“The future is already here – it’s just not evenly distributed yet.” – William Gibson

The real estate industry is experiencing a technological revolution that would have seemed like science fiction just a decade ago. In 2026, artificial intelligence has moved from experimental implementations to becoming the backbone of how properties are bought, sold, valued, and managed. This transformation is reshaping every aspect of the real estate ecosystem, from individual homebuyers to massive commercial property portfolios.

- The AI Revolution in Property Valuation

- Virtual Property Tours and Immersive Experiences

- Smart Property Search and Personalized Recommendations

- Predictive Analytics for Investment Success

- AI-Powered Customer Service and Lead Management

- Predictive Maintenance and Smart Building Management

- Document Processing and Transaction Automation

- Blockchain Integration and Smart Contracts

- Challenges and Considerations

- The Future of AI in Real Estate Beyond 2026

- Conclusion

The AI Revolution in Property Valuation

Property valuation has traditionally been an art as much as a science, relying heavily on human expertise and comparable sales data. Today, AI-powered valuation models are changing this landscape dramatically. Machine learning algorithms now analyze millions of data points simultaneously, including traditional factors like square footage and location, alongside newer variables such as neighborhood walkability scores, future infrastructure developments, and even climate risk assessments.Modern Automated Valuation Models now incorporate advanced computer vision technology to assess property conditions, analyzing everything from curb appeal to interior finishes. These systems deliver valuations with median error rates as low as 2.8 percent, significantly outperforming traditional appraisal methods which contain substantial errors in over 33 percent of cases according to recent industry data.

Companies like HouseCanary and Homesage.ai are leading this transformation. Their platforms generate instant value estimates for millions of homes, adjusting in real time as market data changes. The technology goes beyond simple comparable sales analysis to include geographic intelligence, factoring in neighborhood trends, crime rates, amenities, and even local school performance.

Virtual Property Tours and Immersive Experiences

The way properties are showcased has undergone a complete transformation. Virtual tours powered by AI and computer vision technology have evolved from simple 360-degree photos to fully immersive experiences that rival in-person visits. In 2026, these tours incorporate interactive elements, real-time data overlays, and personalized features that adapt to individual buyer preferences.Platforms like Matterport and Realsee use advanced LiDAR scanning technology combined with AI to create detailed 3D models that can be explored online. These virtual tours allow prospective buyers to walk through properties at their own pace, examining every room and space with unprecedented detail. Users can take self-guided tours of properties, exploring rooms, outdoor spaces, and amenities independently.

The integration of augmented reality takes this further. Buyers can use AR property previews to visualize furniture layouts or potential renovations in real time. AI-generated virtual staging has become a cost-effective alternative to physical staging, with properties using these technologies selling up to 73 percent faster according to industry reports.

According to recent data, 62 percent of U.S. buyers consider a virtual tour the most influential factor in their decision-making process, and 71 percent would be willing to make an offer based solely on a 3D tour. This represents a fundamental shift in how properties are marketed and purchased.

Smart Property Search and Personalized Recommendations

The days of manually scrolling through hundreds of irrelevant listings are over. AI-powered property search platforms in 2026 use sophisticated algorithms to understand buyer preferences and deliver highly personalized recommendations. These systems learn from user behavior, analyzing which properties generate interest and refining suggestions accordingly.Platforms like Homesage.ai provide instant property analysis with comprehensive reports showing estimated ROI, renovation potential, rental yield projections, and negotiation score recommendations. Voice-activated search features allow buyers to describe what they are looking for verbally, and AI platforms instantly surface matching listings.

The technology extends to bulk data mining, where systems rapidly analyze millions of transactions to spot pricing anomalies or identify emerging neighborhoods before competitors catch on. This capability gives savvy investors a crucial first-mover advantage in rapidly appreciating markets.

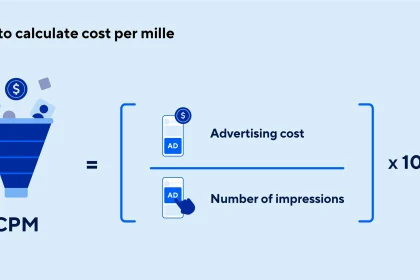

Predictive Analytics for Investment Success

Perhaps the most powerful application of AI in real estate is predictive analytics, which enables investors to forecast future market trends with remarkable accuracy. These systems analyze historical transaction data, demographic shifts, economic indicators, and local development plans to provide insight into future valuations and investment returns.

