Pro Tip: Keep meticulous records of all income and expenses, ensuring clear separation between the owner-occupied and rental portions of the property for accurate deduction calculations.

Blueprint to Financial Freedom: House Hacking 2026

How to Live Rent-Free and Build Wealth (Even With 7% Mortgage Rates)

In a world defined by evolving real estate challenges and higher-for-longer borrowing costs, the traditional path to financial independence often seems like a relic of the past. The dream of homeownership and wealth creation is still alive, but it requires a strategic, entrepreneurial approach. This is where House Hacking emerges not just as a trend, but as the quintessential survival guide and wealth-builder for 2026.

With 30-year fixed mortgage rates predicted to average around 6.3% to 6.4% throughout 2026 (a modest dip from 2025’s average but still far above the historic 4% norm), the urgency to mitigate housing costs—the single largest expense for most households—has never been greater. This comprehensive blueprint reveals how to leverage the owner-occupant advantage to effectively eliminate your housing payments, build significant equity, and aggressively pursue real estate investment in the current market.

The 2026 Real Estate Landscape: Rates, Inventory, and Opportunity

The 2026 housing market is forecast to be a year of subtle but important shifts, moving toward the most “balanced” territory since the pre-pandemic era. While rates stabilize, innovative investors will find new avenues for growth.

1. The Stability of High-for-Longer Rates

Forget waiting for 3% interest rates. Major economic forecasts, including those from Realtor.com and the Mortgage Bankers Association, suggest that the 30-year fixed rate will likely hover above 6% for the entirety of 2026, perhaps averaging around 6.3%.

- The New Reality: High rates dramatically increase the cost of capital, making the traditional 20% down payment on an investment property a steeper hurdle. This environment, however, uniquely favors owner-occupant strategies.

