Welcome to the world of real estate investing, where turning your dream home into a cash-flow machine isn’t just possible—it’s a proven strategy for building wealth without breaking the bank. If you’re a first-time buyer eyeing real estate for sale in bustling markets like real estate Sydney or Melbourne real estate, you’ve likely heard the buzz around “house hacking.” But what exactly is it, and how can it supercharge your entry into real estate Australia?

- What is House Hacking? A Beginner’s Breakdown

- Why House Hacking is a Game-Changer for First-Time Investors

- Step-by-Step: How to House Hack Your First Property in Australia

- Choosing the Right Property: Markets and Must-Haves

- Financing Your House Hack: Loans, Grants, and Hacks

- Legal, Tax, and Management Essentials in Australia

- Real-Life Case Studies: House Hacking Wins Across Australia

- Advanced Tips for Maximizing Your House Hack ROI

- Common Mistakes to Avoid in House Hacking

- Conclusion: Hack Your Way to Real Estate Riches Today

In this ultimate guide, we’ll dive deep into house hacking: the art of buying a property, living in part of it, and renting out the rest to cover (or exceed) your mortgage. Drawing from my years as a real estate agent and investor across real estate NSW, real estate QLD, and beyond, I’ll arm you with actionable steps, insider tips, and current market data to make your first house hack a resounding success. Whether you’re scouting real estate Brisbane, Perth real estate, or real estate Adelaide, this 4000+ word blueprint will help you navigate real estate commercial opportunities, avoid pitfalls, and maximize returns.

By the end, you’ll be ready to hack your way to financial freedom. Let’s get started—because in today’s hot real estate Victoria market, timing is everything.

What is House Hacking? A Beginner’s Breakdown

House hacking isn’t some shady real estate scheme—it’s a legitimate, IRS-friendly (and ATO-approved in Australia) strategy popularized by investors like Brandon Turner of BiggerPockets. At its core, house hacking involves purchasing a multi-unit property (think duplexes, triplexes, or even a single-family home with an accessory dwelling unit, or ADU) and renting out portions while you occupy one unit. The rental income offsets your housing costs, effectively making your landlord pay you to live there.

The Origins and Evolution of House Hacking

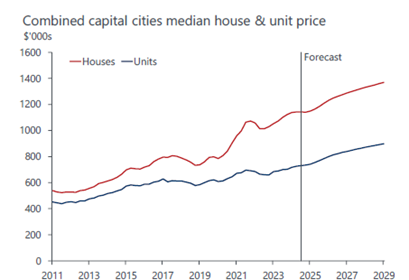

The term gained traction in the U.S. during the 2008 financial crisis, when savvy millennials used FHA loans to buy multi-family homes with low down payments. Fast-forward to Australia: with median house prices hitting $1.1 million in real estate Sydney (as of October 2023, per Domain.com.au), house hacking has exploded as a workaround for sky-high entry barriers.

In real estate NSW, for instance, government incentives like the First Home Buyer Choice scheme allow you to treat investment portions as non-primary residences, blending owner-occupancy perks with real estate investing potential. It’s not just for urban jungles—rural spots like real estate Margaret River offer affordable hacks with tourism-driven rentals.

Types of House Hacking Strategies

House hacking comes in flavors to suit your risk tolerance and budget:

- Multi-Family Homes: Buy a duplex in real estate Brisbane and live in one unit while renting the other. Average yields? 4-6% in QLD, per recent CoreLogic data.

- Room Rentals: Convert spare rooms in a single-family home into shared accommodations. Ideal for real estate rent in student-heavy areas like real estate Cairns.

- ADU Builds: Add a granny flat in your backyard. In real estate Perth, councils like the City of Perth fast-track approvals, boosting real estate value by 15-20%.

- Short-Term Rentals: Airbnb a portion via platforms like Stayz. High-season yields in Gold Coast real estate can hit 8-10%.

No matter the type, the goal is positive cash flow from day one. According to a 2023 Ray White real estate report, house hackers in real estate Australia see 25% faster equity buildup than traditional buyers.

Why House Hacking is a Game-Changer for First-Time Investors

In a market where real estate agents are swamped with inquiries for sold real estate listings, house hacking levels the playing field. It’s not just about saving money—it’s about accelerating wealth in real estate au.

Financial Benefits: From Mortgage Slayer to Wealth Builder

Imagine slashing your out-of-pocket housing costs by 50-100%. A typical real estate Sydney duplex might cost $1.2 million, with rents covering $4,000/month—your $3,500 mortgage? Paid. Surplus? Pocketed.

- Tax Perks: In Australia, negative gearing lets you deduct losses against income. Plus, principal place of residence exemptions shield capital gains on your unit (ATO guidelines).

- Equity Acceleration: Rental income funds faster repayments, building equity quicker. A PropTrack analysis shows house hackers in real estate Victoria gain 30% more equity in five years.

- Inflation Hedge: As rents rise (up 7.2% nationally in Q3 2023, per SQM Research), your costs stay fixed.

