Introduction: Beyond the Obvious – Unearthing Real Estate Value

Welcome, astute investors, to a paradigm shift in real estate investing. The conventional wisdom often steers us towards the established behemoths – the Sydneys, Melbournes, and Brisbanes – where competition is fierce, entry barriers are high, and capital growth can be a slow, arduous climb. But what if I told you the true fortunes in the next five years won’t be made in these familiar territories, but in the often-overlooked, the quietly burgeoning, and the strategically positioned regional powerhouses?

- Introduction: Beyond the Obvious – Unearthing Real Estate Value

- The Methodology: How We Identify the Next Real Estate Powerhouses

- City 1: Bendigo, Victoria – The Golden Heart of Regional Investment

- City 2: Townsville, Queensland – The Tropical North’s Economic Engine

- City 3: Launceston, Tasmania – The Island State’s Emerging Powerhouse

- City 4: Sunshine Coast, Queensland – Beyond the Beachfront Boom

- City 5: Mandurah/Peel Region, Western Australia – Perth’s Southern Growth Corridor

- The Broader Australian Real Estate Landscape: Trends to Watch

- Strategic Investment Principles for the Savvy Real Estate Investor

- Beyond the Hype: A Word on Risks and Mitigation

- Your Next Steps: Turning Insight into Action

- Conclusion: The Future is in the Underrated

As a seasoned observer of the real estate australia landscape, I’ve witnessed countless cycles, market corrections, and the exhilarating rise of new investment hotbeds. The current economic climate, characterised by evolving work patterns, infrastructure spending, and a renewed focus on regional development, presents a unique opportunity. This isn’t just about buying real estate for sale; it’s about strategic foresight, understanding the underlying economic currents, and positioning your portfolio for exponential growth.

The goal isn’t merely real estate rent or marginal capital appreciation. We’re talking about identifying markets on the cusp of significant transformation, places where the confluence of economic drivers, population shifts, and governmental support creates an environment ripe for substantial real estate investing.

Forget the crowded auction rooms and the bidding wars of the capital cities. Our focus today is on uncovering the hidden gems, the real estate commercial opportunities, and the residential pockets that are set to deliver outsized returns.

We’re looking for the next wave, the markets where your dollar stretches further, and the potential for wealth creation is not just a dream, but a tangible, data-backed reality. This deep dive will not only reveal these cities but arm you with the insights to navigate these markets, identify prime opportunities, and truly excel in the dynamic world of real estate investing.

The national narrative in real estate news often sensationalises the ups and downs of the major capitals, but a richer, more nuanced story is unfolding in regional centres. As the cost of living continues to pressure residents in major cities, a diaspora is occurring, leading to significant demographic shifts. These shifts are not random; they are driven by affordability, lifestyle aspirations, and increasingly, by decentralised employment opportunities. Smart investors understand that where people go, property values follow. This is the bedrock of our strategy: identifying where people are moving to, not just where they’ve always been.

The Australian property market, while resilient, is undergoing a transformation. Interest rates, inflation, and global economic headwinds mean that casual Estate speculation is no longer sufficient. Informed decisions are paramount. This is where a deep understanding of local economic drivers, infrastructure pipelines, and demographic trends becomes your most powerful asset. We’re not just looking for real estate for sale; we’re looking for the future economic engines of Australia, and how to position ourselves to benefit from their inevitable ascent.

The Methodology: How We Identify the Next Real Estate Powerhouses

Identifying truly underrated cities requires a rigorous, multi-faceted approach, moving beyond surface-level observations and diving deep into quantifiable metrics. Our methodology is built on a foundation of economic indicators, demographic analysis, and forward-looking projections, ensuring that each recommendation is robust and data-driven. We’re not just chasing a hunch; we’re leveraging comprehensive research to uncover the next generation of real estate investing hotspots.

Here are the key pillars of our assessment:

- Economic Diversification and Growth:

- Beyond Mining and Agriculture: While traditional industries are important, we seek cities with diversifying economies, especially those pivoting towards knowledge-based industries, advanced manufacturing, logistics, healthcare, education, and renewable energy. A diverse economy mitigates risk and ensures sustainable job creation.

- GDP Growth Projections: Cities with consistently strong or projected GDP growth are vital. We look for local government and private sector investment that signals long-term confidence.

- Employment Rates: Low unemployment and high job growth indicate a robust local economy capable of sustaining population influx and strong rental demand. This directly impacts real estate rent stability and growth.

- Population Growth and Demographics:

- Interstate and Intrastate Migration: The primary driver of property demand. We pinpoint cities experiencing significant net migration, particularly from capital cities seeking affordability and lifestyle.

- Age Demographics: A healthy mix of young professionals, families, and retirees indicates a vibrant community. Growth in the 25-45 age bracket is particularly crucial for both residential demand and local economic output.

- Household Formation Rates: Understanding the rate at which new households are forming helps project future housing needs and the demand for real estate rentals.

- Infrastructure Investment:

- Governmental & Private Spending: Significant government funding into transport links (roads, rail, airports), hospitals, universities, and commercial precincts acts as a powerful catalyst for growth. Private investment in major developments (e.g., shopping centres, industrial parks, commercial property) is also a strong indicator.

- Future-Proofing: Investment in digital infrastructure (e.g., NBN expansion, 5G networks) and renewable energy projects can attract tech-savvy residents and businesses.

