Introduction: The Seismic Shift in Real Estate – Beyond Bricks and Mortar

Welcome, discerning readers and fellow enthusiasts of innovation, to a deep dive into one of the most transformative movements sweeping across the global landscape of property: PropTech. For too long, the real estate sector, a colossal titan built on tangible assets like bricks, mortar, and land, has been perceived as stubbornly traditional, a slow-moving giant resistant to change. But a quiet revolution has been brewing, powered by visionary entrepreneurs and cutting-edge technology, fundamentally altering how we buy, sell, manage, invest in, and even experience property. This isn’t just about listing houses online; this is about a complete paradigm shift, a re-imagining of an industry that underpins global economies.

- Introduction: The Seismic Shift in Real Estate – Beyond Bricks and Mortar

- The Driving Forces: Why Now is PropTech’s Moment in the Sun

- The Pillars of Disruption: How PropTech is Reimagining Real Estate

- The Global & Local Landscape: PropTech on Every Shore

- Impact on Traditional Players: Adapt or Be Left Behind

- Challenges and Opportunities for PropTech: Navigating the Future

- The Future of Real Estate: A Hyper-Connected, Intelligent Estate

- Conclusion: Embrace the Transformation of Real Estate

Think about it: from the bustling streets of Sydney real estate to the sprawling developments in Melbourne real estate, from the thriving Brisbane real estate market to the dynamic Perth real estate scene, every facet of property is ripe for digital transformation. This isn’t a speculative future; it’s the vibrant, unfolding present. As a top blog writer, my mission today is to pull back the curtain on this exhilarating world, explaining PropTech in all its glorious complexity, showcasing the startups that are leading the charge, and revealing why this movement is so crucial for anyone involved in real estate investing, whether you’re a seasoned developer, a first-time homebuyer, a property manager, or a shrewd commercial property investor.

The keywords you’ve provided – from geographical markers like real estate NSW, real estate QLD, real estate Victoria, real estate Australia, and real estate NZ, to professional roles like real estate agents and established brands like Domain real estate and Ray White real estate – are not just buzzwords. They represent the very fabric of an industry grappling with unprecedented change, an industry that is now, more than ever, looking to technology for solutions to old problems and gateways to new opportunities. This is the story of how technology is making real estate for sale more accessible, real estate rent more efficient, and real estate news more dynamic than ever before.

What Exactly is PropTech? Defining the Digital Evolution of Estate

Before we explore the fascinating startups and disruptive technologies, let’s firmly establish what PropTech actually means. PropTech, a portmanteau of “Property” and “Technology,” refers to the application of information technology and platform economics to the real estate industry. It encompasses a broad range of technological innovations designed to improve efficiency, streamline processes, enhance user experience, and create new business models across all aspects of property.

Unlike its more established cousins, FinTech (financial technology) or ConTech (construction technology), PropTech specifically targets the entire property lifecycle. It’s not just about one piece of the puzzle; it’s about integrating solutions from concept and construction (where it often overlaps with ConTech), through financing and marketing, to transaction, management, and even eventual decommissioning. It’s about leveraging data, automation, and connectivity to unlock value that traditional real estate methods often leave untapped.

This isn’t just about fancy apps; it’s about deep-seated structural changes. Imagine a future where an inspection can be done virtually with VR, where a rent payment is secured via blockchain, where commercial real estate Perth investments are crowdfunded through digital platforms, or where finding real estate for sale in Adelaide real estate is tailored precisely to your lifestyle, not just your budget. This is the promise of PropTech, transforming the very definition of Estate.

The Driving Forces: Why Now is PropTech’s Moment in the Sun

Why has PropTech suddenly exploded into the mainstream, garnering billions in investment globally? The answer lies in a confluence of powerful trends and enduring challenges within the traditional real estate sector.