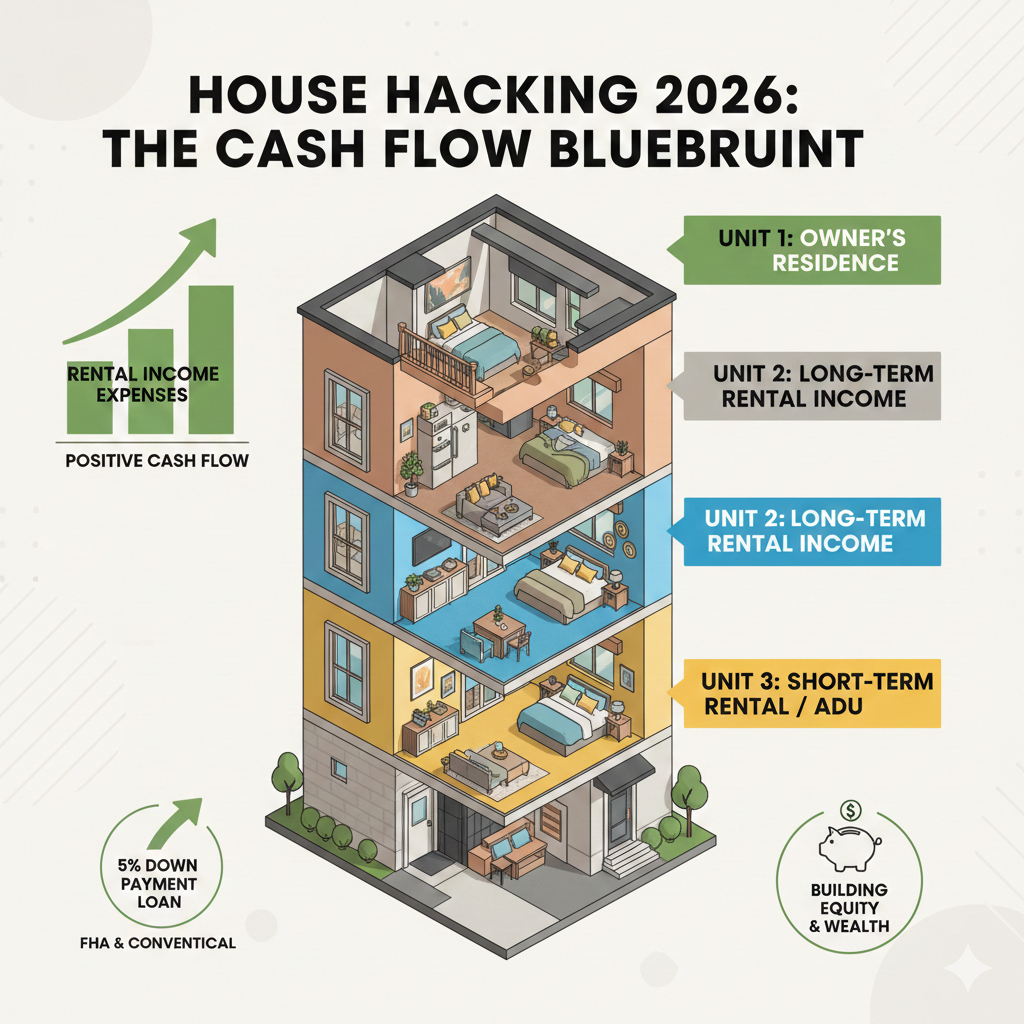

- The Owner-Occupant Advantage: When you buy a property you intend to live in, you gain access to favorable financing options such as FHA loans (as low as 3.5% down) and conventional loans requiring as little as 5% down for multi-unit properties. These low-down-payment loans are the financial engine of a successful House Hacking strategy in this rate environment, dramatically lowering the capital required to jumpstart your wealth journey. Here’s a visual representation of how different units within a property can contribute to income:

2. Inventory and Price Bifurcation

Inventory is expected to continue its slow expansion, giving buyers more options and, critically, more negotiating leverage than they have had in years. Price growth is slowing and is even predicted to decline in about 22 of the largest 100 US metropolitan areas, particularly in the South and West (Source: Realtor.com).

- Strategic Location Scouting: This market bifurcation means an unprecedented opportunity for house hackers. You can target markets where prices are cooling, or focus on specific property types (like multi-family or properties suitable for Accessory Dwelling Units (ADUs)) where the demand for affordable housing remains structurally high.

- The ‘Value-Add’ Focus: Lower-quality or less central properties are facing elevated vacancies in the broader commercial sector, a trend that can be mirrored in residential properties. A skilled house hacker can look for properties that are undervalued due to cosmetic issues or a lack of modernization, allowing for a strategic “buy, rehab, rent, and refinance” (BRRRR-inspired) approach to force equity growth immediately.

The Premier House Hacking Strategies for 2026

House Hacking is not a one-size-fits-all model. It’s a dynamic strategy that must be tailored to the specific property, local zoning laws, and the investor’s personal risk tolerance. The following methods are the most powerful for generating high rental income and maximizing wealth in the current market.

1. The Classic Multi-Unit Hack (Duplex, Triplex, Fourplex)

The original and most powerful House Hacking strategy remains the purchase of a 2-to-4 unit property. You reside in one unit and rent out the remaining units.

- The Financial Leverage: This is where the owner-occupant financing truly shines. You can acquire a 4-unit property (a significant investment vehicle) using a low down payment loan, and your lender may even be allowed to factor in the projected rental income from the other units to help you qualify for the loan.

- The Privacy Dividend: Tenants are in separate units with their own entrances, providing a level of privacy far superior to the roommate model.

- Wealth Acceleration: The rental income from multiple units can often fully cover the principal, interest, taxes, and insurance (PITI) of the entire property. This means you are living rent-free while tenants build your home equity by paying down your entire mortgage.

2. The Accessory Dwelling Unit (ADU) Strategy

As local governments continue to loosen restrictions on ADUs (often called granny flats, in-law suites, or backyard cottages) to address housing shortages, this strategy has become a national phenomenon.

- Building Value: Adding a legally permitted ADU instantly increases the rentable square footage and, thus, the appraised value of the property. This is a crucial element for generating forced appreciation, which is key to overcoming the drag of high mortgage interest.

- Maximizing Land Use: This strategy is ideal for homeowners who live in single-family homes in high-demand urban and suburban markets where multi-family units are scarce or too expensive. You are effectively creating a second (or third) income stream on a single-family property.

- Cost Control: New financing products, such as FHA 203k loans, can sometimes be used to finance the purchase of a single-family home and the construction or renovation of an ADU, bundling the project cost into a single, low-down-payment loan.

3. The Housemate/Room Rental Model

The simplest and most accessible method involves renting out spare bedrooms in a single-family home. This strategy is perfect for those with limited capital and a willingness to share common spaces.

- Highest Cash-on-Cash Return: Since you avoid the construction costs of an ADU or the higher purchase price of a multi-unit building, your initial cash outlay is minimized, often leading to a surprisingly strong return on the cash invested.

- Flexibility and Lower Risk: You can rent rooms on a month-to-month basis, offering superior flexibility compared to a year-long unit lease. This is an excellent way to test the waters of property management.

- Focus on High-Demand Demographics: Target tenants such as working professionals, traveling nurses, or graduate students who value a clean, quiet space and are willing to pay a premium for all-inclusive rent (including utilities and high-speed internet).

- For a deeper dive into the practicalities and benefits of this strategy, watch this insightful video:

Financial Mastery: Making the Numbers Work at 7%

A 7% mortgage rate means your monthly interest payment is significantly higher than it was in previous years. This demands meticulous financial analysis and aggressive cost-management to achieve a rent-free lifestyle.

