Understanding the Silent Storm Transforming American Real Estate

The American housing landscape stands at a critical crossroads as we approach 2026. While headlines scream about market corrections and affordability challenges, a deeper transformation unfolds beneath the surface, one that most analysts failed to predict. This crisis differs fundamentally from the dramatic 2008 collapse. Instead of a sudden crash, we face a slow-burning structural crisis characterized by persistent supply shortages, stubborn mortgage rates, and an affordability gap that continues widening despite modest economic improvements.

- Understanding the Silent Storm Transforming American Real Estate

- The Perfect Storm: How We Arrived at This Critical Juncture

- The Three Markets Defying the Crisis: Your Strategic Opportunities

- Strategic Moves for Winning in the 2026 Housing Market

- The Broader Economic Context Shaping 2026 Real Estate

- Investment Property Performance Expectations Through 2026

- Navigating Insurance and Climate Considerations

- Technology and Innovation Reshaping Real Estate

- The Path Forward: Making Your Move in 2026

Recent market analysis indicates home sales will experience only marginal growth of approximately 3% in 2026, with existing home sales reaching an annualized rate of 4.2 million units. This modest uptick represents a far cry from the robust housing activity seen in previous decades, signaling a fundamental shift in how Americans access homeownership.

The current environment represents what industry experts describe as navigating through fog, where uncertainty permeates every facet of the real estate sector. From macroeconomic volatility to shifting migration patterns, the factors influencing property values have become increasingly complex and interconnected.

The Perfect Storm: How We Arrived at This Critical Juncture

The Supply Crisis That Caught Everyone Off Guard

The United States faces a housing shortage requiring more than seven years to resolve at current construction rates. This shortage did not materialize overnight. It represents the cumulative result of decades of underbuilding following the 2008 financial crisis, restrictive zoning regulations, and labor shortages in the construction industry.

The regional disparities are particularly striking. While the South leads in housing production, other regions lag dramatically. The Midwest would require 41 years to close its housing gap, and the Northeast may never fully resolve its supply deficit. These regional variations create vastly different opportunities and challenges for prospective buyers and investors.

The housing shortage has proven remarkably resilient to market forces. Even as home sales declined and prices moderated in some markets, the fundamental supply deficit persists. Developers face mounting challenges, including elevated construction material costs, labor scarcity, and increasingly complex regulatory environments that slow project approvals and increase development costs.

Mortgage Rate Reality and the Lock-In Effect

Mortgage rates represent perhaps the most significant constraint on housing market activity in 2026. Current 30-year fixed mortgage rates hover around 6.22%, and most experts predict rates will ease down to approximately 5.9% to 6.2% by November 2026. While this represents improvement from the near 7% rates witnessed earlier, these levels remain substantially higher than the ultra-low rates available during the pandemic era.

This rate environment creates what analysts term the golden handcuffs phenomenon. Millions of homeowners locked in mortgage rates below 4% during 2020 and 2021 show extreme reluctance to sell their properties and take on significantly higher financing costs. This psychology dramatically constrains housing inventory, as potential sellers choose to renovate or remain in place rather than upgrade to larger homes with substantially higher monthly payments.

The impact extends beyond individual decision-making. Mortgage rates are forecast to range from 6% to 7% unless a recession occurs, with short-term lending rates potentially falling more quickly in late 2025 or early 2026. This timeline suggests buyers must prepare for an extended period of elevated borrowing costs before meaningful relief arrives.

The Affordability Crisis Deepens

Housing affordability has deteriorated to levels not seen in generations. Housing prices have reached near-record highs even with mortgage rates at their highest levels in over fifteen years. The combination of elevated prices and high financing costs creates a double squeeze on prospective buyers, particularly first-time purchasers and younger households.

Income growth has failed to keep pace with housing cost increases. While wage growth has matched apartment rent increases over recent years, it trails dramatically behind the cost to purchase homes. This divergence forces many would-be buyers to remain in the rental market longer, delaying household formation and homeownership.

Currently, only 38% of U.S. households possess sufficient income to afford a home, down from 57% in the third quarter of 2020. This represents a dramatic erosion in housing accessibility within just a few years, contributing to rising frustration among millennials and Generation Z buyers who find homeownership increasingly out of reach despite strong employment and reasonable incomes.

