Introduction: The Foundation of Financial Well-Being

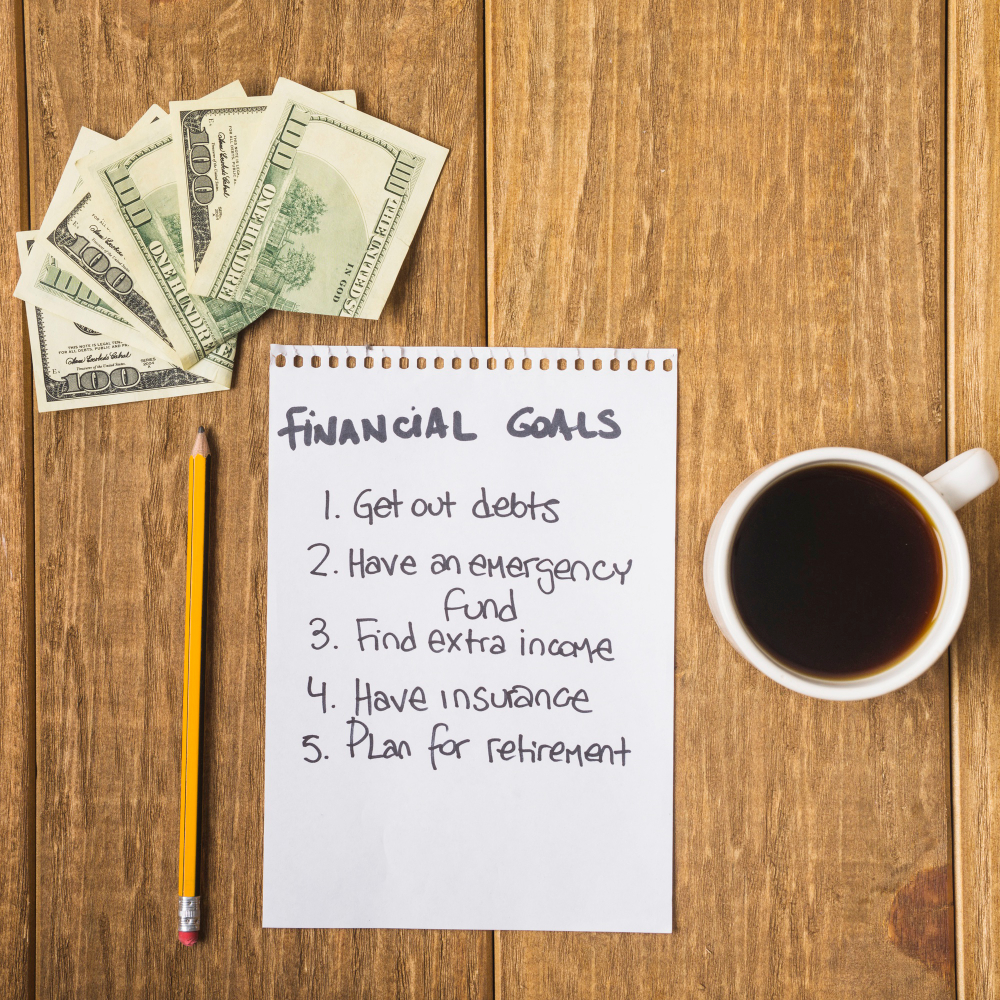

In today’s fast-paced world, achieving financial stability isn’t just about earning money it’s about managing it wisely with a clear vision for the future. Whether you are an individual trying to save for your dream home, a young adult just stepping into the world of personal finance, or someone aiming to build a secure retirement plan, setting financial goals plays a central role in shaping your economic success. It’s not just about wealth; it’s about building a life of freedom, control, and lasting prosperity.

Setting financial goals may sound like a task reserved for business executives or financial advisors, but in reality, it is a vital practice for everyone. Understanding where your money is going, how to control it, and how to grow it is the cornerstone of a stress-free financial life. Without direction, it’s easy to fall into the cycle of paycheck-to-paycheck living, impulsive spending, and uncertainty about the future. The good news is that by aligning your financial decisions with your life goals, you can build a solid strategy that leads to long-term satisfaction and success.

