The moment is electric. You’ve walked through dozens of open homes, scrolled endlessly through Domain Real Estate, and finally found it: The One. It could be a chic apartment overlooking the skyline in real estate sydney, a sprawling family home in the suburbs of melbourne real estate, or a promising piece of commercial real estate perth. The offer is in, the real estate agent calls with the good news, and then it arrives—a document thicker than a novel, filled with dense, intimidating legal jargon. The Contract of Sale.

- Why You Can’t Afford to Skim Your Real Estate Contract

- Today’s Market Pulse: A Live Snapshot for Australian Property Seekers (As of Late 2023/Early 2024)

- Decoding the Clauses: Your Clause-by-Clause Breakdown

- Navigating Different Markets: Location-Specific Nuances

- The Role of Your Professional Team

- Conclusion: From Confused to Confident

For most people, this is where the excitement gives way to a wave of anxiety. This document is the legally binding blueprint for what is likely the biggest financial transaction of your life. Skimming it is not an option. But what are you even looking for? What does “subject to finance” really mean? Is the cooling-off period a get-out-of-jail-free card?

Welcome to your definitive guide. As someone who has navigated the labyrinth of real estate Australia for years, I’m here to translate the legalese into plain English. We’ll break down the most confusing clauses, so you can sign on the dotted line with confidence, not confusion.

Why You Can’t Afford to Skim Your Real Estate Contract

Before we dive in, let’s establish the stakes. This isn’t like the terms and conditions you scroll past for a software update. A real estate contract is a legally enforceable agreement. Once it’s unconditional and signed, you are obligated to follow through. Ignoring a crucial clause could lead to:

- Losing Your Deposit: Misunderstanding your obligations could see you forfeit your hard-earned 10% deposit.

- Unexpected Costs: You might find yourself responsible for repairs you thought the seller would cover.

- Buying a Problem Property: You could unknowingly purchase a property with legal restrictions, unapproved structures, or significant defects.

- Legal Action: In a worst-case scenario, breaching the contract could lead to being sued for damages.

Whether you’re a first-time buyer looking at real estate for sale or a seasoned pro in real estate investing, the contract demands your full attention. Your conveyancer or solicitor is your most valuable player here, but an informed client is an empowered one.

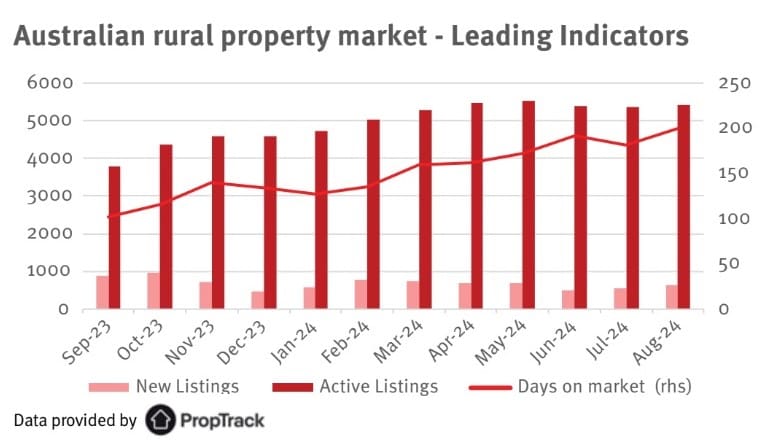

Today’s Market Pulse: A Live Snapshot for Australian Property Seekers (As of Late 2023/Early 2024)

The world of real estate news moves fast. To give you context, here’s a quick look at the current landscape. Remember to check daily sources for the very latest information.

- Interest Rates: The Reserve Bank of Australia (RBA) has been in a cycle of rate hikes to manage inflation. This directly impacts borrowing power and mortgage serviceability. Always check the latest RBA cash rate decisions, as this will influence the finance clause in your contract.

- Live Source: Reserve Bank of Australia – Cash Rate Target

- Auction Clearance Rates: Auction clearance rates are a key health indicator for the market, especially in competitive hubs like real estate sydney and melbourne real estate. A high clearance rate (above 70%) suggests a strong seller’s market, meaning less room for negotiation on contract terms. A lower rate might give buyers more leverage.

- Live Source: Domain’s Weekly Auction Results

- Market Sentiment: Overall, the Australian property market has shown resilience. While rising rates have cooled some of the frenzy, a persistent undersupply of housing in key areas like real estate brisbane and perth real estate continues to support prices. This dynamic environment makes understanding your contractual rights and obligations more critical than ever.

