The Financial Trap Millions Are Stuck In

Living paycheck to paycheck is a reality that millions of people across the globe face every single day. It’s a cycle that feels endless one where no matter how much you earn, your money always seems to vanish by the end of the month. This can create a persistent feeling of anxiety and helplessness. The real problem lies not just in the amount of money you bring in, but in how it’s managed. The key to breaking free from this financial limbo is developing and sticking to a solid monthly budget. Understanding and taking control of your finances can mean the difference between constantly scrambling to make ends meet and finally finding the breathing room you deserve.

Why Most People Struggle with Budgeting

Many individuals have the misconception that budgeting is about restricting your lifestyle. This misunderstanding creates resistance and avoidance, making it easier to continue living without a financial plan. Others simply don’t know where to start. Budgeting is often seen as something only financially savvy people do.

But the truth is, anyone regardless of income or financial knowledge can benefit from a monthly budget. In fact, people with average or even below-average incomes often find that budgeting transforms their financial outlook more drastically than it does for those with higher earnings. When done correctly, a monthly budget is not a punishment; it’s a powerful tool for achieving financial freedom.

The Power of the Monthly Budget

A monthly budget serves as a roadmap for your money. It allows you to understand where your income is going, helps you control unnecessary spending, and ensures you have enough left over for essentials, savings, and even occasional splurges.

The clarity a monthly budget provides can be life-changing. No longer are you guessing whether you can afford a bill or worrying if your debit card will be declined. Instead, you operate with confidence, knowing exactly what you can spend and save. It’s not just about financial control it’s about peace of mind and long-term security.

Understanding Your Current Financial Position

Before you can create an effective monthly budget, you must take a clear-eyed look at your current financial situation. This involves calculating your total monthly income and comparing it against your expenses. For many, this step alone is eye-opening. You may discover you’re spending far more on dining out or subscriptions than you realized. Recognizing patterns in your spending is crucial to creating a realistic and sustainable budget. By becoming more aware of your financial habits, you’re already taking the first step toward meaningful change.

Crafting Your Monthly Budget: The Essentials

To begin crafting a budget that works for you, start with your income. Include all sources of money you receive in a month salary, side gigs, passive income, and so on. Next, categorize your expenses. Fixed costs like rent, utilities, car payments, and insurance should be listed first.

Then, detail your variable expenses, such as groceries, gas, entertainment, and personal spending. Finally, don’t forget irregular expenses that pop up occasionally birthday gifts, car repairs, or annual subscriptions. Incorporating these ensures your budget remains realistic and adaptable.

Setting Realistic Goals

Your budget should not only reflect your current financial situation but also your future goals. Whether you’re aiming to build an emergency fund, pay off debt, save for a home, or invest in your education, your budget needs to align with these aspirations. This makes budgeting more than just number-crunching; it becomes a form of financial empowerment.

Set clear, achievable goals and make them visible within your budget. For instance, designate a specific amount each month to your savings account or credit card debt. Watching these numbers grow or shrink in your favor can be incredibly motivating.

The 50/30/20 Rule: A Popular Framework

A widely-used method for creating a monthly budget is the 50/30/20 rule. This approach allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It’s a flexible yet structured guideline that can help balance financial responsibilities and lifestyle desires. However, it’s important to tailor this framework to your unique situation.

For instance, if you’re aggressively paying down debt, you might allocate more than 20% toward that goal. The essence of this rule is balance it helps prevent both overspending and overly restrictive budgeting.

Building Emergency Savings

One of the most critical components of any monthly budget is the inclusion of an emergency fund. Life is unpredictable, and unexpected expenses can derail even the best financial plans. Setting aside a portion of your income each month for emergencies provides a safety net that reduces stress and keeps your budget intact when surprises arise.

Ideally, your emergency fund should eventually cover three to six months of essential expenses, but starting small say, $500 or $1,000 is perfectly acceptable. The key is consistency. Treat your emergency savings as a non-negotiable part of your budget.