The Three Markets Defying the Crisis: Your Strategic Opportunities

Despite the challenging national picture, three markets stand out as offering exceptional opportunities for buyers and investors in 2026. These locations combine affordability, economic fundamentals, and growth trajectories that position them advantageously for the coming years.

Dallas-Fort Worth: The Undisputed Champion of Real Estate Opportunity

Dallas-Fort Worth maintains its position as the premier real estate market entering 2026. Dallas-Fort Worth ranks as the top market to watch for the second consecutive year in industry surveys. This consistency reflects deep structural advantages rather than temporary momentum.

The metropolitan area’s economic diversity sets it apart from technology-centric markets that have cooled following rapid pandemic-era growth. Dallas-Fort Worth attracted 100 corporate headquarters between 2018 and 2024, demonstrating its business-friendly environment. This corporate migration creates sustained demand for housing across price points, from executive homes to workforce housing.

Financial services represent a particularly robust growth sector in Dallas-Fort Worth. The expansion extends beyond traditional banking to include fintech, insurance, and investment management firms seeking lower operating costs and access to technical talent. The metro area ranks eighth in tech talent concentration, driven partly by Generation Z migration to Texas.

Accessibility distinguishes Dallas-Fort Worth from coastal competitors. The metropolitan area offers multiple airports, extensive highway infrastructure, and relatively affordable living costs compared to similarly sized markets. This accessibility attracts both businesses and residents, creating a virtuous cycle of growth.

For investors, Dallas-Fort Worth presents compelling fundamentals. The combination of job growth, population increases, and relatively affordable entry points creates opportunities for both appreciation and cash flow. Industrial and retail properties receive particularly strong buy recommendations from industry professionals, reflecting robust logistics activity and consumer spending.

The market is not without challenges. Housing costs are rising, creating affordability pressures for some segments of the population. However, the pace of construction and the metro area’s willingness to approve new development helps moderate price increases compared to more constrained markets.

San Antonio: The Value Play with Military Stability

San Antonio emerges as the premier value opportunity in the Texas market. San Antonio’s median home price sits at approximately $297,000, significantly below other major Texas metros. This affordability creates accessible entry points for first-time buyers and investors seeking strong cash flow rather than speculative appreciation.

The city’s economic foundation rests on multiple stable pillars. Healthcare represents a major growth sector, anchored by the expanding University of Texas Health San Antonio system. Manufacturing continues growing, highlighted by major investments including a $500 million JCB manufacturing plant. Logistics and distribution facilities proliferate, taking advantage of San Antonio’s strategic location along major interstate corridors connecting Mexico, the Gulf Coast, and interior markets.

Military presence provides unique stability to San Antonio’s housing market. Joint Base San Antonio ranks among the largest military installations in the United States, providing consistent housing demand year-round. This military population creates reliable rental demand and home purchase activity that proves resilient during economic downturns.

Recent market data reveals San Antonio transitioning toward a buyer-favorable environment. San Antonio ranks as the number one buyer’s market among major U.S. metropolitan areas, with 117% more sellers than buyers. This dynamic gives purchasers meaningful negotiating leverage and choice that was absent during the intense seller’s market of 2021 and 2022.

Price projections for San Antonio remain constructive. Home prices are forecast to increase between 2.5% and 4.5% over the next 12 months, potentially reaching a range of $304,425 to $310,365 by early 2026. This moderate appreciation, combined with affordable entry points, creates favorable conditions for building equity while maintaining positive cash flow on investment properties.

For rental property investors, San Antonio delivers particularly attractive metrics. Average gross rental yields range between 6% and 8% in key submarkets, substantially higher than yields available in more expensive coastal markets. Vacancy rates are declining, supporting stable rental income and modest rent growth potential.

Neighborhoods worth particular attention include West San Antonio, where new development meets affordable pricing, and Southtown, which combines urban amenities with value pricing. Stone Oak and Alamo Heights offer higher-end opportunities with strong school districts attracting families seeking quality education options.

Tampa-St. Petersburg: The Florida Market Finding Its Footing

Tampa-St. Petersburg represents the most complex but potentially rewarding opportunity among our three featured markets. After experiencing dramatic appreciation during the pandemic housing boom, the market has undergone significant correction and adjustment, creating opportunities for strategic buyers.