This article will walk you through the reasons why financial goal setting is essential, how it impacts wealth management, and what strategies you can use to begin mapping out your future. It’s a comprehensive guide to ensure your financial journey is not left to chance but designed with purpose and clarity.

The Psychology Behind Financial Goals

Before diving into strategies and action plans, it’s important to understand why financial goal setting is so powerful. Human behavior is largely driven by purpose and direction. When there’s a clear objective in sight, people are more motivated, more disciplined, and more focused. This is especially true in the realm of finances.

When you identify a financial goal—whether it’s paying off debt, buying a house, or retiring early—you create a mental roadmap. This roadmap influences your everyday decisions, from the coffee you buy in the morning to the way you plan your investments. Financial goals shift your mindset from reactive to proactive. Rather than responding to financial stress, you’re actively preventing it.

Moreover, financial goals serve as internal motivators. Without them, saving money might feel like a chore. But with goals, each dollar saved brings you one step closer to something meaningful. This psychological connection turns routine actions like budgeting or investing into purposeful efforts that contribute to your long-term well-being.

Understanding the Types of Financial Goals

Financial goals can be categorized into three primary types: short-term, mid-term, and long-term. Understanding the difference between these categories can help you prioritize and balance your approach.

Short-term financial goals typically span a timeframe of a few months to a year. These might include building an emergency fund, paying off a credit card, or saving for a vacation. These goals require immediate attention and often demand a strict budgeting routine.

Mid-term goals fall somewhere between one to five years. Examples include saving for a wedding, purchasing a car, or funding further education. These goals require both planning and patience, as they necessitate more savings and often include intermediate milestones.

Long-term goals extend beyond five years and often relate to major life events, such as buying a home, sending children to college, or securing a comfortable retirement. These goals require long-range financial planning, consistent investments, and strategic wealth-building approaches.

By categorizing your financial goals into these three buckets, you can develop a strategy that meets your present needs while also building a sustainable and prosperous future.

How Goal Setting Influences Wealth Management

Wealth management isn’t just about managing assets—it’s about aligning your wealth with your life’s ambitions. When financial goals are clearly defined, they provide the blueprint for how your money should be allocated, invested, and preserved. Without goals, wealth management becomes vague and directionless, which can lead to missed opportunities and inefficient use of resources.

For example, a person saving without a specific purpose might put their money into a standard savings account, earning minimal interest. However, someone saving to buy a home in three years would be more likely to explore high-yield savings accounts or short-term investment options that align with their timeline and risk tolerance.

Wealth management becomes exponentially more effective when you’re clear on what you’re working toward. This clarity allows financial advisors, planners, and even DIY investors to choose the right tools, from stocks and mutual funds to retirement plans and tax-saving strategies.

Goals bring context to your financial actions. They help you measure progress, reassess priorities, and maintain control over your financial destiny.

Building SMART Financial Goals

A popular and highly effective method for setting financial goals is the SMART criteria. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s explore how each component can help sharpen your financial planning.

- Specific: A vague goal like “I want to save money” lacks direction. Instead, a specific goal would be “I want to save $10,000 for a down payment on a house.”

- Measurable: You should be able to track your progress. This means setting benchmarks such as “save $2,500 every three months.”

- Achievable: It’s important to set goals that are realistic given your income and current financial obligations. An unattainable goal can lead to discouragement.

- Relevant: Your goals should align with your broader life plans and priorities. There’s no point in saving for a luxury car if your actual goal is to retire early.

- Time-bound: Deadlines give urgency and structure. Saying “I want to retire by age 60 with $1 million in savings” gives your financial plan a timeline and an endpoint.

Using the SMART framework increases your chances of staying committed and helps in adjusting strategies if you’re falling behind or surpassing expectations.

The Role of Budgeting in Reaching Financial Goals

Budgeting is often perceived as restrictive, but in reality, it’s one of the most empowering financial tools. A budget doesn’t just control your spending—it helps align your everyday choices with your long-term goals. Think of your budget as the engine that drives you toward your financial destination.

When you have clear financial goals, your budget becomes a tool for prioritization. You start making decisions based on what contributes to your future rather than what satisfies a fleeting want. Over time, this leads to better money habits, increased savings, and a more intentional lifestyle.

