The digital ink is barely dry on headlines screaming about interest rate hikes, and for many in the real estate investing community, a cold chill has set in. The strategies that minted millionaires over the last decade are now being stress-tested in an economic environment most new investors have never witnessed. At the heart of this storm is the darling of property investing strategies: the BRRRR Method.

Buy, Rehab, Rent, Refinance, Repeat. It’s a beautifully simple acronym for a powerful wealth-building engine. For years, it was the go-to blueprint for rapidly scaling a property portfolio with minimal capital. But in a world where the cost of money has skyrocketed, the critical “Refinance” step has become a formidable hurdle.

So, we must ask the billion-dollar question: In this new era of hawkish central banks and cautious lenders, does the BRRRR method still work? Or is it a relic of a bygone, low-interest era?

The short answer is yes, it still works. But the game has fundamentally changed. The margin for error has evaporated, the timeline has stretched, and the required level of sophistication has shot through the roof. This isn’t your 2019 BRRRR anymore. This is BRRRR on hard mode, and today, we’re giving you the complete playbook to navigate it successfully.

We’ll break down every stage, from finding deals on Domain Real Estate to managing tenants, and expose the new risks and opportunities in the current market, whether you’re looking at real estate nsw or perth real estate.

What is the BRRRR Method? A Quick Refresher for 2024

Before we dive into the complexities of the current market, let’s ensure we’re all on the same page. The BRRRR method is a cyclical real estate strategy designed to allow you to pull your initial investment capital out of a property to use for the next one. This is what makes it so powerful for scaling.

Stage 1: Buy

This is the foundational step. The entire strategy hinges on buying a distressed or undervalued property. You’re not looking for a turnkey home; you’re looking for a property where you can force appreciation. This means buying it significantly below its After Repair Value (ARV). The profit is made on the purchase.

Stage 2: Rehab

Once you own the property, you begin renovations (the rehab). The goal is to strategically add value, targeting updates that provide the highest return on investment. This isn’t about building your dream home; it’s a calculated business decision to increase the property’s market value and rental appeal. This could be anything from a cosmetic facelift to a full-scale gut job.

Stage 3: Rent

With the renovations complete, you place a high-quality tenant in the property. This step is crucial because the rental income must be sufficient to cover the mortgage, taxes, insurance, and other holding costs (PITI). This rental income is what a bank will look at during the refinance stage to determine the property’s viability as an investment.

Stage 4: Refinance

This is the “magic” step and the one most affected by today’s market. After the property is renovated and tenanted (usually after a “seasoning period” of 6-12 months), you approach a lender for a cash-out refinance. They will appraise the property at its new, higher After Repair Value. Typically, a lender will allow you to borrow up to 75-80% of this new value. In an ideal scenario, this amount is enough to pay off the original purchase loan and cover your renovation costs, returning all (or most) of your initial capital to you.

Stage 5: Repeat

With your initial investment capital back in your bank account, you are now free to go out and find the next deal. You repeat the process, acquiring another property, while the first one continues to generate cash flow and build equity. This is how investors scale from one property to a multi-million dollar portfolio.

The Elephant in the Room: Today’s High-Interest Rate Environment

The BRRRR method thrived in a world of cheap money. When interest rates were at historic lows, the refinance step was a breeze. Lenders were eager, servicing calculations were easy to meet, and pulling out capital was straightforward.

That world is gone.

Central banks globally, including the Reserve Bank of Australia (RBA), have aggressively raised interest rates to combat inflation. This single factor sends shockwaves through every single stage of the BRRRR process.

Live Daily Information & Key Resources:

To stay on top of this fluid environment, you need to be watching the data daily. Here are essential links:

- Reserve Bank of Australia (RBA) Cash Rate Target: https://www.rba.gov.au/statistics/cash-rate/ – This is the primary lever that influences all other interest rates in the economy. Any change here directly impacts mortgage rates.

- Major Australian Bank Mortgage Rates (e.g., Canstar): https://www.canstar.com.au/home-loans/ – Use comparison sites like this to see the real-world rates being offered by lenders for both owner-occupier and investment loans. You’ll notice the significant premium on investment loans.

- CoreLogic Property Market Updates: https://www.corelogic.com.au/news-research – For data-driven insights into property value trends across real estate australia, this is an indispensable resource.