Tampa-St. Petersburg ranks eighth among markets to watch in 2026, with industry professionals viewing apartment acquisitions favorably compared to other Southeast markets. This positioning reflects the metro’s combination of population growth, economic diversification, and moderating prices following overheated conditions.

Recent price action shows meaningful adjustment from peak levels. Tampa’s median home price reached $420,000 in October 2025, representing a 13.8% decline from the previous year. This correction brings pricing more in line with income levels and rental economics, creating improved investment fundamentals.

The market dynamics favor patient, strategic buyers. Tampa shows 53.78% of active listings have reduced prices, yet homes sell 14 days faster than Florida’s statewide median. This combination of price flexibility and steady absorption suggests a market finding equilibrium rather than experiencing distress.

Looking toward 2026, Tampa-St. Petersburg’s fundamentals support cautious optimism. If mortgage rates decline below 6%, likely after Q1 2026, pent-up buyer demand could unlock, potentially triggering renewed competition for well-located homes under $500,000. This scenario would benefit buyers who acquire properties during the current adjustment period.

The metropolitan area’s long-term appeal remains intact. No state income tax, warm climate, beaches, and growing employment opportunities in healthcare, finance, and technology continue attracting new residents. Strong demand from international buyers seeking to diversify investments and younger demographics purchasing investment properties for short-term rentals supports the market.

For investors, Tampa-St. Petersburg requires careful submarket selection. South St. Petersburg shows promise with ongoing revitalization and infill development. Historic Uptown and emerging corridors like the 34th Street area offer opportunities for renovation and value-add strategies. Wesley Chapel continues growing as a suburban alternative with newer construction and family-oriented amenities.

Property condition and location matter enormously in the current Tampa market. Updated homes in non-flood zones with reasonable insurance costs significantly outperform dated properties requiring substantial renovation or those facing elevated insurance premiums. Buyers must carefully evaluate insurance availability and cost, as Florida’s property insurance market remains challenging.

Strategic Moves for Winning in the 2026 Housing Market

For First-Time Homebuyers

First-time buyers face the most challenging environment in decades, but opportunities exist for those willing to be strategic and patient. The key lies in understanding that perfect conditions may never arrive, and good timing matters more than perfect timing.

Focus on affordability over aspiration. The starter home has returned as a necessary stepping stone rather than an outdated concept. Properties that meet essential needs while fitting comfortably within budget provide the foundation for building equity and future upgrades. Consider sacrificing space, finishes, or location amenities in exchange for manageable payments and the ability to enter homeownership.

Alternative financing structures deserve consideration. First-time buyer programs, including FHA loans with lower down payment requirements, remain accessible despite higher overall costs. Some markets offer down payment assistance programs, particularly for buyers in targeted professions like teachers, healthcare workers, or public safety personnel.

Timing strategy should focus on market conditions rather than rate predictions. Attempting to time the bottom of interest rates or prices proves exceptionally difficult. Instead, focus on finding properties that work financially at current rates while keeping the option to refinance if rates decline meaningfully.

Build strong financial positioning before beginning the home search. Higher credit scores translate directly to better mortgage rates and terms. Saving larger down payments provides negotiating leverage and reduces monthly payments. Demonstrating solid employment history and manageable debt ratios strengthens loan applications in a more cautious lending environment.

For Real Estate Investors

Investment strategy in 2026 requires recalibrating expectations and focusing on fundamentals over speculation. The era of easy appreciation through passive holding has ended, replaced by a market rewarding active management, careful property selection, and realistic financial modeling.

Cash flow must take precedence over appreciation hopes. Properties should pencil out at current rents and expenses without relying on future rent growth or value appreciation. Conservative underwriting protects against downside scenarios while creating margin for unexpected expenses or vacancy periods.

Location selection demands heightened scrutiny. Focus on markets demonstrating actual employment growth, positive net migration, and housing supply constraints. Avoid markets where speculation drove recent growth or where fundamental economic weaknesses persist. Our three featured markets represent locations with genuine economic drivers supporting sustained housing demand.

