The days of making multi-million dollar real estate decisions based on gut feeling and a few local comparable sales are fading. Fast. We’ve entered a new era where data is king, and algorithms are the kingmakers. Welcome to the world of Big Data, the invisible force that is radically reshaping everything from how a first-time homebuyer finds a property to how institutional investors deploy billions in commercial property.

- What Exactly Is Big Data in the Context of Real Estate?

- The Predictive Power: How Data Models Forecast Market Shifts

- The Daily Pulse: Real-Time Data in Action

- How Big Data is Revolutionizing Roles in the Real Estate Industry

- A Spotlight on Australia: Data-Driven Trends Down Under

- The Challenges and Ethical Considerations

- The Future is Written in Data

For decades, the industry relied on historical trends, local knowledge, and the seasoned intuition of a top real estate agent. While that expertise remains invaluable, it’s now being supercharged by an unprecedented volume of data. We’re talking about petabytes of information, crunched in real-time, to forecast market movements with staggering accuracy.

This isn’t just a minor upgrade; it’s a paradigm shift. If you’re involved in the property market—whether you’re searching for real estate for sale, managing a portfolio of real estate rentals, or are a leading property manager—understanding and leveraging Big Data is no longer an option. It’s the price of entry for staying competitive and profitable.

In this definitive guide, we will dissect the power of data in the property market. We’ll explore how predictive analytics are identifying the next boom suburbs, how real estate agents are using it to close more deals, and how you can use these insights to inform your own real estate investing strategy, whether you’re eyeing real estate Sydney or the burgeoning market of real estate Perth.

What Exactly Is Big Data in the Context of Real Estate?

Before we dive into the “how,” let’s clarify the “what.” Big Data isn’t just a bigger spreadsheet. It refers to the “Three V’s”:

- Volume: The sheer scale of data being generated is immense. Think beyond property listings. We’re talking about every online search for “real estate rent,” every council development application, every census data point, and every consumer spending habit in a given postcode.

- Velocity: This data is being generated and updated at an incredible speed. Auction clearance rates are no longer weekly news; they are updated live. Buyer sentiment can be tracked daily through online activity.

- Variety: The data comes from a massive range of structured and unstructured sources. It’s not just sale prices and bed/bath counts.

Key Data Sources Fueling the Real Estate Revolution

To truly grasp the power, you need to understand the ingredients. Predictive models are fed a rich diet of information from sources like:

- Property Listing & Transactional Data: This is the bedrock. Every listing on portals like Domain real estate or

realestate.com.au, every sale price recorded, days on market, price adjustments—it all goes into the model. This includes data from every state, from sa real estate to real estate qld. - Economic Indicators: Macro-level data is crucial. Interest rates set by the Reserve Bank of Australia, inflation figures, consumer price index (CPI), GDP growth, and unemployment rates all create the economic weather in which the property market operates.

- Government & Council Data: This is a goldmine. Infrastructure spending (new train lines, highways, hospitals), zoning changes, development approvals, and population forecasts from the Australian Bureau of Statistics (ABS) are powerful predictors of future growth. A new metro line can fundamentally change the value of an entire corridor in real estate NSW.

- Demographic & Social Data: Who is moving where, and why? Census data reveals household income, age distribution, family composition, and migration patterns. This helps predict demand for specific types of housing, whether it’s family homes in Swan View or apartments in inner Melbourne real estate.

- Online Search & Behavioural Data: Google Trends can reveal rising search interest for terms like “gold coast real estate” or “real estate kiama,” often a leading indicator of growing demand. The types of properties people are clicking on, saving, and sharing provide real-time insight into buyer preferences.

- Geospatial & Environmental Data: This is becoming increasingly critical. Data on flood zones, bushfire risk, school catchments, proximity to parks, cafes, public transport, and even noise pollution levels are layered onto property data to create a hyper-detailed picture of a location’s value and livability.

When you combine these disparate datasets, you move from observation to prediction. You can start to answer questions like: “Based on migration trends, infrastructure spending, and rising search volume, which suburbs in real estate Brisbane are most likely to see double-digit growth in the next 24 months?”