The impact is twofold:

- Higher Holding Costs: Your mortgage payments on the initial purchase loan are higher.

- Stricter Refinancing Criteria: The final refinanced loan will have a much higher interest rate, which dramatically impacts your cash flow and the bank’s willingness to lend. The amount of rent you collect might no longer be enough to satisfy the bank’s debt serviceability ratios at these new, higher rates.

Analyzing Each BRRRR Stage in the Current Australian Market

The core principles of BRRRR remain, but the execution at each stage must be flawless. Let’s break down how to adapt.

Stage 1: BUY – Hunting for Deals in a Cautious Market

In a high-interest market, buyer demand cools. This is your opportunity. While there may be fewer listings for real estate for sale, the competition is less frantic than it was 18 months ago.

The New Rules of Buying:

- The 70% Rule is Now the 65% Rule (or Less): The classic “70% Rule” states you should pay no more than 70% of the ARV minus repair costs. With higher interest rates, closing costs, and a greater need for a cash flow buffer, you must be far more conservative. Aiming for 65% or even 60% is the new benchmark for a deal that can withstand the stress of a high-rate refinance.

- Hyper-Local Expertise is Non-Negotiable: You can no longer rely on broad market trends. You need to become an expert in a specific suburb. Is the rental market in real estate brisbane‘s inner-city suburbs holding up better than the outer-rim? How are vacancy rates in real estate qld‘s regional hubs? You need to know which pockets are resilient. Working with top-tier real estate agents who specialize in investment properties, like those from Ray White Real Estate or local experts like Holdsworth Real Estate, is critical. They have the on-the-ground knowledge of what tenants are looking for and where the undervalued gems are hiding.

- Analyze Sold Real Estate Data Religiously: Use platforms like Domain Real Estate and CoreLogic to analyze recent comparable sales (comps). Don’t look at what a property is listed for; look at what similar properties actually sold for in the last 90 days. This gives you a realistic ARV, not an optimistic one.

- Off-Market is Gold: The best deals are often found before they hit the market. Network relentlessly with real estate agents in your target area, from real estate sydney to the quiet streets of real estate margaret river. Let them know you are a serious, ready-to-act buyer looking for properties that need work. A good agent will bring you deals because they know you can close.

Stage 2: REHAB – Renovating Smarter, Not Harder

The cost of construction materials and labor has also increased due to inflation. This means your renovation budget can quickly spiral out of control, destroying your deal.

The New Rules of Rehabbing:

- Focus on the “Rental Trinity”: Kitchens, bathrooms, and curb appeal (including a good paint job). These are the three areas that most significantly impact rental demand and appraisal value. Don’t over-capitalize on high-end finishes a renter won’t pay a premium for.

- Get Multiple Quotes for Everything: Never go with the first quote. For every trade—plumbing, electrical, painting—get at least three detailed quotes. This can save you tens of thousands of dollars.

- Factor in a Larger Contingency: Your standard 10-15% contingency budget is no longer sufficient. In today’s volatile market for materials and labor, a 20-25% contingency is the new professional standard.

- Professional Real Estate Photography is a Must: Once the rehab is done, don’t skimp on photography. High-quality photos are not just for the rental listing; they are for the bank appraiser. A professionally shot property presents better and can influence a higher valuation, which is critical for your refinance.

Stage 3: RENT – Maximizing Cash Flow When Every Dollar Counts

The silver lining in the current market is the incredibly tight rental market across most of Australia. Rents have soared, which provides a crucial buffer against higher interest rates.

The New Rules of Renting:

- Rent for Maximum Market Value: Do your research. Know the exact market rent for a renovated property of your type in your specific suburb, whether it’s melbourne real estate or gold coast real estate. Under-renting your property by even $20 a week can be the difference between a successful refinance and a rejection.

- Hire a Professional Property Manager: While it might be tempting to save the 7-10% fee and manage it yourself, a good property manager is worth their weight in gold. They are experts at tenant screening (reducing your risk of arrears), managing maintenance, and ensuring you are compliant with all tenancy laws. Firms like Turner Real Estate or Elders Real Estate have systems in place to make your life easier and your investment more secure. A professionally managed property is also viewed more favorably by lenders.