Tracking Your Spending Habits

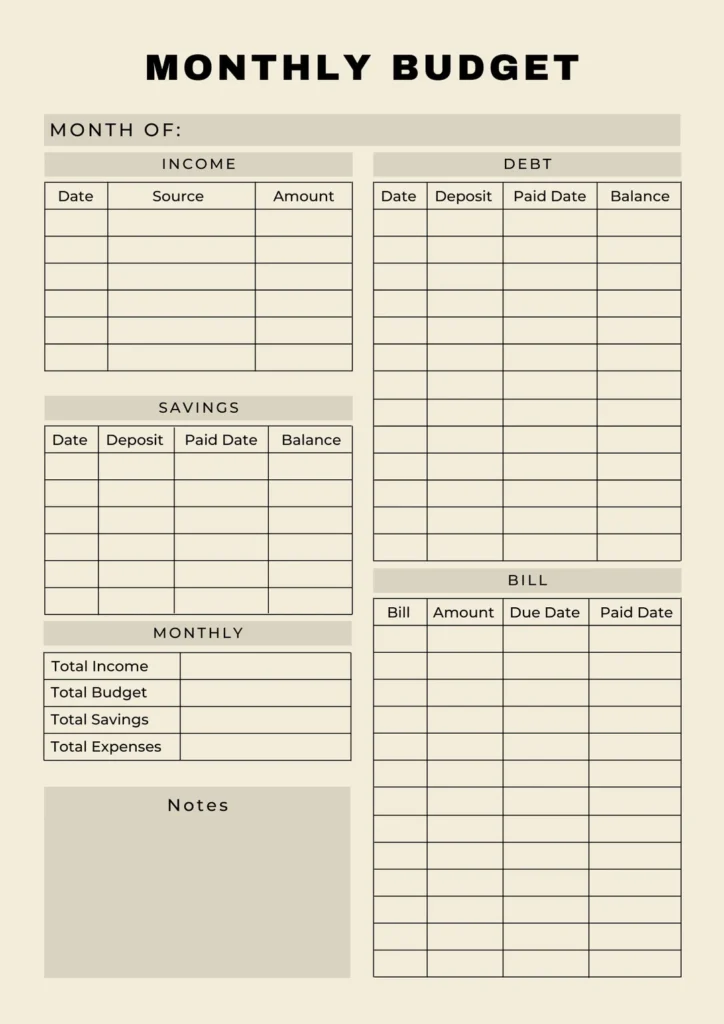

Creating a budget is just the beginning. To make it effective, you must regularly track your spending. This doesn’t have to be complicated. Use a spreadsheet, budgeting app, or even a simple notebook to log your expenses.

Review this data weekly or biweekly to ensure you’re staying on track. Tracking helps identify spending leaks those small, unnecessary purchases that add up over time. By catching and correcting these habits early, you can stay aligned with your financial goals and prevent budget shortfalls.

Dealing with Irregular Income

For freelancers, gig workers, or anyone with an inconsistent income, budgeting may seem more challenging. However, it’s still entirely possible. The key is to base your monthly budget on your lowest expected income and adjust from there.

When you have a higher-earning month, you can allocate the surplus toward savings or debt repayment. It’s also wise to build a buffer fund to smooth out income fluctuations. With proper planning, even irregular income can be managed effectively, allowing you to maintain financial stability.

The Role of Automation in Budgeting

Technology can be a powerful ally in your budgeting journey. Automating your savings, bill payments, and debt repayments ensures you stay consistent and avoid late fees. Many banks and financial apps offer automation features that make managing your money almost effortless. Once your system is set up, it runs in the background, reinforcing good financial habits without requiring constant attention. This reduces the likelihood of missed payments and helps ensure your financial goals remain on track.