Decoding the Clauses: Your Clause-by-Clause Breakdown

Alright, let’s open up that contract. While the exact wording and layout will vary by state (a contract for real estate nsw differs slightly from one for real estate qld), these core clauses are almost universal.

The ‘Subject To’ Clauses (Conditions Precedent)

This is perhaps the most important section for any buyer. These clauses are your safety nets. They make the contract conditional upon certain events happening. If the condition isn’t met, you can often walk away from the sale without penalty and get your deposit back.

1. Subject to Finance

- What it means: This clause states that the contract is only binding if you can secure formal loan approval from your lender by a specific date. You’ve likely got a pre-approval, but this is for the unconditional, formal “yes” for this specific property.

- Why it’s crucial: Without this clause, if your bank unexpectedly rejects your loan application, you would still be legally bound to buy the property. Since you can’t get the money, you’d forfeit your deposit and could even be sued for any loss the seller incurs when they resell.

- What to watch for:

- The Lender: Be specific. Name the financial institution you are using.

- The Amount: The clause should state the minimum loan amount you need.

- The Date: This is the deadline. Ensure it’s realistic. A 14- or 21-day period is common, but check with your mortgage broker or bank for an accurate timeframe.

2. Subject to Building and Pest Inspection

- What it means: This allows you to have the property professionally inspected for structural defects and timber pests (like termites). The contract is conditional on you being satisfied with the results of this inspection.

- Why it’s crucial: This is your chance to uncover hidden, costly problems. A beautiful facade could be hiding rising damp, a cracked foundation, or a termite infestation that could cost tens of thousands to fix. This clause protects you from buying a money pit.

- What to watch for:

- The Wording: The best clauses are worded “subject to the buyer being satisfied with the report in their absolute discretion.” Some weaker agent-drafted clauses might say “subject to the discovery of a major structural defect,” which is much harder to prove and get out of. Push for the wording that gives you the most power.

- The Outcome: If the report reveals issues, this clause gives you three options:

- Proceed with the sale as is.

- Use the report as a tool to negotiate a lower price or for the seller to fix the issues before settlement.

- Terminate the contract and have your deposit refunded.

3. Subject to Sale of Another Property

- What it means: This clause is for buyers who need to sell their current home to fund the purchase of the new one. The contract is conditional on the successful sale and settlement of your existing property by a certain date.

- Why it’s crucial: It prevents you from being contractually obligated to buy a new home when you haven’t yet accessed the funds from your old one.

- What to watch for: This clause is less attractive to sellers, especially in a hot market, as it introduces uncertainty. It often includes a “sunset clause” or “48-hour clause,” allowing the seller to continue marketing the property. If they receive another offer, they can give you 48 hours’ notice to make your contract unconditional (i.e., remove the “subject to sale” condition) or they can terminate your contract and accept the new offer.

The Cooling-Off Period: Your Get-Out-of-Jail-Free Card?

Think of the cooling-off period as a legislated “buyer’s remorse” window. After contracts are exchanged, you have a short period (varying by state) to withdraw from the sale for any reason.

- How it works: In real estate nsw, it’s typically 5 business days. In real estate victoria, it’s 3 business days. For sa real estate, it’s 2 business days.

- The Catch: It’s not free. If you pull out during the cooling-off period, you’ll have to pay a penalty, which is usually a percentage of the purchase price (e.g., 0.25% in NSW and Victoria). This can still be thousands of dollars, but it’s much better than losing your full 10% deposit.

- When it DOESN’T apply: This is critical. The cooling-off period does not apply if you buy a property at or immediately after an auction. It also doesn’t apply to every type of property sale (e.g., some commercial or rural land).

Inclusions and Exclusions: What Stays and What Goes?

This clause seems simple but is a common source of disputes. It lists the items (chattels) that are included in the sale and those that are explicitly excluded.

- Fixtures vs. Chattels: A “fixture” is something physically attached to the property and is assumed to be included (e.g., built-in ovens, ceiling fans, carpets). A “chattel” is a freestanding item (e.g., a fridge, pot plants, a portable shed).

- Why it’s crucial: Never assume. If you love the fancy Smeg refrigerator, the custom-made velvet curtains, or the high-tech home theatre projector, you must ensure it is explicitly listed as an “inclusion.” Otherwise, the seller has every right to take it with them, leaving you with a disappointing empty space.

- Best Practice: Be ridiculously specific. List the make and model if possible. Walk through the property before signing and create a definitive list. This covers everything from dishwashers and garden sheds to TV wall mounts and light fittings.