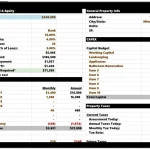

- Affordability & Rental Yields:

- Median House Price-to-Income Ratio: We look for cities where housing is still relatively affordable compared to local incomes, providing room for capital growth. This is a critical factor for first-home buyers and investors alike.

- Strong Rental Yields: A healthy rental yield (the annual return on investment from rent) indicates strong tenant demand and a robust rental property market, making the investment attractive from a cash flow perspective. This is where a good property manager becomes invaluable.

- Vacancy Rates: Low vacancy rates signal high demand and allow for consistent rental income and potential for rent increases.

- Lifestyle & Liveability:

- Amenities: Access to quality education, healthcare, cultural attractions, natural landscapes, and recreational facilities enhances a city’s appeal, attracting and retaining residents.

- Community Vibe: While subjective, a strong sense of community and a welcoming environment are increasingly important for liveability, impacting long-term residency.

- Government Policy & Local Initiatives:

- Regional Development Plans: Local and state government initiatives to decentralise services, offer incentives for businesses, or invest in regional development can be powerful growth drivers.

- Zoning & Planning: Understanding local planning schemes can reveal future development opportunities, including those for commercial real estate or mixed-use projects.

The 5-Year Outlook: Our assessment isn’t just about current stats; it’s about projection. We leverage expert analysis from economic forecasters, property analysts, and demographers to anticipate trends over the next five years. This includes an understanding of how national policies (e.g., immigration targets, infrastructure budgets) will likely impact regional areas. We also consider the ripple effect of major capital cities becoming increasingly unaffordable, pushing people and businesses towards more regional hubs.

By applying this rigorous framework, we filter out speculative bets and focus on cities with fundamental strengths and clear growth trajectories. This is how we pinpoint the markets where real estate investing offers genuine, sustainable potential for significant returns. Now, let’s unveil these five underrated powerhouses.

City 1: Bendigo, Victoria – The Golden Heart of Regional Investment

Why Bendigo is Poised for Growth

Bendigo, once a gold rush city, is now experiencing a modern-day economic boom, solidifying its position as a major regional centre in real estate victoria. Its strategic location, approximately 150 km north-west of melbourne real estate, offers the perfect blend of regional lifestyle with excellent connectivity to a major capital. The city’s economic resilience is a key factor, moving far beyond its mining heritage to embrace diverse sectors like healthcare, education, advanced manufacturing, and professional services.

The Bendigo Health project, a multi-stage redevelopment culminating in a state-of-the-art hospital, has been a significant economic driver, creating thousands of jobs and attracting a highly skilled workforce. This anchors the city as a major healthcare hub for northern Victoria. Coupled with La Trobe University’s Bendigo campus, which draws both domestic and international students, the city benefits from a continuous influx of young professionals and a vibrant academic community, contributing to strong real estate rent demand.

Infrastructure investment is robust. The ongoing Regional Rail Revival program is significantly improving train services between Bendigo and Melbourne, making commuting more feasible and enhancing the city’s appeal to those seeking affordability without sacrificing capital city access. Road network upgrades further bolster its logistical importance. Bendigo’s commitment to renewable energy projects also positions it for future economic expansion and attracts environmentally conscious businesses and residents. Data from the Australian Bureau of Statistics consistently shows positive net migration into Bendigo, particularly from Melbourne residents seeking a better work-life balance and more affordable housing options than melbourne real estate offers. This demographic shift is critical for sustainable property growth.

Real Estate Investment Opportunities in Bendigo

Bendigo offers a broad spectrum of real estate investing opportunities:

- Residential Properties: The housing market benefits from relative affordability compared to Melbourne. Opportunities exist in:

- Established Suburbs: Look for well-located family homes close to schools and amenities. Areas like Strathdale, Kennington, and Flora Hill are popular, often seeing strong sold real estate results.

- New Developments: Expanding fringe suburbs like Marong and Epsom offer new housing estates, attracting first-home buyers and families. This is a fertile ground for developers and investors alike.

- Student Accommodation: With La Trobe University and other educational institutions, purpose-built student accommodation or multi-room rentals are excellent options, often yielding attractive real estate rent.

- Commercial Real Estate: Bendigo’s growing economy supports robust commercial property demand:

- Healthcare Precincts: Proximity to Bendigo Health creates demand for medical offices, allied health services, and specialist clinics.

- Retail & Hospitality: The revitalised CBD and growing population support new retail ventures and a thriving hospitality scene. Investing in strategically located retail spaces or hospitality venues can be highly lucrative.

- Industrial & Logistics: With improved transport links, industrial estates on the city’s outskirts are attracting businesses, making commercial real estate in these zones an excellent long-term play.

- Rental Market Potential: Bendigo consistently exhibits low vacancy rates and strong rental growth, indicating a healthy demand for real estate rentals. A skilled property manager is essential to maximise returns and minimise headaches in this market. The demand extends across all property types, from apartments for singles and students to larger homes for families.

Navigating the Bendigo Market: Key Considerations

Successfully navigating the Bendigo market requires local expertise. Engaging with experienced real estate agents in Bendigo is crucial. They possess invaluable insights into specific suburb performance, local development plans, and emerging trends. Firms like ray white real estate or elders real estate with a strong regional presence can be excellent starting points.

- Due Diligence: Always conduct thorough inspection on any property. Understand local zoning regulations and future development plans for the immediate area.