Effective budgeting includes reviewing your income, understanding fixed and variable expenses, and allocating a portion of your income toward your financial goals. Apps and digital tools can make this easier, but the core principle remains the same: make a plan for every dollar.

As you refine your budget over time, you’ll discover areas where you can cut back and reallocate funds to accelerate your progress. Whether it’s reducing dining expenses or switching to a more affordable mobile plan, every small change compounds toward larger results.

Saving Versus Investing: Which Supports Your Financial Goals Better?

Both saving and investing are important, but they serve different purposes in your financial journey. Saving is ideal for short-term and low-risk goals, while investing is better suited for long-term wealth accumulation.

If you’re planning to buy a home in the next two years, saving in a high-yield savings account or a certificate of deposit might be the safest route. The focus here is on capital preservation and liquidity.

However, if your goal is to retire in 20 years or fund a child’s college education, investing in the stock market, mutual funds, or index funds offers a higher potential return. While it comes with more risk, the long time horizon allows for market fluctuations to balance out.

Understanding the nature of your goal—its timeline, amount required, and your risk tolerance—helps determine whether saving or investing is more appropriate. Often, a balanced approach that includes both is the most effective.

Emergency Funds: A Non-Negotiable First Step

Before you aggressively pursue ambitious financial goals like investing or starting a business, it’s essential to establish an emergency fund. An emergency fund acts as a financial cushion for life’s unexpected events—medical emergencies, car repairs, job loss, and more.

Experts recommend saving three to six months’ worth of living expenses. This might seem daunting, but even starting with a small target, like $1,000, can make a difference. Once in place, your emergency fund allows you to pursue other goals with greater confidence, knowing that you’re protected against financial disruptions.

Without this safety net, one unexpected event could derail your entire financial strategy. That’s why setting up an emergency fund should be one of your first financial goals.

Tracking Progress and Staying Accountable

One of the most overlooked aspects of financial goal setting is the need to track your progress regularly. Just like a GPS recalculates your route based on traffic and roadblocks, your financial plan needs constant adjustments.

Tracking progress involves reviewing your savings, evaluating your spending, and measuring your results against your goals. This not only keeps you accountable but also motivates you by showing how far you’ve come.

Accountability partners can also help. Whether it’s a friend, spouse, or financial advisor, having someone to check in with can increase your chances of success.

Technology can simplify this process. Budgeting apps, investment trackers, and goal-oriented savings platforms give you real-time data and insights to fine-tune your approach.

Adjusting Goals as Life Changes

Life doesn’t follow a straight path, and neither should your financial plan. A marriage, a new job, a baby, or even a global economic shift can alter your priorities. That’s why it’s important to regularly revisit your financial goals and make adjustments when needed.

Flexible planning doesn’t mean abandoning your goals—it means adapting them to stay realistic and relevant. Perhaps you need to push back a timeline, increase your savings target, or switch investment strategies. The key is to stay aligned with your values and long-term vision, even if the specifics change.

The Long-Term Benefits of Setting Financial Goals

The benefits of setting and following through on financial goals extend far beyond dollars and cents. Financial stability reduces stress, improves relationships, and enhances your overall well-being. You sleep better at night knowing you’re prepared for the future. You make decisions more confidently, knowing they align with your bigger picture.

Over time, financial goal setting helps build generational wealth, allowing you to pass on assets, knowledge, and habits to your children and future generations. It positions you to not only enjoy the present but also to contribute meaningfully to your community and the causes you care about.

Final Thoughts: Your Future Is Worth Planning

Designing your financial future starts with setting clear, actionable goals. It’s not a one-time task but an ongoing process of planning, reviewing, and adjusting. Each step you take brings you closer to a life of financial freedom and fulfillment.

Whether you’re starting from scratch or refining an existing strategy, remember that your goals are the compass guiding every financial decision you make. They give purpose to your budget, strategy to your savings, and power to your investments.

Don’t wait for the perfect moment. Start setting financial goals today. Because the future isn’t something that just happens—it’s something you build.

Let me know if you’d like this formatted for WordPress or need SEO metadata (title, meta description, tags) included!