Short-term predictions covering 6 to 12 months achieve 82 to 91 percent accuracy for property values in stable markets with good data, while medium-term forecasts reach 72 to 82 percent accuracy. These prediction capabilities empower investors to identify neighborhoods positioned for growth before prices surge, allowing them to maximize returns on investment.

According to a Deloitte study, over 72 percent of real estate firms now use predictive analytics to identify investment opportunities and manage risks. The technology processes economic trends, demographic data, zoning changes, and infrastructure developments to create comprehensive market models that guide investment strategies.

Platforms like PropStream employ various data sources and AI algorithms to generate propensity scores for properties, predicting the likelihood of default and identifying distressed asset opportunities. These forecasting tools help investors anticipate supply crunches or market floods that impact negotiating leverage.

AI-Powered Customer Service and Lead Management

The customer service experience in real estate has been transformed by AI chatbots and virtual assistants. These systems handle up to 80 percent of routine customer inquiries, freeing human agents to focus on complex negotiations and relationship building.Modern AI chatbots work around the clock, engaging leads through voice, text, Facebook Messenger, and website interactions. They qualify prospects by asking questions about budget, location preferences, and timeline, then schedule appointments directly into agent calendars. Real estate teams using AI chatbots have seen up to 40 percent increase in lead conversion rates.

Portugal’s Porta da Frente Christie’s closed $100 million in sales in early 2025 using AI assistants that handle lead qualification and property matching around the clock, allowing human agents to focus exclusively on negotiations and relationship building. The automation of repetitive tasks allows agents to concentrate on higher-value activities while ensuring no potential client inquiry goes unanswered.

Predictive Maintenance and Smart Building Management

Property management has been revolutionized by AI-powered predictive maintenance systems. These tools analyze data from IoT sensors installed throughout buildings to monitor the health of critical systems including HVAC, elevators, plumbing, and electrical infrastructure.

By 2026, leading property management firms are using AI-IoT dashboards to cut energy waste by 25 percent and maintenance costs by 30 percent, setting new benchmarks for operational efficiency. The systems detect anomalies in performance metrics that suggest possible equipment failures, enabling proactive maintenance that minimizes downtime and repair costs.

Smart thermostats, lighting systems, and energy management platforms use AI to automatically adjust building operations based on occupancy patterns and usage data. These systems continuously learn from data to make real-time operational decisions, improving performance over time while reducing environmental impact.

For property managers, this technology means transforming from reactive to proactive operations. Instead of waiting for tenant complaints about broken air conditioning, AI systems alert managers days or weeks in advance, allowing scheduled repairs during convenient times rather than emergency interventions.

Document Processing and Transaction Automation

The paperwork burden in real estate has been significantly reduced through AI-powered document processing. Natural language processing systems can read and extract critical information from leases, purchase agreements, and other documents in seconds, organizing data that would traditionally require hours of manual review.AI-powered fraud detection systems analyze transaction patterns and property listings using machine learning to detect anomalies. These systems minimize human error, ensure compliance with evolving regulations, and build trust through automated transparency in every transaction. Credit and risk scoring algorithms evaluate buyer profiles to mitigate financial risk before deals close.

Blockchain Integration and Smart Contracts

While blockchain technology operates independently, its integration with AI is creating powerful synergies in real estate transactions. Smart contracts, self-executing agreements with terms directly written into code, automate transaction milestones and reduce the need for intermediaries.

Blockchain’s decentralized ledger records transactions across multiple computers, making it nearly impossible to alter data without detection, providing high levels of trust and integrity in property transactions. According to Deloitte, blockchain-driven efficiencies could cut transaction costs by up to 30 percent.

Companies like Propy leverage AI and blockchain technology to enable 24/7 real estate closings with enhanced transparency and security. The technology records deeds onchain to avoid fraud, while AI systems reduce human work by 40 percent in processing transactions. Beeline Loans has pioneered blockchain-recorded home equity transactions, becoming the first U.S. platform to tokenize residential home equity at scale.

The combination allows for property tokenization, dividing real estate assets into digital shares that represent fractional ownership. This democratizes access to real estate investments and enhances liquidity by enabling tokens to be traded on secondary markets. The technology lowers barriers to entry for investors who may not have capital for full property purchases.