- Factor in Rising Overheads: It’s not just the mortgage. Insurance premiums, council rates, and water rates are all increasing. You must factor these rising costs into your cash flow analysis. Your property must have positive cash flow after all expenses are accounted for.

Stage 4: REFINANCE – The Biggest Hurdle

This is where the new BRRRR strategy lives or dies. The days of walking into a bank and easily getting a cash-out refinance are over.

The New Rules of Refinancing:

- Servicing is the New King: Banks use a calculation called the Debt Service Ratio (DSR) or Household Expenditure Measure (HEM) to determine if you can “service” (afford) the loan. They will assess your total income (including the new rental income) against all your debts and living expenses. Crucially, they don’t use the actual interest rate of the loan; they add a “serviceability buffer” of around 3%. So, if the investment loan rate is 6.5%, they will assess your ability to repay it at 9.5%. This is the single biggest reason refinances are failing today.

- LVRs are Tighter: While 80% Loan-to-Value Ratio (LVR) refinances are still possible, many lenders are becoming more conservative, especially for investors. You may find they are only willing to go to 75% or even 70% LVR, meaning you will leave more of your own capital trapped in the deal.

- Appraisals are More Conservative: Bank appraisers are now more cautious. In a declining or flat market, they are less likely to give you a “best-case scenario” valuation. This is why buying at a deep discount in Stage 1 is so vital. You need to have forced enough equity to withstand a conservative valuation.

- Work With an Investment-Savvy Mortgage Broker: Do not just walk into your local bank branch. A specialist mortgage broker who understands real estate investing and has relationships with dozens of lenders, including second-tier and non-bank lenders, is an essential part of your power team. They know which lenders have more favorable policies for investors and can structure your application for the highest chance of success.

A Tale of Two Refinances: A Numbers Breakdown

Let’s illustrate the difference.

The “Old Market” (2020) Scenario:

- Purchase Price + Closing Costs: $400,000

- Rehab Costs: $50,000

- Total Capital In: $450,000

- After Repair Value (ARV): $620,000

- Refinance at 80% LVR: 620,000∗0.80=∗∗620,000∗0.80=∗∗496,000**

- Result: You pull out $496,000, paying off your initial $450,000 and even pocketing $46,000. Your full capital is returned, and you’re ready for the next deal.

- Old Interest Rate (e.g., 3.5%): Mortgage payment is manageable, and the property has strong positive cash flow.

The “New Market” (2024) Scenario:

- Purchase Price + Closing Costs: $400,000

- Rehab Costs: $50,000

- Total Capital In: $450,000

- After Repair Value (ARV) – Conservative Appraisal: $600,000

- Refinance at 75% LVR (tighter lending): 600,000∗0.75=∗∗600,000∗0.75=∗∗450,000**

- Result: You pull out exactly your initial capital. No profit, no buffer. If the appraisal came in any lower or the LVR was 70%, you would have to leave thousands of dollars of your own money in the deal.

- New Interest Rate (e.g., 6.5%): The mortgage payment is significantly higher. With the bank assessing you at 9.5%, your rental income may not be enough to pass their servicing test, and the refinance could be rejected entirely.

This simple example shows how the margin for error has vanished.

Stage 5: REPEAT – Is Scaling Still Possible?

Yes, but the pace has changed. The “Repeat” stage is now slower and more deliberate. Instead of doing 3-4 BRRRRs a year, you may only be able to do one every 12-18 months.

The new strategy is about building a foundation of high-quality, cash-flowing assets. You may need to inject more of your own cash or partner with others to get deals done. The “no money down” dream of BRRRR is much harder to achieve today.

Advanced Strategies & Alternatives for Today’s Investor

To succeed now, you need more tools in your belt.

The “BRR” and Hold Strategy

This involves completing the Buy, Rehab, and Rent stages but delaying the Refinance. You leave the property on its initial, often cheaper, loan and focus on paying it down while it generates cash flow. You wait for either interest rates to fall or for the property to appreciate further before attempting the cash-out refinance. This is a more patient approach that reduces risk.