- Economic Outlook: Keep an eye on regional economic updates and infrastructure project announcements. The momentum from current projects is strong, but sustained growth relies on continued investment.

- Demographic Shifts: Monitor migration patterns and age demographics. A growing younger population often signifies a dynamic rental market.

- Affordability: While still affordable, prices are rising. Early entry into promising growth corridors can yield significant capital appreciation.

- Market Research: Don’t just follow the crowd. Look for areas with specific drivers, such as new schools, medical facilities, or business parks, which will underpin future demand for real estate for sale.

Bendigo is more than just a regional town; it’s a strategically significant hub poised for substantial real estate investing growth. Its diversified economy, strong population influx, and continuous infrastructure investment paint a clear picture of an underrated city ready to shine.

City 2: Townsville, Queensland – The Tropical North’s Economic Engine

Why Townsville is Poised for Growth

Townsville, North Queensland’s unofficial capital, is emerging as a dynamic hub for real estate investing, offering a compelling alternative to the often-overheated brisbane real estate and gold coast real estate markets. Its strategic location as a port city, coupled with a diverse economy, positions it for significant growth over the next five years. The city serves as a critical economic gateway to Northern Australia, facilitating trade, defence, and a burgeoning tourism sector.

A major driver of Townsville’s growth is its robust defence presence, home to the largest army base in Australia (Lavarack Barracks) and a significant air force base. This provides a stable, high-income employment base and consistent demand for real estate rentals. Beyond defence, the city is a powerhouse in resources, agriculture, education (James Cook University is a major research institution), and healthcare, boasting world-class medical facilities.

Crucially, major infrastructure projects are transforming Townsville. The Port of Townsville Channel Upgrade is a multi-billion-dollar project set to dramatically increase the port’s capacity, enhancing its role as an export gateway and creating long-term jobs in logistics and trade. The Hells Gates Dam project, a proposed major water infrastructure development, if realised, would unlock vast agricultural potential in the region, leading to significant economic activity. Furthermore, Townsville’s role in supporting Queensland’s renewable energy ambitions, with several large-scale solar and wind farms in the region, is attracting investment and skilled labour. The city’s focus on “future-proofing” its economy through projects like the Townsville City Deal (a collaboration between federal, state, and local governments) underscores its commitment to sustainable growth. This kind of concentrated, government-backed development makes it an attractive proposition for real estate investing.

Real Estate Investment Opportunities in Townsville

Townsville’s diverse economy translates into varied real estate for sale opportunities:

- Residential Properties: The market offers attractive entry points and strong rental yields compared to southern capitals.

- Defence Housing: Proximity to Lavarack Barracks ensures a consistent demand for housing. Suburbs like Douglas, Idalia, and Annandale are popular with defence families.

- Student Accommodation: James Cook University drives demand for student housing. Investing in properties near the university campus can offer strong real estate rent.

- Waterfront & Lifestyle Living: Suburbs like North Ward and Pallarenda offer desirable coastal living, appealing to a growing number of lifestyle buyers and providing opportunities for capital growth.

- Affordable Family Homes: Outlying suburbs like Kirwan and Rasmussen offer more affordable family homes, appealing to first-home buyers and families relocating for work.

- Commercial Real Estate: Townsville’s role as a regional capital means significant demand for commercial property:

- Industrial & Logistics: The expanding port and regional export focus drive demand for industrial warehouses, logistics centres, and storage facilities. Opportunities exist in areas like Garbutt and Bohle.

- Healthcare & Education Precincts: Near the university and hospital, there’s a need for medical suites, specialist offices, and educational facilities.

- Retail & Hospitality: A growing population and a revitalised CBD support a diverse retail and hospitality sector. Investing in retail strips or hospitality venues in key areas can be lucrative. The city also benefits from significant tourism, creating demand for hotels and serviced apartments.

- Rental Market Potential: Townsville’s rental market is robust, characterised by low vacancy rates and strong rental growth, making real estate rentals a sound investment. The transient nature of defence personnel and students ensures a consistent turnover of tenants, which a proactive property manager can effectively leverage.

Navigating the Townsville Market: Key Considerations

Success in Townsville requires understanding its unique market dynamics and local specifics. Consulting experienced real estate agents who specialise in real estate qld, particularly the Northern Queensland region, is vital. Professionals real estate or ray white franchises in the area will have in-depth market knowledge.

- Economic Diversification: While defence is a constant, monitor the growth of other sectors like renewable energy and agriculture for broader economic resilience.

- Infrastructure Impact: Stay abreast of progress on major projects like the port expansion and potential dam developments. These will have significant ripple effects on demand for real estate for sale.

- Cyclical Nature: Resource-driven economies can sometimes experience cycles. However, Townsville’s increasing diversification mitigates some of this risk.

- Climate Considerations: Be aware of the tropical climate, including cyclone season. Insurance costs and building standards are important factors for property inspection and ownership.

- Local Policy: Understand local council planning and development policies, which can influence future growth and investment opportunities for commercial real estate.

Townsville represents an exciting frontier for real estate investing, offering a potent mix of economic stability, substantial infrastructure investment, and a growing population. It is an underrated city poised for significant capital appreciation and strong rental returns in the coming years.

