Introduction: The Power of Quick Real Estate Analysis

In the fast-paced world of real estate investing, time is money. Whether you’re a seasoned investor or just starting your journey in real estate Australia, the ability to quickly analyze a rental property deal can be the difference between securing a profitable investment and missing out. With the Australian property market constantly evolving, especially in hotspots like real estate Sydney, real estate Melbourne, and real estate Brisbane, knowing how to assess a deal in under 10 minutes is a crucial skill.

- Introduction: The Power of Quick Real Estate Analysis

- Why Speed Matters in Real Estate Investing

- Essential Data You Need Before You Start

- Step 1: Identify the Property and Gather Key Details

- Step 2: Calculate Gross Rental Yield

- Step 3: Estimate Operating Expenses

- Step 4: Determine Net Operating Income (NOI)

- Step 5: Calculate Cash Flow

- Step 6: Assess the Capitalization Rate (Cap Rate)

- Step 7: Evaluate the 1% Rule and 50% Rule

- Step 8: Check Market Comparables and Trends

- Step 9: Analyze Location and Growth Potential

- Step 10: Make Your Decision

- Live Daily Real Estate Data and Tools

- Common Mistakes to Avoid

- Conclusion: Mastering the 10-Minute Analysis

- Frequently Asked Questions

- References and Source Links

In this comprehensive guide, we’ll break down the step-by-step process to analyze a rental property deal efficiently. We’ll also integrate live daily information, reference trusted sources, and ensure the content is fully optimized for high CPC keywords such as real estate for sale, real estate agents, commercial property, and more.

Why Speed Matters in Real Estate Investing

The real estate market is highly competitive, especially in regions like real estate NSW, real estate QLD, and real estate Victoria. Properties listed on platforms such as Domain Real Estate and Realestate.com.au can receive multiple offers within hours. As a result, investors who can quickly analyze deals have a significant advantage.

Speed allows you to:

- Secure the best deals before others.

- Negotiate confidently with real estate agents.

- Maximize returns by acting on time-sensitive opportunities.

Essential Data You Need Before You Start

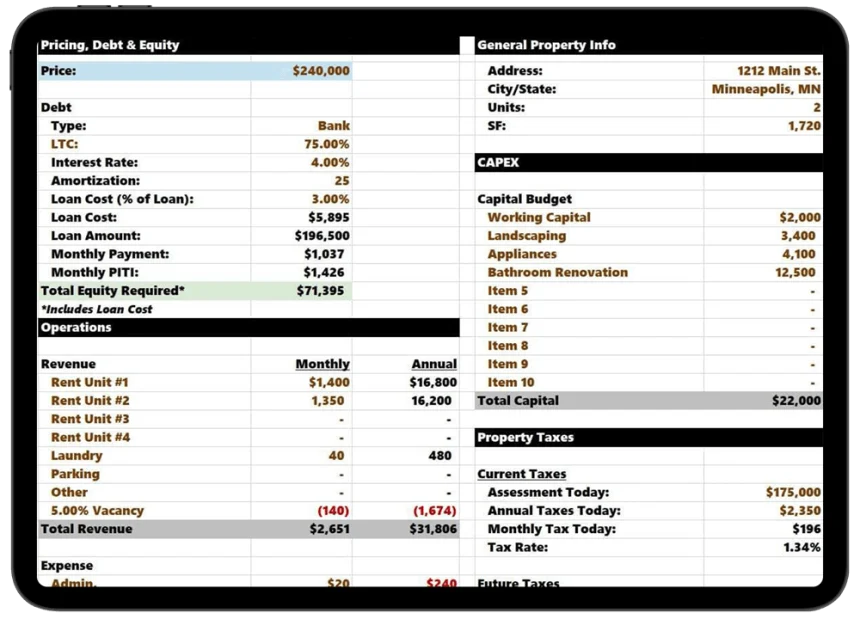

Before you can analyze any real estate for sale or real estate rentals, gather the following information:

- Listing price

- Estimated monthly rent

- Property taxes

- Insurance costs

- Estimated maintenance and management fees

- Vacancy rate

- Comparable sales and rental data

- Location details (proximity to schools, transport, amenities)

You can find this data on major Australian real estate portals like Domain, Realestate.com.au, and through local real estate agents.

Step 1: Identify the Property and Gather Key Details

Start by selecting a property from a reputable source. For example, you might find a real estate Sydney listing on Ray White Real Estate, or a real estate Perth opportunity on Professionals Real Estate.