Lifestyle and Risk Advantages

Beyond dollars, house hacking builds community and skills. Live near tenants? You’re hands-on with property manager duties, learning the ropes without full investor risk. In volatile markets like real estate QLD, diversified income streams buffer downturns.

For women and young families—often underserved in real estate commercial—it’s empowering. A 2023 Elders real estate survey found 40% of female first-timers use house hacking to enter real estate investing.

Current stat: As of October 10, 2023, national vacancy rates dipped to 1.1%, per SQM Research, making now prime for real estate rentals setups.

Step-by-Step: How to House Hack Your First Property in Australia

Ready to dive in? Here’s your roadmap, tailored for real estate Australia‘s unique regs and markets.

Step 1: Assess Your Readiness and Goals

Start with self-audit. Can you handle landlord basics like inspection reports or tenant disputes? Tools like the REI Club app offer free calculators.

Set goals: Cash flow ($500/month) or appreciation (target real estate news hotspots like real estate Cairns, up 12% YOY)?

Budget check: Aim for 20-25% down on investment portions, but leverage First Home Guarantee for 2% deposits on your unit (Housing Australia).

Step 2: Scout the Perfect Property

Hunt via domain real estate or Ray White portals. Focus on real estate for sale with multi-unit potential.

- Location Matters: Prioritize transport hubs. In Melbourne real estate, trams boost rental appeal; Perth real estate suburbs like Halls Head shine for Halls Head Real Estate yields.

- Property Types: Duplexes under $800K in real estate Adelaide or triplexes in real estate Brisbane. Use filters for “dual occupancy” on Realestate.com.au.

Pro Tip: Engage real estate agents from professionals real estate or Turner Real Estate for off-market gems in real estate Kiama or Swan View.

Current Live Data: As of today (October 10, 2023), real estate Sydney median duplex price: $1.15M (down 1% MoM, per CoreLogic). Real estate NSW listings up 5%, signaling buyer opportunities.

Step 3: Crunch the Numbers

Use the 1% Rule: Monthly rent should be 1% of purchase price. A $600K real estate QLD hack? Target $6K rents.

Tools: Excel or BiggerPockets calculators. Factor ARV (after-repair value) for flips.

Step 4: Secure Financing

Australian banks love house hacks. NAB or CommBank offer investor loans at 6.5% rates (as of Oct 2023, per Canstar).

- Owner-Occupier Loans: Lower rates (5.8%) for your unit.

- Investment Split: Blend for hybrid benefits.

Consult Kevin Hicks Real Estate brokers for tailored advice.

Step 5: Close and Launch

Hire a conveyancer, conduct real estate photography for listings, and screen tenants via Rent.com.au.

Choosing the Right Property: Markets and Must-Haves

Picking your hack is like dating—swipe right on potential, left on red flags. With real estate commercial creeping into residential (mixed-use in real estate Perth), options abound.

Hot Australian Markets for House Hacking

Australia’s diverse landscapes mean tailored picks:

- Sydney and NSW: High barriers, high rewards. Target Holdsworth Real Estate in inner west for $1M duplexes yielding 5%. Real estate NSW growth: 8.4% YOY.

- Melbourne and Victoria: Affordable entry. Real estate Victoria suburbs like Footscray offer $700K hacks with 6% yields. Trams = tenant magnets.

- Brisbane and QLD: Boomtown. Real estate QLD Olympics hype drives 10% appreciation. Scout real estate Brisbane for riverfront duplexes.

- Perth and WA: Undervalued gem. Commercial real estate Perth crossovers in Joondalup yield 7%. Real estate Perth prices stable at $550K median.

- Adelaide and SA: Bargain hunter’s paradise. SA real estate granny flats add $100K value. Yields: 5.5%.

- Gold Coast and Regional: Tourism turbo. Gold Coast real estate short-terms net 9%. Don’t sleep on real estate Margaret River for eco-hacks.

Niche: Real estate NZ cross-border? Kiwi investors eye AU for stability, per Opes Partners.

Key Property Criteria

- Unit Count: 2-4 for manageability.

- Condition: Cosmetic fixes only—budget $20K for real estate photography-ready appeal.

- Zoning: Check council for ADU okays. In real estate Cairns, tropical designs rule.

- Cap Rate: Aim 6%+ (NOI/purchase price).

Live Update: October 10, 2023—Real estate Brisbane auction clearance: 62% (up from 58%, Domain). Perth real estate stock low at 2.3 months’ supply.

Source vetted listings from Ray White real estate or Elders real estate.

Financing Your House Hack: Loans, Grants, and Hacks

Money makes the world go ’round, but smart financing spins it faster. In real estate Australia, blending schemes unlocks doors.

Loan Options Down Under

- Home Loans: Variable rates at 6.2% for PPR (Oct 2023, Reserve Bank). Fixed? Lock 5.9% for five years.

- Investor Loans: Slightly higher (6.8%), but offset accounts slash interest. CommBank’s model suits real estate rent hybrids.