City 3: Launceston, Tasmania – The Island State’s Emerging Powerhouse

Why Launceston is Poised for Growth

Launceston, Tasmania’s second-largest city, is quietly transforming into a regional economic powerhouse and a highly attractive destination for real estate investing. Often overshadowed by melbourne real estate or sydney real estate, this charming city in the heart of northern Tasmania offers a compelling mix of lifestyle, economic resilience, and strategic growth drivers. Its isolation, once perceived as a drawback, is now a key asset, providing a unique sense of community, affordability, and a highly desirable quality of life.

The city’s economy is undergoing significant diversification. While agriculture and forestry remain pillars, Launceston is rapidly expanding into advanced manufacturing, defence support, education, and particularly, a booming tourism sector. The University of Tasmania’s Northern Transformation Project, a multi-million-dollar investment, is relocating a significant portion of its campus into the city centre. This massive development is a game-changer, bringing thousands of students and staff into the CBD, revitalising the urban core, and creating a ripple effect across retail, hospitality, and residential real estate for sale.

Infrastructure spending is also key. Significant upgrades to the Launceston Airport are enhancing connectivity, making the city more accessible for both tourists and business travellers. Road infrastructure improvements are further connecting Launceston to the broader regional economy. The city’s burgeoning food and wine industry, coupled with its natural beauty (the Tamar Valley is on its doorstep), is attracting a growing number of visitors and permanent residents seeking a lifestyle change. This surge in lifestyle migration, often from mainland capitals, is a consistent trend reflected in real estate news about Tasmania, driving demand and upward pressure on property values.

Real Estate Investment Opportunities in Launceston

Launceston presents a unique blend of historical charm and modern development, offering diverse real estate investing avenues:

- Residential Properties: Affordability is a major draw, offering excellent value compared to mainland cities.

- Inner-City & Fringe Suburbs: The University transformation is breathing new life into the CBD and surrounding suburbs like Mowbray and Newnham, creating demand for student accommodation and inner-city living. These areas are ripe for refurbishment and development.

- Family Homes: Established suburbs like Prospect, Kings Meadows, and Norwood offer well-maintained family homes that appeal to owner-occupiers and provide stable real estate rent returns.

- Lifestyle Properties: Areas along the Tamar River or on the city’s outskirts offer larger blocks and lifestyle appeal, attracting those seeking a tree-change or sea-change.

- Commercial Real Estate: The university project is a catalyst for commercial property growth in the CBD:

- Education & Office Space: Demand for modern office space, co-working facilities, and commercial premises catering to the university’s needs is set to surge.

- Retail & Hospitality: The influx of students and tourists is driving demand for cafes, restaurants, bars, and boutique retail. Investing in strategically located retail premises, especially within the revitalised CBD, holds significant potential.

- Industrial: As a regional hub, Launceston supports industrial activity. Investing in light industrial parks or logistics facilities on the city’s periphery can provide stable returns.

- Rental Market Potential: Launceston consistently experiences some of the lowest vacancy rates in Australia, signifying incredibly strong demand for real estate rentals. The University expansion will further tighten this market, allowing for substantial real estate rent growth. A proactive property manager is crucial for securing and retaining quality tenants.

Navigating the Launceston Market: Key Considerations

Investing in Launceston requires a nuanced understanding of its specific market drivers. Local real estate agents are indispensable, as they can provide insights into micro-markets, heritage overlays, and local planning policies. Firms like turner real estate or ray white with a strong local presence would be excellent contacts.

- University Impact: Closely monitor the progress and full implementation of the University of Tasmania’s Northern Transformation Project. Its completion will unlock significant demand.

- Tourism Trends: Tasmania’s tourism industry is booming. Consider properties that could appeal to both long-term renters and short-term holidaymakers (subject to local regulations).

- Infrastructure Connectivity: Keep an eye on ongoing airport and road upgrades, as improved connectivity will further enhance the city’s appeal.

- Heritage Overlays: Many parts of Launceston have significant heritage value. Understand any heritage overlays that might impact renovations or development.

- Demographic Shift: The influx of mainlanders seeking lifestyle and affordability is a strong, sustained trend, underpinning property demand.

Launceston offers a rare combination of affordability, lifestyle, and significant future growth drivers. For the discerning investor, it represents a golden opportunity for real estate investing in a market that is still largely underrated but rapidly gaining momentum.

City 4: Sunshine Coast, Queensland – Beyond the Beachfront Boom

Why the Sunshine Coast is Poised for Growth

While parts of the Sunshine Coast might seem “rated” due to its stunning beaches and tourism appeal, the region as a whole, extending beyond the immediate coastal strip, is a significantly underrated real estate investing destination, particularly when considering its economic diversification and infrastructure. Far from being just a holiday playground, the Sunshine Coast is rapidly transforming into a major economic hub in real estate qld, boasting impressive population growth, substantial government and private investment, and a deliberate strategy to create a sustainable, high-value economy. It offers a distinct alternative to the traditional gold coast real estate and brisbane real estate markets.

The region’s economic drivers extend far beyond tourism. The Sunshine Coast University Hospital (SCUH) at Kawana, a state-of-the-art facility, has anchored a burgeoning health and medical precinct, creating thousands of jobs and attracting highly skilled professionals. This has spurred significant commercial real estate development and residential demand. Furthermore, the Sunshine Coast Airport expansion (now an international airport) is dramatically improving connectivity, opening up new markets for tourism and business. The Maroochydore City Centre development, a greenfield project designed as a new CBD, is poised to become a smart city showcasing cutting-edge technology and creating a wealth of commercial property and employment opportunities. This deliberate economic diversification into health, education, technology, and advanced manufacturing differentiates it from purely tourism-dependent regions. Migration patterns consistently show strong net migration into the Sunshine Coast, with many residents relocating from sydney real estate and melbourne real estate for lifestyle, career opportunities, and relative affordability.