1. The Digital Native Generation: A Demand for Seamless Experiences

A new generation of consumers and investors has emerged, raised in a world of instant information, on-demand services, and intuitive digital interfaces. They expect the same level of seamlessness and transparency when engaging with real estate, whether they’re looking for real estate rentals in Gold Coast real estate or researching commercial property opportunities. Traditional processes, often characterized by mountains of paperwork, fragmented communication, and slow turnaround times, simply no longer cut it. This demand for digital fluency is a primary accelerant for PropTech innovation.

2. The Data Deluge: Unlocking Insights from the Physical World

Every day, vast amounts of data are generated about properties, people, and places. From satellite imagery and IoT sensors in smart buildings to social media activity and demographic shifts, this “data exhaust” holds immense potential. PropTech leverages advanced analytics, Artificial Intelligence (AI), and Machine Learning (ML) to transform this raw data into actionable insights. This allows for more accurate valuations, predictive maintenance, personalized marketing for real estate agents, and smarter real estate investing strategies across locales like real estate Cairns or real estate Margaret River.

3. Maturing Technologies: From Hype to Practical Application

Many of the technologies central to PropTech – AI, blockchain, IoT, virtual and augmented reality (VR/AR), big data analytics – have matured beyond their initial hype cycles. They are now robust, scalable, and increasingly affordable, making their application in the historically slow-moving real estate sector not just feasible but imperative. These technologies empower startups to build solutions that were unimaginable just a decade ago.

4. The Need for Efficiency: Tackling Legacy Inefficiencies

The real estate industry, despite its massive economic footprint, has long been plagued by inefficiencies. Fragmented information, opaque processes, high transaction costs, and reliance on manual tasks are common. PropTech offers solutions to these pain points, automating repetitive tasks, centralizing data, and streamlining complex workflows, leading to significant cost savings and improved productivity for everyone from independent real estate agents to large real estate Australia firms.

5. Urbanization and Sustainability: Global Challenges Demanding Smart Solutions

With global urbanization rates soaring, cities face immense pressure on housing, infrastructure, and environmental sustainability. PropTech offers tools to create smarter, more sustainable, and more livable urban environments. From optimizing energy consumption in buildings to facilitating sustainable development practices, technology is key to addressing these grand challenges. The push for green real estate practices, for instance, is a significant driver for innovation.

The Pillars of Disruption: How PropTech is Reimagining Real Estate

PropTech isn’t a monolithic entity; it’s a vast ecosystem comprising diverse solutions tackling different segments of the real estate market. We can broadly categorize these innovations into several key pillars, each teeming with innovative startups.

I. Transactional Technologies: Streamlining How Property Changes Hands

This category focuses on transforming the buying, selling, and leasing process, making it faster, more transparent, and more accessible. It’s where much of the direct impact on real estate agents and consumers is felt.

A. Online Marketplaces and Listing Platforms: Beyond the Classifieds

While platforms like Domain real estate and realestate.com.au have been around for a while, PropTech is taking online listings to the next level. Startups are offering:

- Enhanced Discovery & Search: AI-powered search engines that understand buyer preferences beyond simple filters. Imagine searching for “a family home with a big backyard near top schools in Kiama real estate” and getting hyper-relevant results, perhaps even with predictions of future value.

- Virtual Showings & Immersive Experiences: VR/AR tours that allow potential buyers to walk through a property from anywhere, anytime. This is particularly valuable for overseas investors or those looking at real estate NSW properties from interstate. This technology can reduce the need for physical inspection until a serious interest is established.

- Direct-to-Consumer Models: Platforms that enable sellers to list properties directly, bypassing traditional real estate agents entirely or offering hybrid models. This is particularly impactful for “for sale by owner” scenarios, potentially reducing commission costs.

- Pre-Market Sales & Off-Market Opportunities: Platforms connecting sellers and buyers confidentially before a property officially hits the market, creating exclusive opportunities.

Source Insight: According to a recent report by CB Insights, funding into transaction-focused PropTech companies continues to surge, driven by consumer demand for frictionless experiences. [Placeholder Link: e.g., https://www.cbinsights.com/research/proptech-funding-report/]

B. Digital Brokerage and Agent Tools: Empowering the Professionals

While some PropTech aims to disintermediate real estate agents, much of it also seeks to empower them. Startups are developing tools that:

- Automate Administrative Tasks: CRM systems, marketing automation, and scheduling tools that free up real estate agents from mundane tasks, allowing them to focus on client relationships.

