the room would look like with a different paint color. Aim it at an empty corner, and AR shows how a specific piece of furniture would fit. This technology bridges the gap between imagination and reality, helping buyers visualize possibilities.

AI-guided virtual tours adapt to individual interests. The system tracks where users focus attention during tours, what features they examine closely, and which rooms they revisit. Based on these signals, AI narration highlights relevant details and answers likely questions proactively. If a user spends significant time in the kitchen, the tour might automatically provide information about appliance age, energy efficiency ratings, and storage capacity.

The impact on real estate marketing is profound. Properties with high-quality 3D tours receive significantly more inquiries and sell faster than those with only photographs. Data shows that 62 percent of buyers consider virtual tours the most influential factor in their decision-making process. The technology has become table stakes rather than a luxury, with buyers increasingly unwilling to seriously consider properties lacking immersive virtual presentation.

For international buyers and investors purchasing in markets far from their primary residence, virtual tour technology removes geographic barriers. Sophisticated buyers now routinely purchase properties they’ve never visited physically, relying on detailed 3D tours, AI-generated property reports, and video consultations with local agents to make informed decisions.

Predictive Analytics Powering Investment Decisions

Perhaps the most powerful application of AI in real estate is predictive analytics, which enables investors to forecast future market conditions, property values, and investment returns with unprecedented accuracy. These capabilities transform real estate investing from an art based largely on intuition and experience into a data-driven science supported by rigorous quantitative analysis.

Predictive models ingest vast amounts of historical data including decades of transaction records, economic indicators, demographic trends, employment statistics, infrastructure development plans, zoning changes, school district performance, crime rates, and hundreds of other variables that influence property values. Machine learning algorithms identify complex relationships and patterns in this data, learning which factors drive appreciation in different market segments and conditions.

Short-term predictions covering 6 to 12 months achieve 82 to 91 percent accuracy for property values in stable markets with comprehensive data. Medium-term forecasts spanning 1 to 3 years reach 72 to 82 percent accuracy. While longer-term predictions face greater uncertainty due to unpredictable economic and political events, even 3 to 5 year forecasts provide valuable directional guidance for strategic investment planning.

These prediction capabilities empower investors to identify neighborhoods positioned for growth before prices surge. AI systems can detect early signals of gentrification, spot areas where infrastructure improvements will drive appreciation, and recognize demographic shifts that increase housing demand. Getting ahead of these trends allows investors to acquire properties at current prices and capture appreciation as the market recognizes changing fundamentals.

Risk assessment represents another critical application of predictive analytics. AI models evaluate default probability for specific properties based on borrower characteristics, loan terms, property attributes, and local economic conditions. This risk scoring helps lenders make better underwriting decisions and allows investors to price risk appropriately when purchasing mortgage-backed securities or making direct loans.

Market timing models attempt to predict cyclical turning points, helping investors know when to accumulate properties aggressively versus when to harvest gains and reduce exposure. While perfectly timing markets remains impossible, AI systems that analyze leading indicators, credit conditions, investor sentiment, and market momentum can provide valuable signals about relative risk and opportunity across the real estate cycle.

Portfolio optimization tools use AI to analyze holdings and recommend strategic adjustments. These systems consider factors like geographic concentration risk, property type diversification, correlation between holdings, individual property performance, and market outlook to suggest acquisitions or dispositions that would improve overall portfolio risk-adjusted returns.

According to Deloitte research, over 72 percent of real estate firms now use predictive analytics in their investment process. The competitive advantage has shifted from those with access to the technology to those who can interpret AI insights effectively and integrate them into investment decision-making alongside qualitative factors and market expertise.

AI-Driven Customer Service and Lead Management

Customer service in real estate has traditionally been labor-intensive and time-sensitive. Potential buyers expect quick responses to inquiries, but agents juggling multiple clients and transactions often struggle to respond promptly, especially outside business hours. This responsiveness gap results in lost opportunities as prospects move on to competitors who engage more quickly.

AI-powered chatbots and virtual assistants have transformed this dynamic by providing instant, 24/7 engagement with prospective clients. These systems handle routine inquiries about property details, neighborhood information, showing availability, and financing options without human intervention. Natural language processing allows chatbots to understand questions posed in conversational language and provide relevant, helpful responses.