Real Estate Investment Opportunities on the Sunshine Coast

The Sunshine Coast’s diverse growth engines translate into a wide array of real estate for sale opportunities:

- Residential Properties: High demand ensures strong capital growth and rental returns.

- Health & Education Precincts: Areas around Kawana (for SCUH) and Sippy Downs (for the University of the Sunshine Coast) are high-demand zones for both rental and owner-occupier properties, driven by professionals and students.

- Master-Planned Communities: New communities like Aura and Harmony offer modern housing, appealing to families and providing excellent long-term growth potential.

- Established Lifestyle Suburbs: Suburbs like Buderim, Mooloolaba, and Caloundra continue to be popular, offering a mix of housing types and strong tenant demand for real estate rentals. These areas also attract retirees and downsizers.

- Commercial Real Estate: The region’s economic transformation is fueling massive commercial property demand:

- Maroochydore City Centre: This new CBD offers unparalleled opportunities for office space, retail, and mixed-use developments, poised for significant capital appreciation. This is a prime location for forward-thinking commercial real estate investors.

- Health & Medical Precincts: Proximity to SCUH creates strong demand for medical suites, specialist clinics, and allied health services.

- Industrial & Logistics: With improved airport and road infrastructure, industrial parks in areas like Kunda Park and Bells Creek are attracting businesses, making industrial real estate investing highly attractive.

- Rental Market Potential: The Sunshine Coast consistently records extremely low vacancy rates, indicating robust demand for real estate rentals. Strong population growth and a diverse employment base ensure a constant pool of tenants, driving strong real estate rent growth. A professional property manager is indispensable in this active market.

Navigating the Sunshine Coast Market: Key Considerations

Investing on the Sunshine Coast requires a strategic approach, distinguishing between the high-profile tourist areas and the underlying economic growth zones. Collaborating with local real estate agents with deep insights into the region’s specific sub-markets is critical. Firms like ray white real estate or elders real estate with a strong presence in the region will be invaluable partners.

- Diversification Focus: Prioritise investments in areas supported by the health, education, technology, or new CBD developments, rather than solely tourism-dependent locations.

- Infrastructure Impact: Stay updated on the progress of the Maroochydore City Centre, airport expansion, and new road networks. These projects are transformative.

- Population Growth: The Sunshine Coast’s population is projected to continue its rapid growth. This consistent demand underpins long-term real estate investing success.

- Sustainability: The region has a strong focus on environmental sustainability, which can influence planning and development.

- Due Diligence: Perform thorough inspection and research into local council planning schemes, especially around new growth corridors. Understanding zoning for commercial property is also vital.

The Sunshine Coast is more than just beautiful beaches; it’s a dynamic economic region with sophisticated growth strategies. For the discerning investor, it offers a wealth of real estate investing opportunities that extend far beyond its reputation, promising significant returns over the next five years.

City 5: Mandurah/Peel Region, Western Australia – Perth’s Southern Growth Corridor

Why Mandurah/Peel is Poised for Growth

Mandurah, the principal city of the Peel Region, located approximately 72 km south of perth real estate, is emerging as a compelling, yet still underrated, destination for real estate investing. While perth real estate continues its upward trajectory, the Peel Region offers significant affordability, lifestyle benefits, and robust economic drivers that position it for substantial growth over the next five years. It presents an attractive alternative for those priced out of commercial real estate perth or seeking higher rental yields.

The Peel Region’s economy is surprisingly diverse, moving beyond its traditional reliance on mining and agriculture to embrace tourism, healthcare, education, and logistics. A significant driver for future growth is the transformative “Transforming Peel” strategy, a long-term plan backed by state and federal governments designed to diversify the regional economy, create jobs, and attract investment. This includes developing a major port at Kwinana (just north of Peel), which will increase logistical importance, and significant investment in agricultural processing, aquaculture, and tourism infrastructure.

The region also benefits from critical infrastructure. The Mandurah train line provides a fast, direct commute to Perth CBD, making it an increasingly viable option for those working in the capital but seeking a more affordable and relaxed lifestyle. This connectivity is a powerful driver of population growth. Furthermore, the Peel region is strategically positioned to support the resource sector, with major mining and energy projects in the broader Western Australian context providing employment for many residents. The focus on developing new industries like hydrogen and renewable energy further enhances its long-term economic prospects, attracting a skilled workforce and driving demand for real estate for sale. The suburb of Halls Head Real Estate within Mandurah, for example, is already seeing renewed interest due to these growth drivers.

Real Estate Investment Opportunities in Mandurah/Peel

The Mandurah/Peel region offers a range of real estate investing opportunities catering to different investor profiles:

- Residential Properties: Strong affordability and lifestyle factors drive demand.

- Coastal Living: Mandurah itself, with its canals, foreshore, and beaches, offers attractive coastal living options, from apartments to family homes. Areas like Halls Head Real Estate and Falcon are highly sought after.

- Commuter Suburbs: Suburbs with good access to the train line or major arterial roads, such as Greenfields and Coodanup, are appealing to those working in Perth but seeking better value. These areas often provide strong real estate rent returns.