- Provide Data-Driven Insights: Tools offering predictive analytics on market trends, neighborhood desirability, and optimal pricing strategies. This gives agents a competitive edge in markets like Melbourne real estate or commercial real estate Perth. Knowing what sold real estate achieved in a specific area is gold.

- Enhance Communication: Integrated platforms for seamless communication with clients, legal teams, and other stakeholders, reducing friction in complex transactions.

- Digital Offer & Closing Platforms: Streamlining the offer process, handling digital signatures, and managing closing documents securely and efficiently. This can dramatically shorten the time it takes to finalize real estate for sale agreements.

Example: Companies like OJO Labs (US) use AI to assist real estate agents and buyers, providing personalized insights. In Australia, platforms integrate with major players like Ray White real estate or Elders real estate to offer advanced tools to their agents.

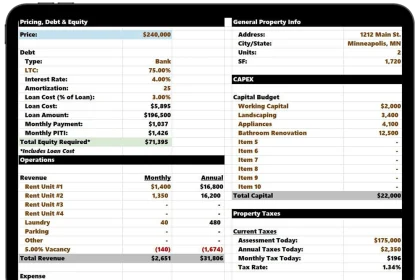

C. Financing & Investing Platforms: Democratizing Access to Property Wealth

PropTech is fundamentally altering how real estate investing happens, opening it up to a broader range of investors and creating new financing mechanisms.

- Crowdfunding Platforms: Allowing individuals to invest smaller sums into larger commercial property or residential projects, democratizing access to potentially lucrative real estate investing opportunities that were once only for the wealthy. This is particularly relevant for diverse markets from real estate Adelaide to real estate NZ.

- Blockchain for Property Titles & Fractional Ownership: Using blockchain technology to create immutable records of property ownership, reducing fraud and speeding up transactions. It also enables fractional ownership, where investors can own a “share” of a property, akin to buying stocks, making real estate investing more liquid and accessible.

- AI-Powered Lending & Mortgage Solutions: Streamlining the mortgage application process, using AI to assess creditworthiness and personalize loan products, speeding up approvals for buying real estate for sale.

- Predictive Analytics for Investment Decisions: Offering sophisticated tools that use vast datasets to predict market movements, identify undervalued assets, and optimize real estate investing portfolios. This is invaluable for anyone looking at long-term holdings in real estate Australia.

Source Insight: Deloitte’s recent “Future of Real Estate” report highlights the increasing adoption of tokenization and fractional ownership for alternative real estate investing models. [Placeholder Link: e.g., https://www2.deloitte.com/us/en/pages/financial-services/articles/future-of-real-estate.html]

II. Property Management & Operations: The Smart, Connected Building

This segment of PropTech focuses on optimizing the ongoing operation and management of properties, from individual homes to large commercial property complexes. It’s about enhancing tenant experience, reducing operational costs, and improving sustainability.

A. Smart Home & Building Technologies (IoT): The Intelligent Environment

The Internet of Things (IoT) is making buildings smarter, more responsive, and more efficient.

- Energy Management Systems: Sensors and AI optimizing HVAC, lighting, and other systems to reduce energy consumption and operational costs, a major concern for commercial property owners.

- Predictive Maintenance: IoT sensors monitoring equipment (e.g., HVAC, elevators) to predict failures before they occur, scheduling maintenance proactively, and minimizing downtime. This is a game-changer for property manager roles.

- Security & Access Control: Smart locks, video surveillance, and biometric access systems enhancing security for residents and tenants.

- Environmental Monitoring: Sensors tracking air quality, temperature, and humidity to create healthier and more comfortable living and working environments.

Live Daily Information: As of today, smart building technology is no longer a luxury but an expectation in new real estate developments, particularly in premium markets like Sydney real estate and Melbourne real estate. The focus is increasingly on integrating these systems into a single, cohesive platform for ease of management.