Property type and positioning matter increasingly. Class B neighborhoods with workforce housing often outperform both luxury segments experiencing softness and class C areas facing elevated management challenges. Single-family rentals in good school districts maintain consistent tenant demand, while carefully selected small multifamily properties offer economies of scale.

New construction deserves serious consideration despite higher upfront costs. New-build homes help investors lock in maintenance and repair costs at lower levels while attracting quality tenants willing to pay premium rents for modern amenities. The reduced capital expenditure requirements in early ownership years improve cash flow predictability.

Property management quality determines long-term investment success. Professional management, whether in-house for larger portfolios or outsourced for smaller holdings, protects property values and maximizes returns. Self-management works for local investors with appropriate skills and time, but remote investors should factor professional management costs into underwriting.

Tax strategy optimization becomes more critical in a moderate appreciation environment. Cost segregation studies, proper depreciation scheduling, and strategic timing of purchases and sales all impact after-tax returns significantly. Engaging qualified tax professionals familiar with real estate pays dividends through the investment lifecycle.

For Current Homeowners Considering Selling

Homeowners contemplating sales in 2026 face difficult decisions balancing financial considerations with lifestyle needs. The rate lock-in effect creates powerful incentives to remain in place, but life circumstances often necessitate moves regardless of market conditions.

Realistic pricing proves essential in the current environment. Markets have shifted from sellers dictating terms to buyers holding meaningful negotiation power. Overpriced listings languish while appropriately priced properties attract multiple showings and competitive offers. Working with agents who understand current market dynamics and provide honest pricing guidance protects against extended time on market.

Home preparation and presentation matter more than ever. With increased inventory giving buyers choice, homes must show exceptionally well to command premium pricing. Professional staging, pre-listing inspections addressing obvious defects, and high-quality marketing materials separate successful listings from those requiring price reductions.

Strategic timing considerations vary by market and property type. Spring typically brings peak buyer activity, but increased competition from other sellers may offset this advantage. Fall markets often see reduced competition from other sellers, though buyer pools narrow somewhat. Local market dynamics should guide timing decisions more than national seasonal patterns.

For sellers needing to relocate, simultaneous coordination of sales and purchases requires careful planning. Contingent offers become more common in buyer-favorable markets, but sellers must protect their interests through appropriate contract terms. Bridge financing or temporary housing may be necessary to execute smooth transitions.

The Broader Economic Context Shaping 2026 Real Estate

Inflation and Federal Reserve Policy

Inflation dynamics remain central to housing market performance through 2026. The Federal Reserve forecasts the Consumer Price Index at 3.3% at the end of 2025, above the Fed’s 2% target. This persistent inflation limits the Fed’s ability to aggressively cut interest rates, maintaining pressure on mortgage rates.

The relationship between Federal Reserve policy rates and mortgage rates proves less direct than many assume. Mortgage rates more closely track 10-year Treasury yields, which reflect broader economic expectations including growth, inflation, and fiscal policy. Even as the Fed cuts short-term rates, long-term rates may remain elevated if bond markets anticipate continued inflation or economic strength.

Market participants should prepare for a prolonged period of rates oscillating in the 6% to 7% range rather than expecting dramatic declines. This environment favors buyers comfortable with current rates over those waiting for conditions that may not materialize.

Employment and Income Trends

Labor market strength provides crucial support for housing demand. Despite concerns about technology sector impacts and economic uncertainty, overall employment remains relatively robust. Job growth continues in healthcare, logistics, professional services, and skilled trades, all supporting sustained housing needs.

Wages are growing faster than home prices for the first time since the aftermath of the 2008 financial crisis. This reversal represents a significant positive development for affordability, though the gap remains substantial given how far home prices outpaced wages during the pandemic boom.

Income growth varies substantially by sector and geography. Technology workers face more challenging conditions with layoffs and hiring freezes affecting some markets. Meanwhile, healthcare, skilled trades, and certain professional services see continued wage growth and hiring. Geographic variations mean income trends in Dallas-Fort Worth or San Antonio diverge meaningfully from struggling markets in the Northeast or West.

Policy and Regulatory Environment

Housing policy remains politically charged heading into 2026, with both parties proposing various solutions to affordability challenges. However, the gap between rhetoric and effective action remains substantial.