Modern real estate chatbots go well beyond simple question answering. They actively qualify leads by gathering information about budget, location preferences, must-have features, timeline, and financing status. This qualification process helps agents prioritize their time on the most serious and suitable prospects. The chatbot can schedule property showings directly into agent calendars, send property information and virtual tour links, and maintain engagement through automated follow-up messages.

Voice-enabled AI assistants extend this capability to phone inquiries. These systems can handle inbound calls, answer basic questions, collect contact information, and route serious prospects to human agents for detailed consultation. The technology has advanced to the point where many callers don’t realize they’re initially speaking with an AI system rather than a person.

Lead scoring algorithms analyze prospect behavior across multiple touchpoints to assess purchase likelihood and timeline. The system tracks website visits, email opens, property tour views, inquiry frequency, search behavior, and engagement patterns to score leads on likelihood to convert. High-scoring leads get prioritized for agent follow-up, while lower-scoring leads receive automated nurture campaigns until their engagement signals indicate readiness for personal outreach.

Real estate teams using AI chatbots have reported up to 40 percent increases in lead conversion rates. The improvement stems from faster initial response, consistent qualification, prevention of leads falling through cracks, and better matching between agents and clients. Portugal’s Porta da Frente Christie’s closed $100 million in sales in early 2025 using AI assistants that handle lead qualification around the clock.

For property management companies, AI customer service handles routine tenant inquiries about lease terms, payment procedures, maintenance request status, and community policies. This automation frees property managers to focus on complex issues, tenant relations, and strategic initiatives rather than answering the same basic questions repeatedly.

Sentiment analysis tools monitor customer communications to detect satisfaction issues before they escalate. These systems analyze email, chat, and call transcripts to identify negative sentiment, frustration, or dissatisfaction. Alerts notify managers when intervention might prevent a tenant from leaving or a client from switching agents.

Smart Building Management and Predictive Maintenance

Property management has been revolutionized by AI systems that optimize building operations and predict maintenance needs before failures occur. These intelligent systems connect to networks of IoT sensors distributed throughout buildings, continuously monitoring environmental conditions, equipment performance, energy consumption, and space utilization.

Predictive maintenance represents one of the highest-value applications. Traditional maintenance follows either reactive or scheduled approaches. Reactive maintenance waits until equipment fails, resulting in unexpected downtime, emergency repair costs, and potential tenant disruption. Scheduled maintenance performs service at fixed intervals regardless of actual equipment condition, often replacing parts with remaining useful life or missing emerging problems between scheduled services.

AI-powered predictive maintenance monitors equipment in real time to detect early warning signs of potential failure. Sensors track vibration patterns in motors, temperature fluctuations in HVAC systems, unusual sounds in elevators, pressure variations in plumbing, and power consumption anomalies in electrical systems. Machine learning algorithms learn normal operating patterns and flag deviations that suggest developing problems.

This early detection enables proactive intervention. Instead of an air conditioning system failing during a summer heatwave, the predictive system alerts managers that a compressor bearing shows abnormal vibration suggesting replacement within two weeks. Maintenance can be scheduled during a convenient time, parts ordered in advance, and tenants notified of planned service rather than dealing with emergency breakdown and uncomfortable conditions.

The financial impact is substantial. Leading property management firms using AI-IoT dashboards have cut energy waste by 25 percent and maintenance costs by 30 percent. These savings flow directly to property net operating income, increasing valuations and returns. Reduced emergency repairs also improve tenant satisfaction and retention.

Energy optimization systems use AI to continuously adjust building operations for maximum efficiency. Smart thermostats learn occupancy patterns and automatically adjust heating and cooling to occupied zones while reducing conditioning in vacant spaces. Lighting systems dim or turn off in unoccupied areas while ensuring well-lit conditions where people are working. These adjustments happen dynamically throughout the day based on real-time occupancy detection and learned patterns.

Space utilization analytics help commercial property owners and managers understand how tenants actually use their space. Sensors track desk occupancy, conference room usage, common area traffic, and amenity utilization. This data informs decisions about space allocation, amenity investments, and lease structures. The rise of hybrid work has made space utilization analysis particularly valuable as companies reevaluate their real estate needs.

Security systems enhanced with AI provide more effective monitoring with fewer false alarms. Computer vision analyzes video feeds to distinguish between actual security threats and benign events that trigger traditional motion sensors. Facial recognition controls access to restricted areas while tracking unauthorized entry attempts. Pattern recognition identifies suspicious behavior that human monitors might miss during long surveillance shifts.