Settlement Date and ‘Time is of the Essence’

The settlement date is the grand finale—the day ownership officially transfers to you. It’s when you pay the balance of the purchase price, and the seller hands over the keys.

- Typical timeframe: Usually 30, 60, or 90 days after the contract date, but this is negotiable.

- ‘Time is of the Essence’: You will see this phrase in the contract. This isn’t just a suggestion; it’s a strict legal term. It means all deadlines, especially the settlement date, are critical and must be met exactly. A delay of even one day can be considered a breach of contract.

- Consequences of a delay: If you (the buyer) can’t settle on time because your bank isn’t ready, the seller can charge you penalty interest for every day you are late. In a more extreme case, they could issue a Notice to Complete, and if you still can’t settle, they can terminate the contract, keep your deposit, and sue you for damages. This is why having a proactive conveyancer and mortgage broker is essential.

Special Conditions: The Wildcard Section

This is the part of the contract where anything unique to the sale is added. These conditions are written specifically for your transaction and override the standard terms.

- Common Examples:

- Early Possession: A clause allowing you to move in before settlement, usually by paying a license fee or rent to the seller.

- Repairs: A condition stating that the seller must fix a specific issue (e.g., a leaking tap or broken window) before the settlement date.

- Approval for Renovations (for Strata): If you’re buying an apartment and planning immediate renovations, you might add a clause making the sale subject to the owner’s corporation (strata) approving your plans.

- Rent-Back Agreement: A situation where the seller stays in the property after settlement and pays you rent. This would involve a separate rental agreement managed by a property manager.

This section requires careful review by your solicitor, as these custom clauses can have significant implications.

Navigating Different Markets: Location-Specific Nuances

While the core principles are the same, the real estate Australia market has unique characteristics depending on where you’re buying.

- Sydney and Melbourne: In the highly competitive markets of real estate sydney and melbourne real estate, auctions are king. This means no cooling-off period and no ‘subject to’ clauses. All your due diligence—finance, building inspections, and contract review—must be done before you raise your hand. Agencies like Ray White Real Estate are masters of the auction process in these cities.

- Queensland: The contract process in real estate qld is often seen as more buyer-friendly, with the building and pest and finance clauses being standard inclusions. The REIQ (Real Estate Institute of Queensland) contracts are commonly used.

- Western Australia: In perth real estate, the Offer and Acceptance (O&A) document is used, and it’s common to have a “structural soundness” clause rather than a full building inspection clause, which is a key difference to be aware of. Whether it’s a home in Swan View or an apartment in Halls Head Real Estate, understanding the local O&A is vital.

- Regional & Niche Markets: Properties in areas like the Gold Coast real estate market will often involve complex strata titles and body corporate rules that need scrutiny. In places like real estate Margaret River or near Real Estate Broke, you might encounter rural property contracts with clauses related to water rights, easements, or livestock that you wouldn’t see in a city. Local agents like Elders Real Estate, with their regional expertise, or even smaller specialists like Turner Real Estate in Adelaide or Holdsworth Real Estate and Kevin Hicks Real Estate in regional Victoria, have deep knowledge of these local contractual quirks. Even in smaller coastal towns like real estate kiama, local council regulations can find their way into special conditions.

The Role of Your Professional Team

You are not alone in this process. Building the right team is the best investment you can make.

- Conveyancer or Solicitor: Non-negotiable. They are a legal expert whose sole job is to review the contract, protect your interests, identify risks, and manage the entire legal transfer of the property.

- Real Estate Agent: Remember, agents like those from Professionals Real Estate or Ray White are engaged by and legally work for the seller. A good real estate agent is a fantastic facilitator and source of information, but they are not your legal advisor. Their goal is to secure the sale for their client.

- Mortgage Broker: A good broker doesn’t just find you a loan; they manage the entire process with the bank to ensure your finance is approved on time and you are ready for settlement.

- Building and Pest Inspector: Engage an independent, reputable inspector. Don’t just use one recommended by the seller’s agent without doing your own research.

Conclusion: From Confused to Confident

The Contract of Sale is a formidable document, but it is not indecipherable. By understanding these key clauses, you transform it from a source of fear into a tool of empowerment. It is your rulebook, your protection, and your roadmap to ownership.

Whether you’re looking at real estate rentals to understand your lease or diving into your first purchase of sold real estate, the principle is the same: read everything. Ask questions. Never feel pressured to sign something you don’t understand.

Your dream property, whether it’s in real estate adelaide, real estate cairns, or even across the Tasman in real estate nz, is worth the diligence. Take a deep breath, engage your professional team, and decode that fine print. The keys to your future home are waiting on the other side of that signature.