- Master-Planned Communities: New developments like Lakelands and Meadow Springs are attracting families and first-home buyers with modern housing and amenities.

- Retirement Living: The lifestyle appeal of Mandurah makes it a popular choice for retirees, creating demand for over-55s communities and smaller, low-maintenance properties.

- Commercial Real Estate: The “Transforming Peel” strategy and growing population underpin commercial property demand:

- Retail & Hospitality: A growing resident and tourist population supports a thriving retail sector and expanding hospitality offerings along the foreshore and in major shopping precincts.

- Industrial & Logistics: With its strategic location and planned port developments, the region is ripe for industrial and logistics investments, particularly in areas like Greenfields and developing industrial estates.

- Healthcare & Education: Demand for medical suites, allied health services, and educational facilities will grow with the population.

- Rental Market Potential: Mandurah and the broader Peel Region have experienced tightening rental markets and strong real estate rent growth, reflecting increasing demand from both lifestyle migrants and commuters. Low vacancy rates make real estate rentals an attractive proposition. An efficient property manager is essential for securing good tenants and optimising returns.

Navigating the Mandurah/Peel Market: Key Considerations

Successful real estate investing in the Peel Region requires a focus on its distinct growth drivers and local market conditions. Partnering with experienced real estate agents who specialise in real estate perth and the southern corridors, such as professionals real estate or ray white real estate with a local branch, is paramount.

- “Transforming Peel” Strategy: Closely monitor the progress and outcomes of this strategy. It will be the primary catalyst for long-term economic and population growth.

- Infrastructure Connectivity: The train line and road networks are crucial. Invest in areas that benefit from seamless connectivity to Perth and regional centres.

- Employment Growth: Keep an eye on job creation in emerging sectors like aquaculture, advanced manufacturing, and renewable energy, as these will drive future housing demand.

- Lifestyle Migration: Understand the demographics of those relocating to the region – often families and retirees seeking affordability and quality of life.

- Due Diligence: Conduct thorough inspection and research local council plans for new developments or zoning changes, particularly for commercial property. Even areas like Swan View or real estate margaret river in broader WA can offer insights into regional market trends.

The Mandurah/Peel Region is on the cusp of a significant growth phase, driven by strategic governmental planning, infrastructure investment, and its appealing lifestyle. For investors seeking strong capital appreciation and rental returns outside the immediate perth real estate bubble, it represents a genuinely underrated opportunity for real estate investing.

The Broader Australian Real Estate Landscape: Trends to Watch

While our focus has been on these five underrated cities, it’s crucial to contextualise them within the broader real estate australia market. The national landscape provides both opportunities and challenges that every astute real estate investing enthusiast must understand.

National Economic Outlook: As of early 2024, Australia’s economy demonstrates resilience, though with ongoing inflationary pressures and a watchful RBA. Interest rates remain a key factor, directly influencing borrowing capacity and investor sentiment. While there have been hikes, the expectation is for stability or potential easing in the medium term, which could further stimulate real estate for sale markets. Global factors, including commodity prices and geopolitical stability, also play a role, particularly for resource-rich states like real estate qld and real estate wa.

Migration Patterns: Australia’s strong net overseas migration is a foundational pillar of property demand. With record numbers of new arrivals, housing supply in major capital cities like sydney real estate and melbourne real estate is under immense pressure. This “overflow” effect increasingly benefits regional centres, as new migrants and internal movers seek more affordable living and growing job opportunities. This trend will continue to fuel demand in our identified underrated cities.

Interest Rates and Inflation: The cost of borrowing impacts both owner-occupier and investor activity. Higher interest rates can dampen buyer enthusiasm in the short term, but also create opportunities for cash-rich investors or those with strong serviceability. Inflation, while a concern, can also push up construction costs, leading to higher new build prices and underpinning the value of existing Estate properties. Keep a close eye on the RBA’s quarterly statements and real estate news for the latest economic forecasts.

Housing Supply Shortage: A critical national issue, the chronic undersupply of housing across Australia is not just a capital city problem. It means that any city experiencing population growth, even modest, will likely see upward pressure on property values and real estate rent. Government initiatives aimed at boosting housing supply are slow to materialise, further cementing the favourable supply-demand dynamics for investors.

Government Policy & Regional Focus: Both federal and state governments are increasingly focused on regional development, investing in infrastructure, decentralising services, and offering incentives for businesses and residents to move beyond the major capitals. Programs like regional grants, stamp duty concessions for first-home buyers in regional areas, and major infrastructure projects (e.g., in real estate nsw, real estate victoria, real estate qld) directly benefit our selected underrated cities. This sustained governmental commitment provides a robust framework for regional real estate investing.

Commercial Property Resilience: While residential often grabs headlines, commercial property remains a bedrock for many serious investors. The shift to flexible work has redefined office space, but industrial, logistics, and specialised commercial sectors (healthcare, education) are thriving, especially in growth-oriented regional hubs. The demand for industrial real estate commercial near ports, transport links, and renewable energy projects is particularly strong. Investors should look at these sectors for diverse returns.

Technological Advancements: The rise of remote work capabilities, improved digital infrastructure (Commerce platforms, high-speed internet), and smart city initiatives mean that geographical location is less of a barrier for businesses and skilled professionals. This further empowers regional centres, making them attractive for relocation without sacrificing career opportunities. The growth of proptech also makes real estate investing more accessible and data-driven, helping investors make informed decisions.