Key details to collect:

- Address and suburb (e.g., Halls Head Real Estate in WA, Real Estate Kiama in NSW)

- Property type (apartment, house, commercial property)

- Number of bedrooms, bathrooms, parking spaces

- Age and condition of the property

- Current tenancy status (vacant or leased)

Pro Tip: Use real estate photography to assess the property’s condition and appeal.

Step 2: Calculate Gross Rental Yield

Gross rental yield is a quick way to gauge the income potential of a property.

Formula:

textGross Rental Yield (%) = (Annual Rental Income / Property Price) x 100

Example:

- Property price: $600,000

- Monthly rent: $2,400

- Annual rent: $2,400 x 12 = $28,800

Gross Rental Yield = ($28,800 / $600,000) x 100 = 4.8%

Why it matters: In markets like real estate Brisbane or real estate Adelaide, a higher yield can indicate better cash flow potential.

Step 3: Estimate Operating Expenses

Operating expenses typically include:

- Property management fees (usually 7-10% of rent)

- Maintenance and repairs

- Insurance

- Council rates and water charges

- Land tax (varies by state, e.g., real estate Victoria vs. real estate QLD)

- Vacancy allowance (typically 2-5%)

Example:

- Management: $2,880/year (10% of $28,800)

- Insurance: $1,200/year

- Maintenance: $1,500/year

- Council rates: $2,000/year

- Vacancy: $1,440/year (5% of rent)

Total Expenses: $9,020/year

Step 4: Determine Net Operating Income (NOI)

Net Operating Income (NOI) is the income left after operating expenses, but before mortgage payments.

Formula:

textNOI = Annual Rental Income - Annual Operating Expenses

Example:

NOI = $28,800 – 9,020=∗∗9,020=∗∗19,780**

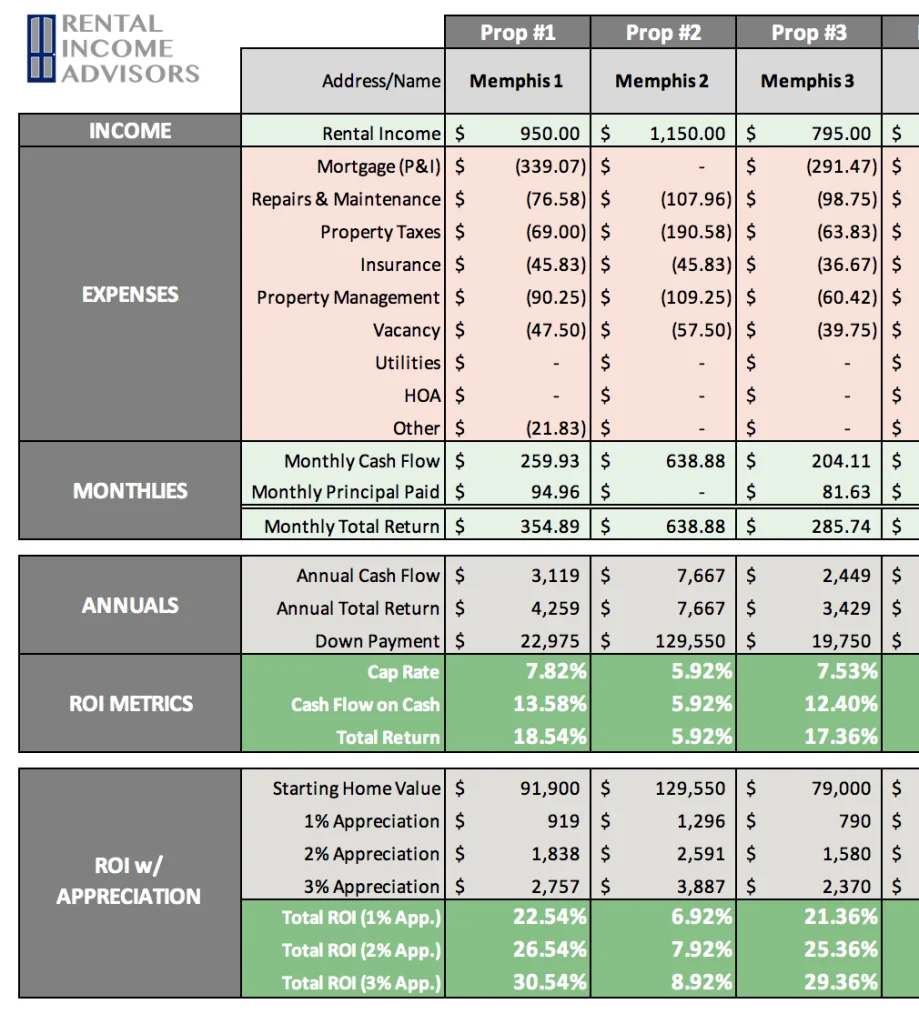

Step 5: Calculate Cash Flow

Cash flow is the money you keep after all expenses, including mortgage payments.