Increasing housing supply through zoning and land use reform represents the core solution to the affordability crisis. States and municipalities increasingly recognize that restrictive zoning limiting density and housing types contributes directly to supply shortages. California, Oregon, and other states have enacted reforms allowing greater density and reducing barriers to accessory dwelling units.

Federal policy impacts remain uncertain. Proposals range from tax incentives for first-time buyers to restrictions on institutional investors in single-family housing markets. The actual implementation and impact of these policies will evolve through 2026, creating both opportunities and risks depending on final legislative outcomes.

Environmental regulations increasingly affect housing development costs and timelines. Climate change concerns drive new building standards, flood plain restrictions, and insurance requirements that raise construction costs and limit developable land. Markets successfully balancing environmental protection with housing production will outperform those tilting heavily toward either extreme.

Investment Property Performance Expectations Through 2026

Rental Market Dynamics

Rental housing demand remains robust entering 2026, supported by multiple factors. Affordability challenges force many would-be buyers to remain in the rental market, supporting consistent demand. This dynamic particularly affects millennials and Generation Z households who reach typical home-buying years but find ownership financially out of reach.

Multifamily supply dynamics show regional variations. Markets that experienced substantial apartment construction during 2023 and 2024 face absorption challenges, with landlords offering concessions to attract tenants. Multifamily completions will decline sharply by 2026 to approximately 371,000 units from peak levels above 550,000. This supply reduction should support rent stabilization and growth in previously oversupplied markets.

Single-family rental demand demonstrates particular strength. Approximately 6% of Americans struggling with housing affordability moved in with roommates in mid-2025, with this share expected to increase. Single-family rentals appeal to families desiring space and privacy unavailable in apartment settings, supporting premium rents compared to multifamily alternatives.

Rent growth projections vary substantially by market. High-growth Sunbelt markets that overbuilt apartments may see flat or modest rent growth through 2026. Meanwhile, supply-constrained markets with strong job growth could experience 3% to 5% annual rent increases. Single-family homes generally outpace apartment rent growth given more limited supply additions.

Property Value Appreciation Forecasts

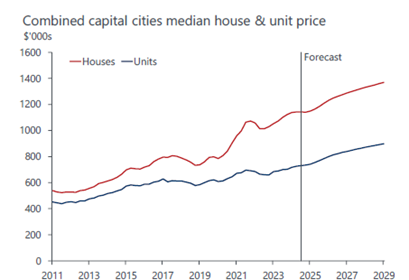

Home price appreciation expectations for 2026 remain modest compared to the double-digit gains witnessed during the pandemic era. National home price growth is projected to decelerate to 3.8% in 2025 and 3.6% in 2026. This represents healthy, sustainable growth rather than speculative excess.

Regional variations will prove substantial. Markets with strong employment growth, limited supply, and favorable affordability metrics like San Antonio and Dallas-Fort Worth may exceed national averages. Conversely, markets that experienced outsized pandemic gains followed by correction, including some smaller Sunbelt metros, may see flat or declining values.

Property condition and location increasingly differentiate performance within markets. Updated properties in desirable neighborhoods outperform dated properties requiring renovation. Location near employment centers, quality schools, and lifestyle amenities commands premiums as buyers become more selective.

Long-term appreciation potential depends primarily on local supply and demand fundamentals. Markets demonstrating sustained population growth, job creation, and constrained housing supply will deliver superior returns. Speculative markets lacking fundamental drivers face elevated risk of prolonged price stagnation or decline.

Navigating Insurance and Climate Considerations

Property insurance represents an increasingly critical factor in real estate decision-making. Florida markets, including Tampa-St. Petersburg, face particularly acute insurance challenges. Carriers have exited the market, premiums have surged, and availability has tightened for properties in coastal and flood-prone areas.

Insurance costs must be carefully incorporated into investment underwriting. Properties requiring flood insurance or located in hurricane-prone regions face substantially higher operating costs that directly impact cash flow and investment returns. Some properties that appeared attractive based on purchase price and rents become unprofitable once true insurance costs are factored.

Climate change considerations extend beyond Florida. Wildfire risk affects Western markets, with insurers restricting coverage or raising rates substantially in high-risk areas. Severe weather events across the country drive industry-wide insurance cost increases that affect operating expenses regardless of location.