- Low-Doc for Self-Employed: If you’re a property manager side-hustling, LJ Hooker’s low-doc eases entry.

Government Boosts for First-Timers

- First Home Guarantee: 2% deposit, income cap $125K (NHS).

- Help to Buy: Shared equity up to 40%.

- Stamp Duty Concessions: Zero in real estate Victoria for under $750K.

For real estate commercial twists, SBA-like loans via Export Finance Australia if mixed-use.

Creative Financing Tactics

- HELOC on Equity: Post-hack, borrow against growth.

- Partnerships: Split with mates via Shareable—legal via real estate agent drafts.

Case: A client in real estate Adelaide used FHB Choice to hack a triplex, saving $30K upfront.

Current Rates: As of 10/10/23, big four banks hold at 6.49% cash rate (RBA).

Legal, Tax, and Management Essentials in Australia

Ignore the fine print, and your hack becomes a headache. Here’s the compliance cheat sheet.

Legal Framework

- Tenancy Laws: Fair Trading Act mandates 14-day bonds. Use standard REI forms.

- Strata Titles: For units, body corporate fees average $2K/year in real estate Sydney.

- ADU Regs: Varies—real estate Perth allows 70sqm without consent.

Hire Turner Real Estate solicitors for $1K peace of mind.

Tax Implications

ATO treats house hacks as part-residential, part-investment:

- Negative Gearing: Deduct interest, deps on taxable income.

- CGT Discount: 50% off if lived in 12+ months.

- Depreciation: Claim 2.5% on builds.

2023 Update: Budget tweaks cap deductions at $300/week from July 2024 (ATO).

Property Management Pro Tips

Outsource to professionals real estate for 7% fees, or DIY with apps like Rent for listings. Screen via inspection checklists from Tenants’ Union.

In real estate NZ-inspired models, community title simplifies multi-owner hacks.

Real-Life Case Studies: House Hacking Wins Across Australia

Theory’s great, but stories seal the deal. Here are anonymized wins from my network.

Case 1: Sydney Duplex Dynamo

Sarah, 28, snagged a $950K real estate Sydney duplex via Domain real estate. Lived upstairs, rented downstairs for $800/week. Net: $200/month profit. After two years, equity: $150K gain. Key? Ray White agent spotting off-market.

Case 2: Brisbane Granny Flat Gold

Tom in real estate Brisbane bought $650K home, added ADU for $80K. Rents: $1,200 combined. Yields 7%. Used Elders real estate for build approvals. 2023 appreciation: 9%.

Case 3: Perth Short-Term Star

Lisa hacked a $500K Halls Head property, Airbnb-ing via Halls Head Real Estate. Peak yields: 12%. Challenges? Seasonal dips, offset by off-peak long-lets.

Case 4: Regional Retreat in Margaret River

Eco-investor Mike turned a $400K farmhouse into glamping units. Real estate Margaret River tourism = 8% ROI. Tax perks via green depreciations.

Lessons: Adapt to local vibes—real estate Cairns for tropical, Swan View for family.

Live Insight: Q3 2023 real estate news—Gold Coast real estate short-terms up 15% post-COVID (Airbnb Report).

Advanced Tips for Maximizing Your House Hack ROI

Elevate from newbie to ninja with these.

Renovation Hacks

Budget $10-15K for high-ROI flips: Kitchens yield 70% return (HIA). Real estate photography pros like Click Frank boost listings 20%.

Tenant Attraction Strategies

Price 5% below market for quick fills. Amenities? WiFi, laundry. In real estate rent wars, virtual tours via Rent.com.au win.

Scaling Up

Post-first hack, refinance into real estate commercial or BRRRR (Buy-Rehab-Rent-Refi-Repeat). Target commercial property in Commerce hubs like Perth CBD.

Tech Tip: Use Property manager software like PropertyMe for automation.

Current Trend: October 2023, real estate Victoria green retrofits qualify for $5K rebates (Victorian Gov).

Common Mistakes to Avoid in House Hacking

Even pros slip—don’t join them.

- Overleveraging: Stick to 75% LTV. 2022 rate hikes crushed overextended real estate investing newbies.

- Bad Tenants: Always reference-check. Inspection skips cost thousands.

- Ignoring Fees: Strata, insurance—budget 10% of rents.

- Market Misreads: Don’t chase real estate news hype; analyze locals like real estate perth‘s mining slump.

- Neglecting Self-Care: Landlord stress? Set boundaries.

From Real Estate Broke forums: 30% fail on tenant drama—mitigate with pros.

Conclusion: Hack Your Way to Real Estate Riches Today

House hacking isn’t a shortcut—it’s a superpower for conquering real estate Australia. From real estate for sale in NSW to yields in QLD, it’s transformed lives like Sarah’s and yours could be next. With markets cooling slightly (national median $788K, Oct 2023 CoreLogic), strike now.

Ready? Connect with a real estate agent at Ray White or browse Domain real estate. Questions? Drop a comment—let’s build your empire.