Water leak detection systems use acoustic sensors and AI analysis to identify leaks in plumbing systems before they cause visible damage. Early detection can prevent catastrophic water damage that destroys finishes, creates mold problems, and displaces tenants. The cost savings from preventing a single major leak often justifies the entire smart building sensor investment.

Streamlining Transactions and Document Processing

Real estate transactions involve substantial paperwork including purchase agreements, disclosures, inspection reports, title documents, loan applications, and closing statements. Processing these documents has traditionally required significant manual effort from agents, attorneys, and title companies to review terms, extract key information, identify issues, and ensure compliance with regulations.

AI-powered document processing systems use natural language processing and machine learning to automate much of this work. These systems can read contracts and extract critical terms including purchase price, contingencies, deadlines, earnest money requirements, and closing dates. The extracted information populates transaction management systems automatically, reducing data entry errors and saving hours of manual work.

Document comparison tools identify differences between versions of contracts, highlighting changes made during negotiations. This capability helps attorneys and agents quickly spot modifications without reading entire documents word by word. The system flags potentially problematic changes that require careful review while confirming routine updates.

Compliance checking algorithms verify that transactions meet regulatory requirements. The system reviews disclosures to ensure all required information is included, checks that deadlines align with legal requirements, validates that signatures and acknowledgments are complete, and flags potential fair housing or lending discrimination issues. This automated compliance review reduces legal risk while freeing attorneys to focus on complex judgment calls that require human expertise.

Due diligence on commercial transactions involves reviewing extensive financial records, lease agreements, environmental assessments, and property condition reports. AI systems can analyze thousands of pages of documentation to extract relevant financial metrics, identify concerning lease terms, flag environmental issues, and summarize property condition. This analysis, which might take analysts weeks to complete manually, can be performed in hours or days with AI assistance.

Fraud detection systems use machine learning to identify suspicious patterns in transactions. These algorithms analyze property values, transaction velocities, borrower characteristics, and documentation patterns to flag potential mortgage fraud, identity theft, straw buyer schemes, and property flipping scams. Banks and title companies use these systems to protect against losses from fraudulent transactions.

Smart contracts built on blockchain technology with AI integration automate transaction execution based on predefined conditions. When specified milestones are reached, such as inspection approval or loan funding, smart contracts automatically trigger the next transaction step without requiring manual intervention. This automation accelerates closing timelines while reducing the coordination burden on transaction parties.

Integration of Blockchain Technology

While blockchain operates independently of AI, the integration of these technologies creates powerful synergies for real estate transactions. Blockchain provides a decentralized, immutable ledger for recording property ownership, transaction history, and associated documentation. This transparency and security address long-standing problems in real estate title systems.

Traditional title systems rely on centralized county records that may contain errors, gaps, or fraudulent entries. Title insurance protects against these defects, but the system is reactive rather than preventive. Blockchain-based title recording creates a transparent, verifiable chain of ownership that is extremely difficult to alter fraudulently. Each transaction is cryptographically signed and linked to previous transactions, creating an auditable trail from the current owner back to the original property grant.

Companies like Propy have pioneered blockchain-enabled real estate transactions, facilitating property sales where the entire process from offer to deed recording occurs on-chain. These transactions provide high levels of transparency as all parties can verify each step in real time. Smart contracts automate fund disbursement when conditions are met, reducing settlement risk and accelerating closings.

Property tokenization represents another significant blockchain application. This process divides property ownership into digital tokens that can be bought and sold like shares of stock. Tokenization enables fractional ownership, allowing investors to purchase portions of properties rather than acquiring entire buildings. This democratizes access to real estate investment, particularly for high-value commercial properties that would otherwise require millions in capital.

Tokenization also improves liquidity in real estate, traditionally an illiquid asset class. Token holders can sell their shares on secondary markets without waiting for the entire property to sell. This liquidity is particularly attractive for investors who want real estate exposure but need the ability to exit positions more quickly than traditional real estate allows.

Beeline Loans has pioneered blockchain-recorded home equity transactions in the United States, becoming the first platform to tokenize residential home equity at scale. This innovation creates a new financial instrument that combines the security of real estate collateral with the tradability of digital assets.

The integration of AI with blockchain enhances these systems through intelligent analysis and automation. AI algorithms verify document authenticity before blockchain recording, detect potentially fraudulent transactions before they are committed to the ledger, analyze token trading patterns to identify market manipulation, and provide valuation services for tokenized properties.