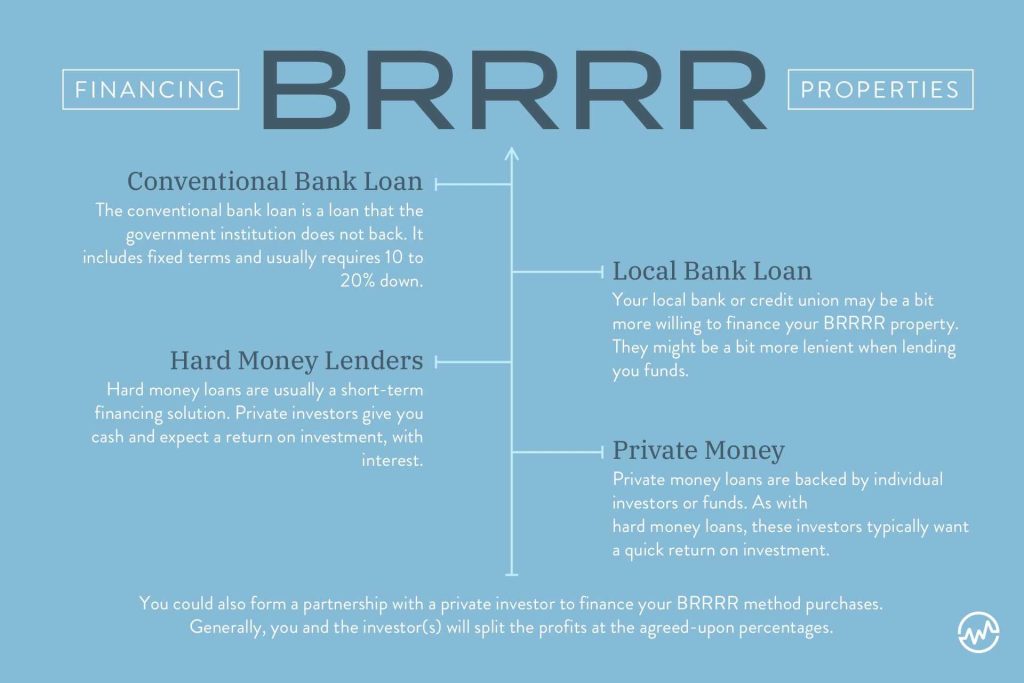

Partnering and Joint Ventures (JVs)

If your own borrowing capacity is tapped out, consider partnering. You might provide the deal-finding expertise and project management (the “sweat equity”), while a money partner provides the deposit and financing. You split the equity and cash flow according to a pre-agreed structure. This allows you to keep doing deals when the banks say “no.”

Pivoting to Commercial Real Estate

While more complex, commercial property can be an excellent alternative. Lenders for commercial real estate perth, for example, often focus more on the property’s income-generating potential (the lease) than on your personal income. Yields are often higher, and leases are longer, providing more security. This could involve small warehouses, local shopfronts, or medical suites. Commerce in this sector operates on different fundamentals that can be advantageous in the current climate.

Building Your Power Team

Now more than ever, you cannot do this alone. Your team is your greatest asset.

- A Mortgage Broker: An investment-savvy one, as mentioned.

- A Buyer’s Agent: A professional who specializes in finding undervalued properties that fit your criteria.

- A Conveyancer/Solicitor: To handle the legalities of your Estate transactions.

- An Accountant: To advise on the best ownership structures for tax efficiency.

- **A Property Manager: To handle the day-to-day operations and maximize your returns.

The Verdict: So, Does BRRRR Still Work?

Yes, absolutely. But it is a different beast.

The BRRRR method has evolved from a rapid-scaling velocity strategy into a more deliberate, fundamentals-focused value-add strategy. The days of sloppy analysis and easy money are over. Success in 2024 and beyond requires:

- Deeper Discounts on Purchase: You must buy better.

- More Conservative Underwriting: Your numbers must be bulletproof.

- Larger Cash Buffers: You need reserves to weather the storm.

- Patience: The “Repeat” cycle is longer.

- Unwavering Expertise: You must know your market, your numbers, and your strategy inside and out.

The high-interest-rate environment has shaken out the amateurs and speculators. For serious, educated investors who treat real estate investing like a business, it has created an opportunity. It has brought a semblance of sanity back to the market, allowing astute buyers to find deals without the frenzy of a bull run.

The BRRRR method isn’t broken. The market has simply raised the barrier to entry, and only the most prepared and disciplined investors will succeed.