By keeping these broader national trends in mind, investors can better understand the tailwinds supporting the growth of our five underrated cities and make more informed, resilient real estate investing decisions.

Strategic Investment Principles for the Savvy Real Estate Investor

Identifying underrated cities is the first step; the next is applying strategic real estate investing principles to maximise your returns and mitigate risks. Whether you’re a seasoned player in real estate commercial or a newcomer to the Estate market, these guidelines will serve you well.

- Diversification is Key: Don’t put all your eggs in one basket. While focusing on one city might seem appealing, spreading your investments across different property types (residential, commercial property, industrial) and even across a few of these promising regional cities can cushion you against localised downturns. This also applies to different investment strategies: some properties for capital appreciation, others for strong real estate rent yield.

- Long-Term Vision with Short-Term Agility: Real estate is generally a long-term game. Aim for holding periods of 5-10 years to truly benefit from market cycles and compounding growth. However, be agile enough to capitalise on unexpected opportunities or pivot if market conditions significantly change. Keep an eye on real estate news for early indicators.

- Thorough Due Diligence (The Inspection Imperative): Never skip this step. Before any purchase, conduct exhaustive research:

- Property-Specific: Get a building and pest inspection. Understand maintenance history, potential repair costs, and structural integrity.

- Local Market: Research recent sold real estate prices, vacancy rates, and rental yields in the specific suburb. Understand local council zoning, future development plans, and any heritage overlays.

- Financials: Accurately calculate all costs – purchase price, stamp duty, legal fees, ongoing rates, insurance, property manager fees, and potential repair budgets.

- Economic Drivers: Revisit the economic fundamentals of the city. Are the growth drivers still strong? Are there new threats or opportunities?

- Partner with Local Experts: This cannot be overstated for regional markets. Engage with reputable, local real estate agents who have their finger on the pulse of the market. They often have insights into off-market deals, upcoming developments, and local nuances that national data might miss. Also, a good local property manager is invaluable for optimising real estate rentals, handling tenant issues, and ensuring your investment performs.

- Consider specific firms: Whether it’s ray white real estate, elders real estate, professionals real estate, or more boutique local agencies like turner real estate, kevin hicks real estate, or holdsworth real estate – their local expertise is golden.

- Understand Cash Flow vs. Capital Growth: Decide your primary investment objective. Some properties offer higher rental yields (good for cash flow), while others are poised for stronger capital appreciation (good for wealth building). The ideal investment often balances both. In our underrated cities, many properties offer the potential for both, which is a significant advantage over overheated capital city markets.

- Leverage, But Wisely: Utilising borrowed funds (leverage) can amplify returns, but it also increases risk. Ensure your financial position is robust enough to handle potential interest rate increases or periods of vacancy. Seek advice from financial advisors and mortgage brokers.

- Stay Informed: The real estate market is dynamic. Regularly consume real estate news, economic reports, and local council announcements. Follow trends in population shifts, infrastructure spending, and industry growth. Knowledge is power in real estate investing. Even broader trends from real estate nz can sometimes offer comparative insights into regional growth.

- Networking: Connect with other investors, developers, and local business owners. Their insights and experiences can provide valuable perspectives and uncover opportunities.

By integrating these principles into your real estate investing strategy, you’ll be well-equipped to capitalise on the exciting opportunities presented by these underrated cities and build substantial wealth over the coming years.

Beyond the Hype: A Word on Risks and Mitigation

Every investment, particularly in real estate, carries inherent risks. While the opportunities in our five underrated cities are compelling, a savvy investor must acknowledge and strategise to mitigate potential downsides. Ignoring risks is akin to being a real estate broke before you even start.

- Market Volatility and Economic Downturns:

- Risk: Regional markets can sometimes be more susceptible to economic shocks, especially if heavily reliant on a single industry (e.g., a mining town during a commodity price slump). A national economic downturn can also impact all real estate australia markets.

- Mitigation: Diversify your portfolio across different cities and property types. Invest in cities with diverse economies (as we’ve prioritised). Maintain a strong cash reserve to weather potential periods of vacancy or reduced real estate rent. Focus on long-term trends rather than short-term fluctuations.

- Interest Rate Changes:

- Risk: Rising interest rates increase borrowing costs, impacting mortgage repayments and potentially reducing buyer demand. This can affect affordability and capital appreciation.

- Mitigation: Stress-test your finances. Can you comfortably afford repayments if rates rise by 1-2%? Consider fixing a portion of your mortgage if rates are low, or have a buffer. Strong rental yields can help absorb increased costs.

- Vacancy Rates and Rental Yields:

- Risk: While our selected cities currently boast low vacancy rates and strong real estate rent growth, market dynamics can shift. Over-supply in a specific area or a local economic shock could lead to higher vacancies and reduced rental income.

- Mitigation: Invest in high-demand areas within the city. Ensure your property is well-maintained and attractive to tenants. Engage a professional property manager to minimise vacancy periods and manage tenants effectively. Regularly review real estate rentals in your area to ensure competitive pricing.

- Local Policy and Planning Changes:

- Risk: Changes in local council zoning, development regulations, or infrastructure plans can impact property values, development potential for commercial property, or even restrict certain types of real estate investing (e.g., short-term holiday rentals).