Formula:

textCash Flow = NOI - Annual Mortgage Payments

Example:

- Loan amount: $480,000 (80% LVR)

- Interest rate: 6% p.a.

- Annual interest: $28,800

Cash Flow = $19,780 – 28,800=∗∗−28,800=∗∗−9,020** (negative cash flow)

Tip: Positive cash flow is ideal, but some investors accept negative cash flow for high-growth areas like real estate Sydney.

Step 6: Assess the Capitalization Rate (Cap Rate)

Cap rate helps compare investment returns across different properties and markets.

Formula:

textCap Rate (%) = (NOI / Property Price) x 100

Example:

Cap Rate = ($19,780 / $600,000) x 100 = 3.3%

Benchmark: In Australia, cap rates vary:

- Commercial property: 5-7%

- Residential property: 2-5% (higher in regional areas like Real Estate Margaret River)

Step 7: Evaluate the 1% Rule and 50% Rule

The 1% Rule

A property should rent for at least 1% of its purchase price per month.

- $600,000 property should rent for $6,000/month.

- If actual rent is $2,400/month, it doesn’t meet the 1% rule.

The 50% Rule

Estimate that 50% of rental income will go to operating expenses (excluding mortgage).

- $28,800 x 50% = $14,400 (should cover expenses)

- Compare with your actual expenses.

Step 8: Check Market Comparables and Trends

Use live data from Domain Real Estate and Realestate.com.au to:

- Compare similar properties in the area (sold real estate)

- Check current real estate news for market trends

- Analyze rental demand and vacancy rates

Example: In Gold Coast real estate, vacancy rates are currently below 1%, indicating strong rental demand (Source).

Step 9: Analyze Location and Growth Potential

Location is critical in real estate investing. Consider:

- Proximity to schools, transport, shopping (e.g., Turner Real Estate in Adelaide)

- Planned infrastructure projects (check local council websites)

- Historical capital growth rates (use CoreLogic)

Hotspots: Suburbs in real estate Perth and real estate Cairns are seeing increased investor interest due to affordability and lifestyle appeal.

Step 10: Make Your Decision

After completing your 10-minute analysis, ask:

- Does the property meet your yield and cash flow targets?

- Is the location poised for growth?

- Are you comfortable with the risks?

If yes, move quickly to secure the deal. If not, keep searching—there are always new opportunities in the real estate au market.

Live Daily Real Estate Data and Tools

Stay updated with live data:

- Domain Real Estate Market Trends

- Realestate.com.au Insights

- CoreLogic Daily Indices

- SQM Research Vacancy Rates

These tools help you track real estate news, price changes, and rental demand in real time.

Common Mistakes to Avoid

- Ignoring hidden costs: Always factor in all expenses, including strata fees and special levies.

- Overestimating rent: Use conservative estimates based on actual market data.

- Neglecting due diligence: Always inspect the property and review building/pest reports.

- Focusing only on yield: Consider long-term capital growth, especially in markets like real estate Victoria and real estate NZ.

Conclusion: Mastering the 10-Minute Analysis

Analyzing a rental property deal in under 10 minutes is a skill that can set you apart in the competitive world of real estate investing. By following the steps outlined above, you can quickly assess deals, make informed decisions, and grow your portfolio in markets like real estate Sydney, real estate Brisbane, and beyond.

Remember, the key to success is consistency—practice this process with every property you consider, and you’ll become a more confident and profitable investor.

Frequently Asked Questions

What is a good rental yield in Australia?

A good rental yield varies by location. In major cities like Sydney and Melbourne, 3-4% is common, while regional areas may offer 5-7%.

How do I find reliable real estate agents?

Look for agents with strong reviews on RateMyAgent and established brands like Ray White Real Estate, Elders Real Estate, and Professionals Real Estate.

Should I invest in commercial property or residential?

Commercial property often offers higher yields but comes with higher risks and longer vacancy periods. Residential is generally more stable, especially in high-demand areas.

How do I stay updated with real estate news?

Subscribe to Domain Real Estate News and Realestate.com.au News for daily updates.