The Predictive Power: How Data Models Forecast Market Shifts

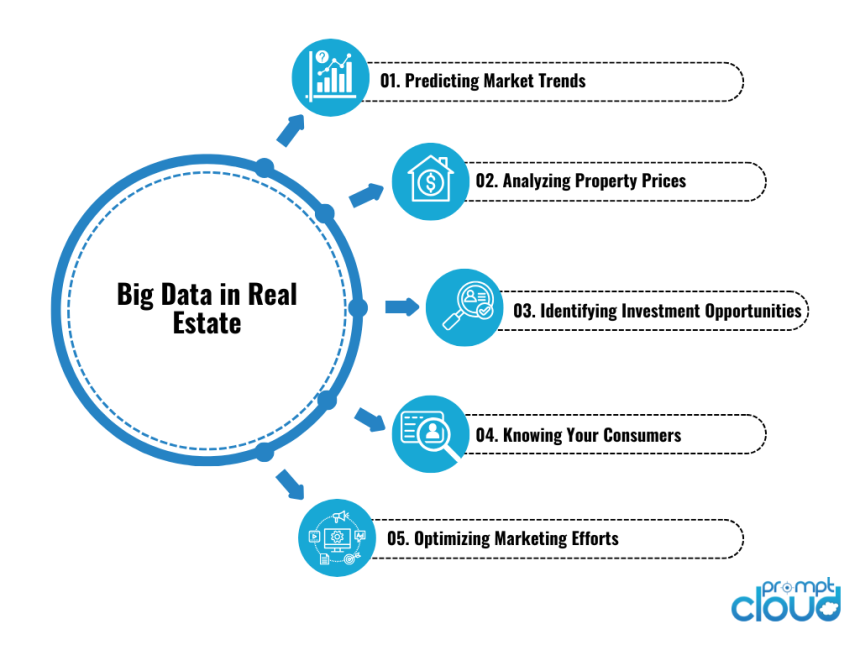

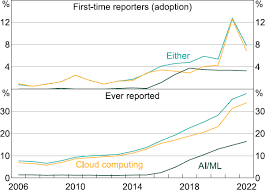

This is where the magic happens. Using machine learning and artificial intelligence (AI), data scientists build complex algorithms that identify patterns and correlations invisible to the human eye. These models are transforming the core functions of the real estate industry.

Identifying Hotspots and Gentrifying Suburbs Before They Boom

The holy grail of real estate investing is buying in an area just before it takes off. Big Data makes this a science, not a lottery. Algorithms can screen for a “gentrification signature” by looking for a confluence of factors:

- A sudden increase in building permits for renovations.

- The opening of trendy cafes, independent bookstores, or boutique gyms (tracked via Google Maps and business registration data).

- A shift in demographics towards younger, higher-income professionals.

- A rise in online searches for that suburb combined with a low but tightening supply of real estate for sale.

An investor looking at Perth real estate could use a data service to flag suburbs showing these early signals, allowing them to get in before the wider market catches on and prices surge.

Pinpoint Pricing Accuracy: The Evolution of AVMs

An Automated Valuation Model (AVM) is an algorithm that estimates a property’s value. Early AVMs were basic, using only recent sales and property attributes. Today’s AVMs are incredibly sophisticated, incorporating hundreds of variables: the quality of the school catchment, the walking score, the angle of natural light, the specific finishes in the kitchen, and even the sentiment of comments on the online listing.

For a top real estate agent, this is a powerful tool. It allows them to provide sellers with a data-backed valuation, manage expectations, and justify their pricing strategy. For buyers, it provides a crucial sanity check. This technology is being leveraged by major agencies across the country, from Ray White Real Estate to smaller, boutique firms like Holdsworth Real Estate or Turner Real Estate.

Risk Mitigation for Commercial Real Estate and Investors

For those in commercial real estate, the stakes are even higher. A bad investment can be catastrophic. Big Data is the ultimate risk mitigation tool.

- Retail Site Selection: A company looking to open a new store can analyze mobile phone location data (anonymized, of course) to understand foot traffic patterns by time of day. They can layer this with credit card transaction data to understand local spending power and demographic data to ensure the local population matches their target customer. This is the science behind choosing the perfect location for commerce.

- Climate Risk Analysis: Insurers and large funds are now using sophisticated climate models to predict the long-term risk of floods, fires, and coastal erosion on their property portfolios. A waterfront property in real estate cairns might look beautiful today, but data models can project its insurance risk in 30 years, directly impacting its long-term value.

- Tenant Default Prediction: For owners of large rental portfolios, predicting which tenants are likely to default is a game-changer. By analyzing payment histories and other variables, a property manager can proactively work with at-risk tenants, reducing vacancies and financial losses.