B. Tenant Experience & Rent Management Platforms: Elevating Occupant Satisfaction

For both residential and commercial property, tenant satisfaction is paramount. PropTech solutions are designed to make the tenant journey smoother and more engaging.

- Tenant Portals & Communication Hubs: Online platforms for tenants to pay rent, submit maintenance requests, communicate with the property manager, and access building amenities.

- Digital Lease Management: Streamlining lease signing, renewals, and document storage, making the process paperless and efficient for real estate rentals.

- Community Building Apps: Fostering a sense of community in residential buildings or co-working spaces through social features and event listings.

- Automated Rent Collection & Accounting: Solutions that automate rent collection, reconciliation, and financial reporting, a huge benefit for property manager teams.

Example: MRI Software and Yardi are enterprise-level solutions that have integrated numerous PropTech features for comprehensive property manager tools. Smaller startups focus on specific aspects like automated rent payments or tenant engagement.

C. Facility Management & Maintenance Solutions: Efficiency Behind the Scenes

Behind every well-run building is a complex web of facility management tasks. PropTech is bringing much-needed innovation here.

- Work Order Management Systems: Digital platforms for submitting, tracking, and managing maintenance requests, ensuring timely resolution.

- Vendor Management: Streamlining the process of managing external contractors for cleaning, repairs, and other services.

- Space Utilization Analytics: Using sensors and data to understand how spaces are being used in commercial property, optimizing layouts, and reducing wasted space. This is critical for businesses looking to maximize their commerce footprint.

- Automated Inspection Tools: Drones for roof inspections, AI for identifying maintenance issues from images.

III. Data Analytics & AI: The Brains Behind the Property Business

Perhaps the most pervasive and transformative aspect of PropTech is the application of advanced data analytics and Artificial Intelligence. This is the “brain” that drives smarter decisions across all other pillars.

A. Market Insights & Valuation: Beyond Comparative Sales

Traditional property valuation often relies on historical sold real estate data. PropTech brings real-time, predictive power.

- AI-Powered Valuation Models (AVMs): Using vast datasets (property characteristics, location data, economic indicators, social media trends) to provide highly accurate, real-time property valuations, far beyond what simple AVMs could do a few years ago. This is crucial for rapidly moving markets like real estate Sydney or real estate Gold Coast.

- Predictive Analytics for Market Trends: Forecasting future price movements, identifying emerging hot spots (real estate Perth, real estate Cairns), and predicting demand shifts, offering invaluable insights for real estate investing.

- Risk Assessment: AI models assessing various risks associated with a property or investment, from environmental factors to market volatility.

- Personalized Recommendations: For buyers and investors, AI can sift through countless properties to present those that best fit their specific criteria and investment goals, whether it’s a family home in Swan View or a commercial property in the CBD.

Source Insight: JLL’s “Real Estate and Technology” report consistently emphasizes data and AI as the most impactful technological drivers for future real estate investing decisions. [Placeholder Link: e.g., https://www.jll.com/en/trends-and-insights/research/real-estate-technology]

B. Location Intelligence & GIS: Understanding the “Where”

Geographic Information Systems (GIS) combined with other data layers provide profound location intelligence.

- Demographic & Lifestyle Analysis: Understanding the population density, income levels, amenities, and lifestyle preferences of specific areas, crucial for developers and real estate agents in targeting the right buyers for real estate for sale.

- Accessibility & Infrastructure Mapping: Analyzing proximity to transport, schools, hospitals, and other critical infrastructure, impacting property desirability and value.

- Environmental Impact Assessment: Mapping flood plains, noise pollution, green spaces, and other environmental factors that influence property value and sustainability.

- Footfall & Traffic Analysis: For commercial property, understanding customer traffic patterns, vital for retail and office space selection.

C. Personalization & Recommendation Engines: The Netflix of Real Estate

Just as streaming services recommend content, PropTech is building engines to recommend properties or investment opportunities.

- Buyer/Investor Matching: Matching buyers with ideal properties based on an intricate understanding of their needs, not just basic filters.