Buyers should conduct thorough insurance due diligence before committing to purchases. Obtaining actual insurance quotes rather than relying on estimates prevents costly surprises at closing. Properties that prove uninsurable or insurable only at prohibitive cost should be avoided regardless of attractive purchase prices.

Technology and Innovation Reshaping Real Estate

Proptech Solutions

Technology continues transforming how real estate is bought, sold, and managed. Virtual property tours became mainstream during pandemic lockdowns and remain popular, allowing buyers to efficiently screen properties before in-person visits. High-quality photography, video walkthroughs, and even virtual reality experiences enable remote property evaluation.

Artificial intelligence applications are proliferating across real estate functions. Automated valuation models provide instant property valuations, though their accuracy varies significantly by market and property type. AI-powered property management platforms handle tenant communications, maintenance requests, and rent collection with minimal human intervention.

Blockchain technology and property tokenization represent longer-term innovations that may democratize real estate investment access. Fractional ownership models enabled by blockchain could allow smaller investors to access commercial properties and large residential developments previously requiring substantial capital commitments.

Smart home technology increasingly influences buyer preferences and property values. Modern buyers expect keyless entry, smart thermostats, integrated security systems, and energy management capabilities. Properties with these features command premiums and rent more quickly than comparable properties lacking modern technology.

Data-Driven Decision Making

Access to comprehensive market data empowers both individual buyers and professional investors to make more informed decisions. Platforms providing neighborhood-level analytics, school ratings, crime statistics, and economic trends enable granular market research previously available only to institutional players.

Predictive analytics help forecast market movements and identify emerging opportunities. Machine learning models analyze historical patterns, current trends, and multiple variables to project future price movements with increasing accuracy. While imperfect, these tools provide valuable inputs for investment decision-making.

Real-time market monitoring allows rapid response to changing conditions. Days on market, price reductions, inventory levels, and absorption rates are tracked daily rather than monthly, enabling market participants to identify shifts before they become widely recognized. This information advantage creates opportunities for nimble investors and buyers.

The Path Forward: Making Your Move in 2026

The 2026 housing market presents challenges unlike any previous cycle, but opportunities exist for informed, strategic participants. The crisis that nobody saw coming is not a dramatic collapse but a grinding affordability squeeze combined with structural supply shortages that will take years to resolve.

Success in this environment requires abandoning expectations of easy profits through passive ownership. Instead, winning strategies combine careful market selection, realistic financial analysis, patient timing, and active management. The three markets highlighted, Dallas-Fort Worth, San Antonio, and Tampa-St. Petersburg, represent locations where fundamentals support sustainable value creation despite national headwinds.

For first-time buyers, the message is clear: perfection is the enemy of progress. Waiting for ideal conditions may mean missing opportunities to build equity and wealth through homeownership. Focus on properties you can comfortably afford that meet your essential needs, with plans to upgrade as equity accumulates and circumstances improve.

Investors must recalibrate expectations around cash flow rather than speculation. Properties that generate positive returns at current rents and expenses provide resilience regardless of whether appreciation materializes. Markets with genuine employment growth, positive migration, and supply constraints offer the best risk-adjusted return potential.

Current homeowners face difficult trade-offs between rate lock-in effects and lifestyle needs. Those who must move should approach sales with realistic pricing expectations and strong property presentation. Those able to remain in place may find staying put financially optimal despite evolving household needs.

The housing crisis of 2026 differs fundamentally from past downturns. Rather than a collapse requiring rescue, we face a slow-motion adjustment toward more sustainable conditions. This transition creates pain for those priced out of homeownership but opportunities for those positioned to act strategically.

Real estate has always been cyclical, with periods of exuberance followed by correction and consolidation. The current cycle emphasizes the importance of fundamentals: location, cash flow, and realistic expectations. Markets that never lost sight of these principles will emerge strongest, while those built on speculation face extended challenges.

Your path to success in the 2026 housing market starts with education, careful analysis, and strategic action. The crisis that nobody saw coming is here, but within every crisis lie opportunities for those prepared to recognize and seize them. Choose your markets wisely, underwrite conservatively, and act decisively when the right opportunity presents itself.