According to Deloitte analysis, blockchain-driven efficiencies could reduce real estate transaction costs by up to 30 percent. These savings come from reduced title insurance expenses, lower escrow costs, eliminated intermediary fees, faster closings, and reduced fraud losses. As the technology matures and gains wider adoption, these benefits should expand.

Watch: AI Transforming Real Estate in 2026

Challenges and Ethical Considerations

Despite the tremendous benefits AI brings to real estate, significant challenges and ethical concerns require careful attention. Data privacy ranks among the top concerns as AI systems require access to sensitive personal information including financial details, employment history, family size, lifestyle preferences, and search behavior. Real estate firms must implement robust security measures to protect this data from breaches while ensuring compliance with regulations like GDPR, CCPA, and emerging AI-specific governance frameworks.

Algorithmic bias represents a particularly serious challenge given real estate’s history of discrimination. AI systems learn from historical data, and if that data reflects past discriminatory practices, algorithms may perpetuate or even amplify those biases. Studies have documented that Automated Valuation Models tend to undervalue homes in predominantly Black and Latino neighborhoods, not because the algorithms are explicitly programmed with bias, but because they learn patterns from historical appraisals that reflected human bias.

Research shows bias can infiltrate algorithms through prejudiced training data, incorrect model assumptions, or skewed interpretation of outcomes. For example, if historical loan approval data shows lower approval rates for certain demographic groups, an AI trained on that data might learn to reject applicants from those groups at higher rates, creating a self-reinforcing cycle of discrimination.

Addressing algorithmic bias requires multi-faceted approaches. Real estate firms must audit their AI systems regularly for discriminatory outcomes, use diverse training datasets that represent all population segments, implement bias detection tools that flag suspicious patterns, and maintain human oversight for decisions with significant equity implications. Transparency in AI decision-making processes helps stakeholders understand how systems reach conclusions and identify potential bias issues.

The Fair Housing Act and Equal Credit Opportunity Act impose legal requirements that AI systems must respect. Algorithms cannot use protected characteristics like race, religion, national origin, family status, or disability in housing and lending decisions. However, seemingly neutral variables like zip code or educational attainment may correlate strongly with protected characteristics, creating proxy discrimination even when protected variables aren’t directly used.

Explainability poses another significant challenge. Many AI systems, particularly deep learning neural networks, operate as “black boxes” where even developers struggle to explain exactly how the system reached a specific conclusion. This opacity creates problems for regulatory compliance, appeals processes, and consumer trust. The real estate industry increasingly demands explainable AI that can articulate the reasoning behind valuations, credit decisions, and recommendations in terms humans can understand and validate.

Job displacement concerns merit consideration as AI automates tasks previously performed by humans. Appraisers worry about automated valuation models, transaction coordinators fear document processing automation, and property managers see maintenance prediction systems handling some responsibilities. However, the evidence suggests AI augments rather than replaces human professionals. Agents freed from routine tasks can focus on relationship building and complex negotiations. Appraisers can handle more assignments with AI assistance. Property managers oversee more units efficiently with smart building systems.

The digital divide creates equity concerns as AI tools become essential for competitive real estate practice. Small brokerages and individual agents may struggle to afford sophisticated AI platforms that large firms deploy. This technology gap could accelerate industry consolidation as firms with better tools capture market share. Ensuring broad access to AI capabilities, perhaps through shared platforms or affordable subscription services, helps maintain competitive diversity in real estate markets.

Environmental and climate considerations are increasingly important as AI systems influence development and investment decisions. Algorithms should account for climate risks including flooding, wildfires, extreme weather, and sea level rise. Properties in high-risk areas may face declining values as climate impacts intensify, and AI systems need to incorporate these long-term risks even when short-term price trends remain positive.

The Future Beyond 2026

Looking ahead, AI capabilities in real estate will continue advancing rapidly. Autonomous systems that operate with minimal human oversight will become more common, handling everything from property management to investment portfolio rebalancing based on AI-generated insights and strategic parameters set by humans.

Integration with smart city infrastructure promises revolutionary changes. Properties will communicate with urban transportation systems, utility grids, and municipal services. Real-time data flows will enable dynamic optimization across entire metropolitan areas. Parking availability, traffic patterns, public transit schedules, and building energy demand will all inform AI systems managing urban operations.