The Daily Pulse: Real-Time Data in Action

To demonstrate the immediacy of this data, here’s what a hypothetical “Daily Market Snapshot” might look like. While the specific numbers here are illustrative, they represent the kind of real-time information that professional investors and top-tier firms like Ray White are monitoring every single day.

Today’s Australian Real Estate Market Snapshot

- National Auction Clearance Rate (Live): 68.7% (Up 0.5% from yesterday’s rolling average). Sydney is leading at 72.1%, while Melbourne is seeing a slight softening at 66.5%.

- Source: Live auction data aggregated from Domain, REA Group, and major agency feeds.

- Top 5 Searched Suburbs (Last 24 Hours):

- Buderim, Real Estate QLD (High search volume for family homes with pools).

- Castle Hill, Real Estate Sydney (Driven by strong school catchment interest).

- Frankston, Real Estate Victoria (Increased searches for affordable coastal living).

- Joondalup, Real Estate Perth (Spike in searches for units and townhouses near the city center).

- Glenelg, Real Estate Adelaide (Consistent high demand for lifestyle apartments).

- Source: Aggregated search trend data from major real estate portals.

- Investor Finance Inquiry Index: 112.4 (A reading above 100 indicates above-average inquiry levels for investment loans). The index is strongest for commercial real estate Perth and residential property in Brisbane.

- Source: Data from mortgage brokers and financial aggregators.

- Rental Demand vs. Supply Indicator:

- National Vacancy Rate: 1.0% (Extremely tight).

- Most Competitive Rental Market: Perth real estate with a vacancy rate of just 0.4%. Landlords are seeing applications within hours of listing.

- Highest Rental Yield Growth (YTD): Regional SA real estate and specific markets like real estate Margaret River.

- Source: CoreLogic, SQM Research.

For live, up-to-the-minute data, investors and professionals should consult primary sources like:

- CoreLogic for property data and analytics.

- Australian Bureau of Statistics (ABS) for demographic and economic data.

- Reserve Bank of Australia (RBA) for interest rate decisions and financial stability reports.

- Your preferred major portal like Domain Real Estate or REA for search trends and listing data.

How Big Data is Revolutionizing Roles in the Real Estate Industry

This data revolution isn’t just about abstract numbers; it’s changing the day-to-day reality for everyone in the property ecosystem.

For the Modern Real Estate Agent

The role of a real estate agent is evolving from a gatekeeper of information to a skilled interpreter of it. Top agents are now data consultants.

- Hyper-Targeted Marketing: Instead of a generic letterbox drop, an agent can use data to identify households that are most likely to sell in the next 6-12 months (e.g., empty nesters, growing families in undersized homes). They can then target these specific households with digital ads, dramatically increasing their ROI.

- Predictive Lead Generation: AI platforms can analyze an agent’s contact database and public records to predict which past clients or local homeowners are showing signals of wanting to transact. It might flag someone who just had their third child or whose mortgage has reached a certain age.

- Data-Driven Negotiations: A skilled agent from a firm like Elders Real Estate or Kevin Hicks Real Estate can walk into a negotiation armed with data on recent sales, buyer demand for that specific street, the average time on market for that property type, and the sentiment of recent inspection attendees. This replaces “I think” with “the data shows.”

For the Savvy Property Manager

Managing a portfolio of real estate rentals used to be a reactive job. Today, it’s becoming proactive.

- Dynamic Rental Pricing: Instead of setting the rent and forgetting it for a year, a property manager can use real-time data on local supply, demand, and vacancy rates to adjust rental prices dynamically between tenancies, maximizing returns for the owner.

- Predictive Maintenance: By analyzing data from past maintenance requests across thousands of properties, a property management firm can predict when an air conditioner or hot water system is likely to fail in a specific building. This allows them to schedule preventative maintenance, avoiding costly emergency repairs and keeping tenants happy.

- Tenant Screening 2.0: Beyond a simple credit check, data models can provide a more holistic view of an applicant’s reliability, leading to lower vacancy rates and fewer issues.

For the Commercial Real Estate Investor

For those focused on commercial property, data provides an almost unfair advantage.

- Logistics & Industrial: Companies like Amazon use incredibly complex models to determine the optimal location for their massive warehouses. They analyze transportation networks, workforce availability, land costs, and delivery time data to find the perfect hub, a process that is now being replicated by investors in the industrial commerce space.

