In recent years, the real estate landscape in Australia has witnessed a significant shift, with Accessory Dwelling Units (ADUs), commonly known as “granny flats,” becoming a hot topic among homeowners, investors, and real estate agents alike. Whether you are exploring real estate for sale in NSW, Melbourne, Brisbane, or Perth, understanding the value and potential of ADUs can transform your property investment strategy.

- What is an ADU? Understanding the Basics

- The Current Market Trends: ADUs in Australia

- Why a Granny Flat is Your Best Investment Yet

- How to Invest in ADUs: A Step-by-Step Guide

- ADUs and the Future of Real Estate Investing in Australia

- Real Estate Agents and ADUs: A Growing Partnership

- Case Studies: Successful ADU Investments Across Australia

- Frequently Asked Questions (FAQs)

- Conclusion: Why Now is the Time to Invest in ADUs

- Sources and Further Reading

This comprehensive guide dives deep into why ADUs are rapidly becoming the best investment option in the current market, supported by live data, expert insights, and practical advice for buyers, sellers, and investors.

What is an ADU? Understanding the Basics

An Accessory Dwelling Unit (ADU) is a secondary housing unit on a single-family residential lot. Often referred to as a “granny flat,” these units are self-contained living spaces that can be attached or detached from the main house. ADUs typically include a bedroom, bathroom, kitchen, and living area, making them fully functional homes.

Why Are ADUs Gaining Popularity?

- Affordable Housing Solution: With rising property prices in cities like Sydney, Melbourne, and Brisbane, ADUs offer a cost-effective way to increase housing density without the need for large-scale developments.

- Additional Income Stream: Homeowners can rent out ADUs, generating steady rental income, which is especially attractive in high-demand rental markets such as real estate Sydney and real estate Brisbane.

- Multigenerational Living: ADUs provide a private space for elderly family members, promoting family cohesion while maintaining independence.

- Increased Property Value: Adding an ADU can significantly boost the value of your property, making it a smart investment in the real estate Australia market.

The Current Market Trends: ADUs in Australia

ADU Popularity in NSW and Victoria

According to recent reports from Domain Real Estate and Ray White Real Estate, the demand for ADUs has surged in real estate NSW and real estate Victoria. Local councils are increasingly relaxing zoning laws to encourage ADU construction, recognizing their role in addressing housing shortages.

- In NSW, the government has introduced streamlined approval processes for ADUs under 60 square meters, making it easier for homeowners to build.

- Victoria has seen a 25% increase in ADU applications in the past year, particularly in Melbourne’s inner suburbs.

Commercial Real Estate and ADUs

While ADUs are primarily residential, their impact on commercial real estate is notable. By increasing residential density, ADUs contribute to vibrant local economies, supporting nearby businesses and commercial properties.

Why a Granny Flat is Your Best Investment Yet

1. High Return on Investment (ROI)

Investing in an ADU can yield an ROI of 8-12%, outperforming many traditional property investments. This is due to:

- Lower construction costs compared to buying new property.

- Ability to generate rental income in high-demand areas like real estate Gold Coast and real estate Cairns.

- Increased overall property value, which is attractive to buyers and investors.

2. Flexibility and Versatility

ADUs can serve multiple purposes:

- Rental property for long-term tenants or short-term holiday rentals.

- Home office or studio space.

- Accommodation for family members, reducing the need for costly aged care facilities.

3. Addressing Housing Shortages

Australia faces a critical housing shortage, especially in urban centers. ADUs provide a practical solution by increasing housing supply without expanding urban sprawl, aligning with sustainable development goals.

How to Invest in ADUs: A Step-by-Step Guide

Step 1: Research Local Regulations

Each state and council has different rules regarding ADU construction. For example:

- Real estate QLD councils have specific size and design requirements.

- Real estate Adelaide has recently updated its zoning laws to encourage ADU development.

Consult with local real estate agents or property managers to understand the legal framework.

Step 2: Assess Your Property’s Suitability

Not all properties are ideal for ADUs. Factors to consider include:

- Lot size and shape.

- Access to utilities.

- Proximity to amenities and transport.

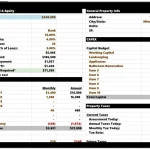

Step 3: Budget and Financing

Typical ADU construction costs range from AUD 100,000 to 250,000, depending on size and finishes. Financing options include:

- Home equity loans.

- Construction loans.

- Government grants or incentives (check with your local council).

Step 4: Hire Professionals

Engage experienced real estate photography experts, architects, and builders who specialize in ADUs. This ensures quality construction and enhances your property’s market appeal.

Step 5: Marketing and Renting

Once completed, list your ADU on popular platforms and work with real estate agents to find reliable tenants. Consider professional property management services to maximize rental income.

ADUs and the Future of Real Estate Investing in Australia

The Role of Technology and Innovation

Smart home technology integration in ADUs is becoming a trend, increasing their appeal to tech-savvy renters and buyers. Features like solar panels, energy-efficient appliances, and smart security systems add value and reduce running costs.

Impact on Real Estate Prices

Studies show that properties with ADUs in markets like Melbourne real estate and Perth real estate command higher prices and sell faster. This trend is expected to continue as demand for flexible living spaces grows.

Environmental Benefits

ADUs promote sustainable living by:

- Reducing urban sprawl.

- Encouraging energy-efficient building practices.

- Supporting local ecosystems through smaller footprints.

Real Estate Agents and ADUs: A Growing Partnership

Top real estate agents such as Ray White and Elders Real Estate are increasingly advising clients on the benefits of ADUs. Their expertise helps buyers and sellers navigate the complexities of ADU investments, ensuring compliance and maximizing returns.

Case Studies: Successful ADU Investments Across Australia

Case Study 1: Sydney Suburb Transformation

A homeowner in real estate Sydney built a 50 sqm granny flat, which they rented out for AUD 450 per week. The ADU increased the property value by AUD 150,000 within 12 months, demonstrating a strong ROI.

Case Study 2: Brisbane Rental Market Boost

In real estate Brisbane, an investor added an ADU to a suburban property, attracting young professionals seeking affordable rentals. The property’s rental yield increased by 30%, outperforming traditional rentals.

Frequently Asked Questions (FAQs)

What is the average cost of building an ADU in Australia?

Costs vary by location and size but typically range from AUD 100,000 to 250,000.

Can I rent out my ADU?

Yes, ADUs are often rented out to generate income, subject to local regulations.

Are there government incentives for building ADUs?

Some states offer grants or streamlined approval processes. Check with your local council.

How long does it take to build an ADU?

Construction usually takes 3-6 months, depending on complexity and approvals.

Conclusion: Why Now is the Time to Invest in ADUs

The rise of ADUs represents a paradigm shift in Australian real estate. With increasing demand for affordable housing, flexible living arrangements, and sustainable development, granny flats are more than just an accessory—they are a smart, lucrative investment.

Whether you are exploring real estate rentals in real estate QLD, looking for commercial real estate Perth, or seeking to enhance your real estate Victoria portfolio, ADUs offer unmatched potential.