Staying Motivated and Avoiding Burnout

Budgeting fatigue is real. Especially in the early stages, it’s easy to feel overwhelmed or discouraged, particularly if your goals are ambitious. That’s why it’s important to celebrate small wins along the way. Did you stay within your grocery budget this month? Great acknowledge that achievement.

Did you finally pay off a lingering bill? Reward yourself in a modest, budget-friendly way. These positive reinforcements help build momentum and keep you motivated for the long haul. Remember, budgeting isn’t about perfection; it’s about progress.

Communicating About Money with Your Partner

If you share financial responsibilities with a spouse or partner, open communication is crucial. A monthly budget should be a team effort, with both individuals having a say in the financial decisions. Sit down together regularly to review your budget, track progress, and make adjustments. Transparency fosters trust and cooperation, making it easier to stay aligned on shared financial goals. Even if one person manages the day-to-day budget, both should be aware of the overall plan and priorities.

Adjusting Your Budget Over Time

A budget is not a static document. Life changes jobs evolve, expenses shift, and goals progress. Your budget should evolve, too. Make it a habit to review and adjust your budget every month. Reflect on what worked, what didn’t, and what can be improved. Flexibility is key. The more adaptable your budget is, the more sustainable it becomes. Don’t be afraid to reallocate funds or tweak spending categories as needed. The goal is to make your budget a living, breathing guide that supports your lifestyle and aspirations.

The Psychological Impact of Budgeting

Beyond dollars and cents, budgeting has a profound psychological effect. It instills discipline, promotes mindfulness, and reduces financial stress. When you know your money is being managed effectively, your overall well-being improves. You sleep better, worry less, and feel more in control. Budgeting also shifts your mindset from reactive to proactive. Instead of constantly putting out financial fires, you’re planning ahead, anticipating needs, and positioning yourself for success. Over time, this mental shift can be just as transformative as the financial gains.

Investing as a Long-Term Goal

Once your monthly budget is stable and you’ve built a solid financial foundation, it’s time to think about long-term growth. Investing should become a key part of your financial strategy. Whether it’s a retirement account, stock market investments, or real estate, putting your money to work helps you build wealth over time. Include a category in your budget for investment contributions. Even small, consistent investments can grow significantly thanks to compound interest. The earlier you start, the more powerful your returns can be.

Teaching Budgeting to Your Children

If you have kids, consider incorporating budgeting lessons into their upbringing. Teaching financial literacy at an early age sets them up for a lifetime of smart money management. Share your budgeting process with them in age-appropriate ways. Let them help plan a family grocery budget or save for a desired toy. These small lessons create strong financial habits that will benefit them for years to come. Your commitment to budgeting can inspire the next generation to value financial responsibility and independence.

Creating a Budgeting Routine That Works

Consistency is the backbone of successful budgeting. Establish a regular time each week or month to review your budget, log expenses, and plan for upcoming costs. Make it a part of your routine, just like exercising or meal prepping. The more you integrate budgeting into your lifestyle, the less effort it takes to maintain. Over time, it becomes second nature. You’ll find that you no longer dread managing your money—instead, you look forward to the clarity and control it provides.

Common Pitfalls and How to Avoid Them

While budgeting can be transformative, it’s important to watch out for common mistakes. Overestimating income, underestimating expenses, and failing to track spending can quickly derail your progress. Another pitfall is creating a budget that’s too rigid, leaving no room for fun or unexpected costs. This often leads to frustration and eventual abandonment. To avoid these traps, approach your budget with honesty, flexibility, and a willingness to adjust. Remember, the goal is not perfection, but sustainable progress.

Embrace the Power of a Monthly Budget

Living paycheck to paycheck doesn’t have to be your forever story. With a well-crafted monthly budget, you can reclaim control over your finances and start building the future you deserve. It’s not about restriction—it’s about freedom. Freedom from stress, freedom from debt, and freedom to pursue your dreams. Whether you’re just getting started or refining an existing budget, the steps you take today can lead to lifelong financial stability and success. Start now, stay consistent, and watch how your financial life transforms for the better.