- Office Space of the Future: By using sensor data (tracking meeting room usage, desk occupancy, and movement within a building), landlords can understand exactly how tenants use their space. This data is invaluable for designing future offices that are more efficient and desirable, especially in a post-pandemic world. It’s crucial for anyone investing in commercial real estate.

For the Home Buyer and Seller

This data empowerment isn’t just for professionals. The average Australian looking at real estate au websites has access to more information than ever before. Free tools on portals can provide value estimates, suburb profiles, and sales histories. This transparency levels the playing field, allowing consumers to conduct their own due diligence before an inspection and engage with agents on a more informed basis. If you’re looking to buy a property that has recently sold real estate, you can instantly see the history and compare it to its neighbours.

A Spotlight on Australia: Data-Driven Trends Down Under

The impact of Big Data varies across Australia’s diverse markets. Let’s look at some specific examples.

Sydney & NSW Real Estate

In a market as complex as real estate Sydney, data is essential for navigating its micro-markets. Data models are tracking the “ripple effect” of price growth from the inner city to the outer suburbs. They are also modelling the impact of major infrastructure projects like the Western Sydney Airport, predicting which suburbs will benefit most from the influx of jobs and new transport links. For regional areas, from real estate Kiama on the coast to inland centres, data tracks migration patterns of city-dwellers seeking a lifestyle change, a key driver of recent growth in real estate NSW.

Melbourne & Victoria Real Estate

Melbourne real estate is heavily influenced by population growth and urban planning. Data analytics are used to model urban sprawl and identify key growth corridors. By analysing building approvals and land release data, developers can forecast where future supply will be concentrated, helping investors avoid oversupplied markets. For real estate Victoria, data also plays a huge role in understanding the distinct drivers of inner-city apartment demand versus the demand for family homes in the middle and outer rings.

Brisbane & QLD Real Estate

The story of real estate Brisbane and greater real estate QLD in recent years has been one of interstate migration. Big Data tracks this in near real-time by analysing removalist company bookings, address change data, and search trends originating from Sydney and Melbourne. This allows investors to anticipate demand surges on the Gold Coast real estate market or in Sunshine Coast hubs. Climate data is also becoming a critical overlay here, assessing flood risk for Brisbane properties and the impact of tourism trends on markets like real estate Cairns.

Perth & WA Real Estate

Historically, Perth real estate has been closely tied to the boom-and-bust cycles of the mining industry. Data models now incorporate a much wider range of inputs, including commodity prices, mining employment forecasts, and economic diversification metrics to provide a more stable and nuanced view of the market. This helps differentiate the prospects of inner-city commercial real estate Perth from lifestyle-driven markets like real estate Margaret River or coastal communities like Halls Head Real Estate. The professionals real estate agencies in the area are heavily reliant on this data.

The Challenges and Ethical Considerations

The rise of Big Data in real estate is not without its challenges.

- Data Privacy: The collection of personal and location data raises significant privacy concerns that need to be managed through regulation and ethical practices.

- Algorithmic Bias: If an algorithm is trained on historical data that reflects past discrimination (e.g., “redlining”), it can perpetuate and even amplify those biases in its predictions for loan approvals or property valuations.

- The Digital Divide: Not everyone has equal access to or understanding of this data. There’s a risk of creating a two-tiered market where data-savvy investors have a significant advantage over the average homebuyer.

- Over-reliance on Data: The human element remains critical. An algorithm can’t understand the unique emotional appeal of a home, the feel of a neighbourhood, or the nuanced motivations of a seller. Data is a tool to inform, not replace, human expertise. A great agent knows when the data is right and when it’s missing a piece of the puzzle. What happens if there’s a Real Estate Broke situation in a suburb, the data might lag behind the on-the-ground reality.

The Future is Written in Data

We are only at the beginning of this transformation. In the near future, expect to see even more granular insights. Imagine real estate photography that uses AI to identify features that correlate with higher sale prices, or virtual reality tours that collect data on what parts of a home viewers focus on the most. The integration of IoT (Internet of Things) devices in smart homes will provide a constant stream of data on everything from energy usage to a building’s structural health.

The power of Big Data is creating a more transparent, efficient, and predictable real estate market. It is arming buyers, sellers, renters, and investors with the insights they need to make better decisions.

For those who embrace this change, the opportunities are immense. By understanding the data, you can look past the headlines and see the underlying trends shaping the future of property in Australia and beyond. Whether your interest is in real estate nz or your local suburb, the language of data is one you need to learn to speak. The future of real estate isn’t just about location, location, location. It’s about data, data, data.