Climate risk modeling will become deeply integrated into all real estate AI applications. As environmental concerns intensify, every valuation, investment analysis, and development decision will incorporate flood probabilities, fire risk assessments, hurricane exposure, heat stress projections, and water availability forecasts. Properties in high-risk zones may become effectively uninsurable and unfundable, requiring AI systems to account for existential climate threats to long-term property viability.

Quantum computing applications, while still largely experimental, could dramatically enhance AI capabilities in real estate. The massive computational power of quantum systems could enable prediction models that consider thousands of variables simultaneously, achieving accuracy levels impossible with classical computing. Quantum-enhanced AI might achieve over 90 percent accuracy for 18 to 24 month property value forecasts by processing vastly more complex models.

Personalized prediction models will evolve beyond generic market forecasts. Future AI systems will generate investment recommendations customized for individual investor profiles, risk tolerances, time horizons, and strategic objectives. Rather than one-size-fits-all predictions, investors will receive guidance optimized for their specific situation and goals.

Virtual reality integration will make property tours even more immersive. Full VR headsets will transport users into properties, allowing them to experience spaces at life scale with realistic depth perception and spatial audio. Haptic feedback could eventually allow users to “feel” surfaces and textures during virtual tours, further closing the gap between virtual and physical property visits.

AI-powered construction technology will influence new development. Generative design algorithms can create optimal building layouts based on site constraints, zoning requirements, construction costs, and market demand. Robotic construction guided by AI may reduce building costs while improving quality and consistency. These advances could help address housing affordability challenges in expensive markets.

Regulatory frameworks for AI in real estate will mature as governments and industry organizations develop standards for algorithmic transparency, bias testing, and consumer protection. We may see certification requirements for AI systems used in high-stakes applications like lending and valuation, similar to how appraisers and inspectors require licensing today.

Conclusion: Navigating the AI-Powered Real Estate Landscape

Artificial intelligence has fundamentally transformed real estate in 2026, creating a new competitive landscape where technology adoption separates market leaders from those struggling to keep pace. The firms thriving in this environment have successfully integrated AI into their operations while maintaining the human expertise, relationships, and judgment that remain essential in real estate transactions.

For real estate professionals, the imperative is clear: embrace AI as a tool that enhances your capabilities rather than a threat to your livelihood. Agents who learn to leverage AI for property search, valuation, and customer engagement will serve clients more effectively while managing larger client rosters. Property managers using smart building technology will operate more efficiently and profitably. Investors applying predictive analytics will make better decisions and generate superior returns.

For consumers, AI democratizes access to sophisticated analysis tools and market insights previously available only to industry insiders. Homebuyers can research markets thoroughly, assess property values accurately, and make informed decisions with confidence. Investors can evaluate opportunities with institutional-grade analytics regardless of portfolio size. Tenants benefit from better-managed buildings with proactive maintenance and optimized operations.

The ethical challenges surrounding AI in real estate demand ongoing attention and action. The industry must remain vigilant against algorithmic bias, protect consumer privacy, ensure transparency in AI decision-making, and maintain human oversight where appropriate. Companies that address these challenges proactively will build trust and sustainable competitive advantages.

As we move further into 2026 and beyond, AI will become even more deeply embedded in real estate infrastructure. The technology will feel less like a distinct tool and more like an invisible foundation supporting every transaction, valuation, search, and management decision. Success will belong to those who adapt skillfully to this AI-augmented reality while preserving the human elements that make real estate fundamentally a people business.

The transformation is irreversible. Artificial intelligence has become essential infrastructure for modern real estate success. Whether you’re a first-time homebuyer, seasoned investor, real estate professional, or property manager, understanding and leveraging AI capabilities will increasingly determine your outcomes in this dynamic, technology-driven market.

Sources and References

- Homesage.ai – AI Changing Real Estate Data 2026

- Medium – Complete Guide to AI in Real Estate 2026

- PROPCORN AI – Hidden Risks in Property Valuation

- GraffersID – AI in Real Estate 2026

- StackDC – Commercial Real Estate AI Strategy 2026

- PwC – Emerging Trends in Real Estate 2026

- Maxiom Tech – Property Valuation AI Trends

- Northpoint Asset Management – AI Changing Property Management 2026

- RTS Labs – AI Chatbot for Real Estate

- Buildium – 2026 Property Management Industry Trends