- Portfolio Optimization: For investors, AI can suggest adjustments to their real estate investing portfolio based on market conditions and risk tolerance.

- Tailored Marketing: Enabling real estate agents to deliver highly personalized marketing messages to potential clients, increasing conversion rates.

IV. Construction Technologies (ConTech’s Intersection): Building the Future

While ConTech is a field unto itself, its innovations directly impact the real estate product, making it faster, cheaper, and more sustainable to build. This intersection is crucial for real estate investing and development.

- Modular & Prefabricated Construction: Manufacturing building components off-site in controlled environments, then assembling them on-site. This speeds up construction, reduces waste, and often lowers costs, crucial for rapid housing development in areas like real estate NSW.

- Robotics & Automation: Drones for site surveying, robotic bricklayers, automated heavy machinery, improving safety and efficiency on construction sites.

- Building Information Modeling (BIM): Digital 3D models that contain all information about a building project, from design and construction to operation, enabling better collaboration and reducing errors.

- Sustainable Materials & Green Building Tech: Innovations in eco-friendly materials and technologies that reduce a building’s environmental footprint, a growing priority for conscious real estate investing.

V. Commercial Real Estate (CRE) Specifics: Revolutionizing Commerce

Commercial property has its unique challenges and opportunities, and PropTech is delivering tailored solutions.

- Space-as-a-Service Platforms: Companies like WeWork (though not a PropTech startup itself, it leverages many PropTech principles) and others offer flexible office solutions, managed through intuitive apps for booking, access, and services.

- Tenant Experience Platforms for Offices: Apps that allow employees to book meeting rooms, order food, report issues, and access amenities within their office buildings.

- Investment & Asset Management Tools for CRE: Sophisticated platforms for managing large commercial property portfolios, optimizing leases, tracking performance, and facilitating real estate investing decisions for institutional investors.

- AI-Driven Lease Negotiation: Tools that analyze market data to provide insights for optimal lease terms for both landlords and tenants in commercial real estate Perth or real estate Brisbane.

Live Daily Information: In the current economic climate, particularly with the shift to hybrid work models, commercial property landlords are aggressively adopting PropTech to enhance tenant experience and optimize space utilization to attract and retain occupants. The demand for flexible, smart office solutions is at an all-time high, driving significant investment in this PropTech sub-sector.

The Global & Local Landscape: PropTech on Every Shore

PropTech is a global phenomenon, but its manifestation varies depending on local market dynamics, regulatory environments, and consumer preferences.

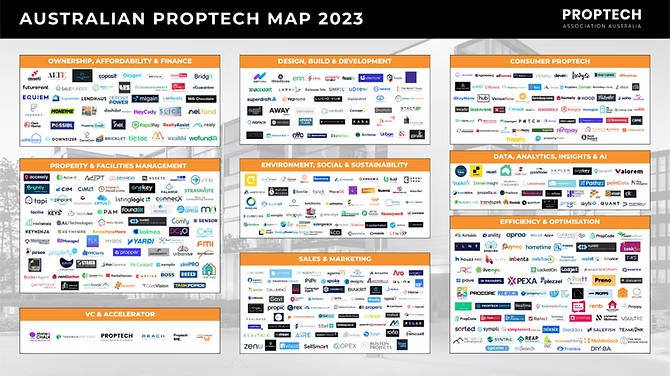

Focus on Australia & New Zealand: A Thriving PropTech Ecosystem

Real estate Australia and real estate NZ are fertile grounds for PropTech innovation, driven by high property values, a tech-savvy population, and a strong culture of real estate investing.

- Australia’s Market Leaders: While giants like Domain real estate and realestate.com.au continually innovate with PropTech features (VR tours, digital applications), a vibrant startup scene is emerging. Companies are focusing on digital conveyancing, automated property management, and real estate investing platforms.

- Regional Specifics:

- Sydney real estate and Melbourne real estate often see the earliest adoption of advanced PropTech, particularly in commercial property and luxury residential sectors, due to their size and international connectivity.