- Mitigation: Stay informed about local government policies and proposed changes. Consult with local real estate agents and planning experts. Factor in potential policy shifts during your due diligence.

- Over-Reliance on Single Projects:

- Risk: While major projects (e.g., a new hospital, university campus, port expansion) are strong drivers, over-reliance on a single project for a city’s growth carries risk if that project faces delays, budget cuts, or is not as impactful as anticipated.

- Mitigation: Choose cities with multiple, diversified growth drivers. Understand that projects like the University of Tasmania’s Northern Transformation in Launceston or the Maroochydore City Centre are part of a broader economic strategy, not standalone initiatives.

- Lack of Liquidity:

- Risk: Real estate is an illiquid asset. Selling can take time, especially in regional markets, and market conditions might not always be favourable for an quick exit.

- Mitigation: Have a clear long-term strategy. Don’t invest funds you might need access to quickly. Understand the market depth before committing.

- Maintenance and Unexpected Costs:

- Risk: Properties require ongoing maintenance, and unexpected issues (e.g., a burst pipe, roof repairs) can arise, impacting your cash flow.

- Mitigation: Factor in a contingency budget for repairs and maintenance. Conduct thorough pre-purchase inspection to identify potential issues. Landlord insurance is also crucial.

By thoughtfully considering these risks and implementing robust mitigation strategies, investors can approach the real estate investing landscape with confidence, turning potential challenges into manageable aspects of a successful, wealth-building journey.

Your Next Steps: Turning Insight into Action

You’ve now been armed with the knowledge of five genuinely underrated cities poised for significant real estate investing growth in the next five years. You understand the critical economic drivers, the specific opportunities in both residential and commercial property, and the essential strategic principles to guide your decisions. But knowledge without action is just potential energy.

Here’s how to transition from insight to impactful investment:

- Deep-Dive Research: While this article provides a comprehensive overview, your next step is to conduct your own targeted research on the city (or cities) that resonate most with your investment goals.

- Local Council Websites: Explore their economic development plans, planning schemes, and infrastructure projects.

- Local News & Demographics: Look for recent real estate news, population statistics, and employment figures specific to the region.

- Property Portals: Utilise sites like domain real estate or real estate au to understand current listings, sold real estate data, and real estate rent trends in specific suburbs.

- Government Statistics: Access data from the ABS and state planning departments for robust, authoritative figures.

- Engage Local Professionals: This is paramount. Contact reputable local real estate agents in your chosen city. They are your eyes and ears on the ground. Seek out property managers early in your process to understand the real estate rentals market, typical yields, and their services.

- Don’t be afraid to interview multiple agents. Look for those with deep local knowledge, a proven track record, and a genuine interest in your investment goals.

- Consider connecting with local financial advisors or mortgage brokers who specialise in regional lending.

- Visit (If Possible): There’s no substitute for experiencing a place firsthand. If feasible, spend a few days in your target city. Drive through different suburbs, visit local businesses, assess amenities, and get a feel for the community. This inspection of the broader environment can solidify your decision.

- Financial Planning: Review your own financial situation.

- What is your budget?

- What are your borrowing capacities?

- What are your risk tolerances?

- Consult with a financial planner to integrate real estate investing into your broader wealth-building strategy.

- Start Small, Think Big: You don’t need to buy a multi-million-dollar commercial property to begin. A well-chosen residential property, offering strong rental yield and capital growth potential, can be an excellent entry point. The key is to start smart, learn, and then scale your investments.

- Stay Patient and Persistent: Real estate investing is a marathon, not a sprint. Market cycles occur, and sometimes patience is your greatest asset. Continue to monitor your investment, stay abreast of real estate news, and be prepared to make informed adjustments as needed.

This is your invitation to look beyond the crowded marketplaces, to see the potential in places others overlook, and to build significant wealth through strategic real estate investing. The future of property prosperity is not just in the capitals; it’s in the quiet confidence of these emerging powerhouses.

Conclusion: The Future is in the Underrated

We’ve traversed the vast and dynamic real estate australia landscape, venturing beyond the well-trodden paths of sydney real estate, melbourne real estate, and brisbane real estate to uncover truly compelling opportunities. Our journey has highlighted five underrated cities – Bendigo, Townsville, Launceston, the Sunshine Coast (beyond its obvious glamour), and Mandurah/Peel – each presenting a unique, data-backed case for substantial real estate investing growth in the next five years.

These cities are not mere regional towns; they are rapidly evolving economic hubs, underpinned by diverse industries, significant infrastructure investment, robust population growth, and a quality of life that increasingly attracts residents from congested capital cities. From healthcare and education to defence, logistics, and renewable energy, their economic foundations are resilient and forward-looking, creating fertile ground for both residential and commercial property investments.

The message is clear: the savvy investor seeking genuine capital appreciation and strong real estate rent returns must look beyond the immediate glare of the major metros. The real estate game has shifted. Affordability, lifestyle, and strategic regional development are now the driving forces shaping the next wave of property prosperity. By applying a disciplined approach, leveraging local expertise (real estate agents, property manager), and understanding the fundamental economic drivers, you can position your portfolio for exceptional performance.

The time to act is now. The “underrated” status of these cities is fleeting. As real estate news increasingly shines a light on regional growth, the opportunities for early entry will diminish. Your journey into high-performing real estate investing in the next five years begins with daring to look where others aren’t – and discovering the gold that awaits. Embrace the unseen frontier, and unlock your future wealth.