Live Daily Information: US National Mortgage Rate Snapshot

As of today, December 5, 2025, the average 30-year fixed conforming mortgage rate is approximately 6.45%, with the average 15-year fixed rate hovering around 5.75%. This data underscores the current high-rate environment, making the need for House Hacking strategies even more critical. Note: Rates are subject to daily change based on economic indicators and the bond market.

The 5% Down Payment Calculation

Let’s model a hypothetical scenario using the most favorable owner-occupant financing terms.

| Financial Metric | Calculation | Notes |

| Property Purchase Price | $400,000 | Example price for a 3-unit property (Triplex) |

| Owner-Occupied Down Payment | 5% of $400,000 = **$20,000** | Using a Conventional 95% LTV Loan |

| Loan Amount | $400,000 – $20,000 = **$380,000** | |

| Mortgage Rate (Hypothetical) | 7.00% | Conservative estimate for 2026 |

| Principal & Interest (P&I) | ≈$2,529 | 30-year amortization |

| Taxes & Insurance (PITI Add-ons) | ≈$550 | Estimated monthly cost |

| Total Monthly Mortgage (PITI) | $3,079 | The full expense you aim to cover |

| Projected Rental Income (Two Units) | $1,600 per unit x 2 units = $3,200 | Based on robust market research |

| Estimated Monthly Cash Flow | $$3,200 – $3,079 = **+$121** | Positive cash flow and rent-free living |

Exporter vers Sheets

Crucial Takeaway: At a 7% rate, the rental income still generates positive cash flow, allowing the investor to live for free. The $20,000 down payment acts as the initial investment into an appreciating, income-producing asset, a fraction of the capital required for a traditional investment purchase.

The Financial Independence Feedback Loop

House Hacking is the foundation for an accelerated path to financial independence.

- Eliminate the Largest Expense: By cutting your housing cost to zero (or near-zero), you instantly free up thousands of dollars of disposable income annually.

- Forced Savings and Equity: The rental income is aggressively paying down the principal portion of your mortgage. This is a form of forced savings that grows your personal equity and net worth every month.

- The Refinance/Second Purchase: After two to three years of paying down the loan and potentially increasing the property value through smart improvements (like an ADU or unit upgrades), you can perform a cash-out refinance. This allows you to pull out tax-free equity (the money your tenants helped you build) to use as the down payment on your second investment property, allowing you to transition your first hack into a purely cash-flowing rental. This process is the core of real estate wealth building. Here’s an illustration of how these cycles contribute to long-term wealth:

Legal and Operational Toolkit for the Modern House Hacker

Being a live-in landlord requires a blend of real estate acumen and business savvy. You must operate with professionalism and compliance.

1. Zoning and Permitting Due Diligence

Local laws are the number one pitfall for new house hackers. Before committing to a purchase, you must verify the following:

- Multi-Family Zoning: Is the property legally zoned for the number of units it contains (e.g., a Triplex must be zoned R-3 or higher)? Never rely on an unpermitted conversion.

- ADU Regulations: If you plan on building an ADU, confirm the maximum size, setbacks, and parking requirements for your specific municipality. Regulations are changing fast, so consult with a local architect or planner.

- Landlord-Tenant Laws: Even when living on-site, you are bound by local and state Fair Housing laws, security deposit regulations, and eviction procedures. A professional lease agreement is non-negotiable.

2. The Power of Property Technology (PropTech)

In 2026, the success of a live-in landlord hinges on efficiency. Leverage technology to manage your property professionally.

- Tenant Screening: Use dedicated platforms to automate background checks, credit reports, and income verification. This is essential for peace of mind.

- Rent Collection: Implement digital rent collection via secure platforms. This eliminates excuses, provides automatic payment tracking, and builds a clear financial record for tax purposes.

- Maintenance: Use a simple digital work order system to track and respond to repair requests promptly. Timely maintenance is key to tenant retention and protecting the asset’s value.

3. Strategic Tax Advantages (The Deductions That Count)

A house hack property operates as a legitimate business, offering significant tax benefits that boost your true return on investment.

- Depreciation: The rental portion of your property (the structure, not the land) can be depreciated over 27.5 years. This is a non-cash expense that reduces your taxable rental income, potentially turning a positive cash flow into a tax loss on paper.

- Expense Deductions: A portion of all operating expenses is deductible against your rental income, including:

- Mortgage Interest (The largest deduction in the high-rate environment)

- Property Taxes

- Insurance

- Repairs, Maintenance, and Utilities (if covered by the landlord)

Pro Tip: Keep meticulous records of all income and expenses, ensuring clear separation between the owner-occupied and rental portions of the property for accurate deduction calculations.