- Brisbane real estate and Perth real estate are embracing smart city initiatives and sustainable building PropTech.

- Adelaide real estate and Cairns real estate are seeing growth in tourism-focused PropTech (e.g., short-term rental management).

- Rural and regional markets like real estate Margaret River, real estate Kiama, Halls Head Real Estate, and Swan View are leveraging technology to bridge geographical distances, offering virtual tours and streamlined buying processes.

- Key Players Adapting: Traditional players like Ray White real estate, Elders real estate, Professionals real estate, Turner Real Estate, Kevin Hicks Real Estate, and Holdsworth Real Estate are not standing still. Many are either investing in PropTech startups, developing their own digital solutions, or partnering with PropTech providers to enhance their services for real estate agents and clients alike. They recognize that to remain competitive, they must embrace innovation.

Source Insight: A recent PropTech report by KPMG Australia indicates significant growth in venture capital funding for Australian PropTech startups, with a particular focus on transaction and data analytics solutions. [Placeholder Link: e.g., https://kpmg.com/au/en/home/industries/real-estate/proptech.html]

Global Trends: Where the World is Heading

- Mega-Funding Rounds: Billions are being poured into PropTech globally, with mature markets like the US, Europe, and Asia leading the way.

- Consolidation: As the industry matures, we’re seeing more mergers and acquisitions, with larger PropTech companies absorbing smaller, innovative players.

- Interoperability: The drive towards integrated platforms where different PropTech solutions can “talk” to each other, creating seamless ecosystems for managing Estate.

- Focus on ESG (Environmental, Social, Governance): A growing emphasis on PropTech solutions that contribute to sustainability, social equity, and good governance in real estate.

Impact on Traditional Players: Adapt or Be Left Behind

The rise of PropTech is not necessarily about the complete obsolescence of traditional real estate agents or property managers. Instead, it’s about evolution and adaptation.

Real Estate Agents and Brokers: The Augmented Professional

The role of the real estate agent is shifting. Repetitive, administrative tasks are being automated, but the human element – negotiation, client relationships, local expertise, empathy – remains irreplaceable. PropTech empowers agents to be more efficient, data-driven, and client-centric. Those who embrace these tools will thrive; those who resist risk becoming obsolete. Firms like Ray White and Professionals real estate are actively investing in training their agents on new digital tools.

Property Managers: From Reactive to Proactive

Property manager roles are being revolutionized. Instead of constant fire-fighting, PropTech allows for proactive maintenance, better tenant communication, and data-driven operational decisions. This leads to happier tenants, lower costs, and more efficient management of real estate rentals and commercial property. The traditional property manager who juggled spreadsheets is now a tech-savvy professional leveraging dashboards and AI.

Real Estate Investing: Democratized and Data-Driven

For investors, PropTech offers unprecedented access to data, market insights, and new investment vehicles. It lowers barriers to entry for real estate investing, making it more accessible to a broader demographic. However, it also requires investors to be more informed and agile, understanding the technological nuances that drive market shifts.

The “Estate” of Tomorrow: A New Horizon for Property

The overall Estate of tomorrow will be more intelligent, interconnected, and efficient. From the earliest stages of construction (ConTech’s influence) to the ongoing management and eventual sale (sold real estate), every process will be enhanced by technology. This means better outcomes for consumers, more sustainable buildings, and more profitable ventures for real estate investing.

Challenges and Opportunities for PropTech: Navigating the Future

Like any transformative wave, PropTech faces its share of challenges, but these also present immense opportunities.

Challenges:

- Data Privacy and Security: The vast amount of data collected by PropTech solutions raises concerns about privacy and cybersecurity. Building trust and ensuring robust security protocols are paramount.

- Regulatory Hurdles: The real estate industry is heavily regulated, and existing laws often lag behind technological advancements. Navigating this complex landscape is a significant challenge for startups.

- Integration with Legacy Systems: Many established real estate companies operate on outdated IT infrastructure. Integrating new PropTech solutions with these legacy systems can be complex and costly.