Challenges and Considerations

Despite the tremendous benefits, AI adoption in real estate faces several important challenges. Data privacy and security concerns remain paramount, as AI systems require massive volumes of buyer, seller, and property data to function effectively. Real estate firms must navigate privacy regulations and ensure compliance with laws like GDPR and various regional data protection standards.Algorithmic bias represents a significant challenge. Bias can infiltrate algorithms through prejudiced training data, incorrect model assumptions, or skewed interpretation of outcomes. Studies have shown that Automated Valuation Models are more likely to undervalue homes in majority Black and Latino neighborhoods, not because algorithms are explicitly biased, but because historical data reflects past discrimination.

To address these concerns, real estate firms must implement bias detection tools, conduct regular audits of AI systems, and ensure diverse data representation in training datasets. Human oversight remains essential, particularly for high-stakes decisions affecting fair housing and lending practices. Transparency in AI decision-making processes helps build trust with clients and ensures compliance with anti-discrimination laws.

The complexity of AI systems can create a black box problem, where decision-making processes are opaque to users. Implementing explainable AI techniques, such as decision trees and rule-based models, helps demystify how systems arrive at recommendations. Clear communication with clients about AI usage factors into building trust and maintaining ethical standards.

Job displacement concerns also merit attention. As AI systems handle more tasks like property valuation, investment analysis, and even aspects of property management, questions arise about the future of human roles in the industry. However, the consensus among industry experts is that AI augments rather than replaces human expertise, allowing professionals to focus on relationship building, complex negotiations, and strategic decision-making.

The Future of AI in Real Estate Beyond 2026

Looking beyond 2026, the trajectory of AI in real estate points toward even more sophisticated applications. Autonomous self-learning platforms will optimize property maintenance, tenant management, and energy efficiency without manual oversight, continuously improving performance through accumulated experience.

Climate risk assessment will become deeply integrated into AI valuation models. As environmental concerns grow, systems will incorporate flooding probabilities, wildfire risks, sea level rise projections, and extreme weather patterns into property valuations and investment recommendations. This integration helps investors and homeowners make informed decisions about long-term property viability.

The convergence of AI with smart city infrastructure promises revolutionary changes. Properties will communicate with urban transportation systems, utility grids, and municipal services, optimizing resource allocation across entire metropolitan areas. Real-time data from thousands of connected sensors will feed AI systems that manage everything from parking availability to energy distribution.

Quantum computing applications, while still developmental, could dramatically enhance predictive capabilities. These systems might achieve over 90 percent accuracy for 18 to 24 month forecasts by processing vastly more complex models than current systems allow. The computational power would enable simultaneous analysis of thousands of variables and their interactions with unprecedented speed.

Personalized prediction models will evolve beyond generic market forecasts. Future systems will generate recommendations optimized for individual investor profiles, risk tolerances, and investment strategies rather than one-size-fits-all predictions. This customization will improve decision relevance for specific investment approaches.

Conclusion

Artificial intelligence has fundamentally transformed real estate in 2026, touching every aspect from property valuation and search to transactions and management. The technology delivers unprecedented accuracy, efficiency, and insight, enabling faster decisions backed by comprehensive data analysis.

The winners in this new landscape are those who have successfully integrated AI into their operations while maintaining the human touch that remains essential in real estate. Technology handles repetitive tasks, data analysis, and initial client interactions, freeing professionals to focus on relationship building, strategic advice, and complex negotiations.

As we move forward, the real estate industry faces the ongoing challenge of balancing innovation with ethical considerations. Ensuring fairness, transparency, and accountability in AI systems while protecting data privacy and addressing algorithmic bias will remain paramount. The firms that master this balance, combining technological sophistication with human expertise and ethical practices, will define the future of real estate.

The transformation is no longer optional. AI has become the invisible infrastructure powering modern real estate success, and those who embrace it thoughtfully will thrive in an increasingly competitive and data-driven market.

Sources:

- Homesage.ai – AI Changing Real Estate Data 2026

- Medium – Complete Guide to AI in Real Estate 2026

- PROPCORN AI – Hidden Risks in Property Valuation

- GraffersID – AI in Real Estate 2026

- StackDC – Commercial Real Estate AI Strategy 2026

- PwC – Emerging Trends in Real Estate 2026

- Maxiom Tech – Property Valuation AI Trends

- Northpoint Asset Management – AI Changing Property Management 2026

- RTS Labs – AI Chatbot for Real Estate

- Buildium – 2026 Property Management Industry Trends