- Adoption Resistance: Change is hard. Many traditional players, including some real estate agents and property managers, may be resistant to adopting new technologies, preferring established methods. Education and demonstrating clear ROI are key.

- Capital Intensity: Developing and scaling sophisticated PropTech solutions often requires significant capital, particularly for hardware-intensive solutions or those involving complex AI. Attracting real estate investing capital is critical.

Opportunities:

- Massive Untapped Market: Despite the growth, a significant portion of the global real estate market remains untouched by advanced technology, presenting immense opportunity for further disruption.

- Solving Real-World Problems: PropTech isn’t just about cool tech; it’s about solving tangible problems – affordability, sustainability, efficiency, transparency – that impact billions of people globally.

- Cross-Industry Collaboration: Opportunities for PropTech to collaborate with FinTech, ConTech, and Smart City initiatives to create truly integrated solutions.

- ESG Imperative: The growing global focus on Environmental, Social, and Governance (ESG) factors in real estate investing creates a huge demand for PropTech solutions that enable sustainable building, efficient resource management, and social impact.

- Global Scalability: Many PropTech solutions, once proven in one market, have the potential for global scalability, particularly in areas like real estate Australia that often mirror trends in other developed nations.

The Future of Real Estate: A Hyper-Connected, Intelligent Estate

Looking ahead, the future of real estate will be defined by an even deeper integration of technology.

- Hyper-Personalized Experiences: AI will understand individual preferences and predict needs to such an extent that finding real estate for sale or real estate rentals will feel like an entirely bespoke experience, tailored to your lifestyle, financial situation, and even emotional preferences for a home. From Halls Head Real Estate to real estate Cairns, every search will be uniquely optimized.

- Blockchain-Enabled Transactions: The entire transaction process, from initial offer to final transfer of ownership, could be executed via smart contracts on a blockchain, eliminating intermediaries, reducing costs, and ensuring unparalleled transparency and security. This will redefine real Estate Brokerage in some aspects.

- Truly Autonomous Buildings: Buildings that don’t just react to their environment but anticipate needs, optimize resources independently, and perhaps even conduct their own maintenance and repairs using robotics and AI. This will redefine the property manager role significantly.

- Sustainable and Resilient Cities: PropTech will be central to building cities that are not only smart but also environmentally friendly and resilient to climate change, integrating everything from waste management to renewable energy at the Estate level.

- New Investment Paradigms: Continued innovation in real estate investing will introduce entirely new asset classes, more liquid secondary markets for property shares, and highly sophisticated risk management tools.

- The End of the “Property Cycle” as We Know It: With real-time data and predictive analytics, the boom-and-bust cycles that have traditionally characterized real estate news might be smoothed out, leading to more stable and predictable markets.

Live Daily Information: The rapid advancement in quantum computing, while still nascent, holds the promise of unlocking computational power that could dramatically accelerate AI-driven market predictions and complex real estate investing models. Keep an eye on this space in the coming years; it could redefine the “daily” of real estate.

Conclusion: Embrace the Transformation of Real Estate

The real estate industry stands at the precipice of its greatest transformation yet. PropTech is not merely an add-on; it is the fundamental force reshaping how we perceive, interact with, and derive value from property. From the individual homeowner in Swan View navigating an inspection to the global commercial property investor seeking optimal returns in real estate Australia, the impact of these technologies is profound and far-reaching.

The startups spearheading this change are not just building apps; they are constructing the very future of our built environment. They are making real estate for sale more accessible, real estate rent more manageable, and real estate investing more intelligent. For those of us immersed in this world – whether as real estate agents, property managers, developers, or simply fascinated observers – the message is clear: the time to engage with PropTech is now.

The traditional landscape populated by Ray White, Domain real estate, and other established names is evolving, not crumbling. Partnerships, innovation, and an open mind are the keys to thriving in this new era. As real estate news continues to report on new breakthroughs, remember that the true power of PropTech lies in its ability to unlock unprecedented efficiency, transparency, and opportunity. The Estate of tomorrow will be a truly intelligent one.