Welcome to the ultimate resource for anyone navigating the thrilling, and let’s be honest, sometimes terrifying, world of Australian real estate. My name is [Your Blogger Name], and for over a decade, I’ve been immersed in the property market, from the bustling streets of Sydney and Melbourne to the serene coastlines of Margaret River and Kiama. I’ve seen it all: the boom times, the downturns, the frenzy of auctions, and the quiet satisfaction of a private treaty sale.

- Phase 1: Laying the Financial Groundwork – Before You Even Look

- Phase 2: The Great Australian Property Hunt – Finding ‘The One’

- Phase 3: Making Your Move – From Offer to Acceptance

- Phase 4: The Final Countdown – From Contract to Keys in Hand

- Navigating Different Markets: A Quick Word on Specialities

- Your Live Dashboard: Daily Resources for the Savvy Buyer

- Congratulations, Homeowner!

- Frequently Asked Questions (FAQ) about Buying Real Estate in Australia

Buying a home is more than a transaction; it’s the foundation for your future. It’s a cornerstone of wealth creation through real estate investing and the place you’ll make memories for years to come. But the path from browsing real estate for sale on Domain Real Estate to holding the keys in your hand is paved with complexities.

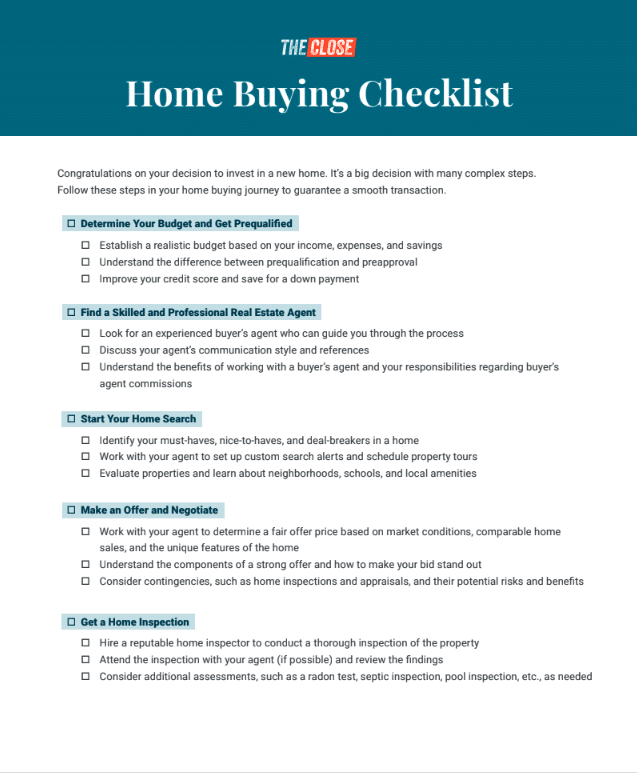

That’s why I’ve created this definitive checklist. This isn’t just a list; it’s a step-by-step roadmap. We will cover every single stage, from the moment you think “maybe I can afford a place” right through to settlement day. Whether you’re a first-home buyer in Adelaide, looking for commercial property in Perth, or seeking a sea-change with Gold Coast real estate, this guide is for you.

Let’s demystify the process and turn your property dream into a reality.

Phase 1: Laying the Financial Groundwork – Before You Even Look

Before you fall in love with a property you can’t afford, the most crucial work happens. This phase is all about getting your finances in pristine condition. Getting this right makes everything that follows smoother and less stressful.

Step 1: The Brutally Honest Budgetary Review

First, you need a crystal-clear picture of your financial health. This isn’t the time for guesstimates. Open a spreadsheet and track every dollar for at least a month.

- Income: List all sources of after-tax income.

- Fixed Expenses: These are your non-negotiables: current rent, car payments, insurance, phone bills, subscriptions.

- Variable Expenses: This is where the truth lies: groceries, dining out, entertainment, fuel, shopping. Be honest!

- Savings: How much are you currently saving each month?

Once you have this, you can see where your money is going and, more importantly, how much you can realistically dedicate to a mortgage repayment. Lenders will scrutinize this, so it’s best you do it first.

Step 2: Understanding and Polishing Your Credit Score

Your credit score is your financial report card. In Australia, a good score (typically 650+) is vital for securing a home loan at a competitive interest rate. A low score can be a red flag for lenders.

- How to Check: You can get a free copy of your credit report from agencies like Equifax, Experian, or illion.

- What to Look For: Check for any defaults, late payments, or errors. Even a small, forgotten utility bill can have an impact.

- How to Improve:

- Pay all bills on time, every time.

- Lower your credit card limits (lenders look at the total available credit, not just your balance).

- Avoid applying for new credit (like personal loans or credit cards) in the 6-12 months leading up to your home loan application.

Source Link: Get a comprehensive understanding of your credit score via the Australian government’s MoneySmart service: MoneySmart – Credit Scores

Step 3: Saving for Your Deposit and The Hidden Costs

The deposit is the big one, but it’s not the only upfront cost. A 20% deposit is the gold standard as it helps you avoid Lenders Mortgage Insurance (LMI). However, many lenders and government schemes allow for deposits as low as 5%.

Here’s a breakdown of the funds you’ll need:

- The Deposit: Typically 5-20% of the property’s purchase price.

- Lenders Mortgage Insurance (LMI): If your deposit is less than 20%, you’ll likely pay LMI. This is a one-off insurance premium that protects the lender, not you, if you default on the loan. It can add thousands, or even tens of thousands, to your upfront costs.

- Stamp Duty: This is a state government tax on property transactions. It’s a significant cost and varies wildly between states. For example, stamp duty on a $800,000 property in real estate NSW will be vastly different from that in real estate QLD or SA real estate.

- Legal/Conveyancing Fees: You’ll need a solicitor or conveyancer to handle the legal paperwork. Budget $1,500 – $3,000.

- Building and Pest Inspection: Absolutely non-negotiable. This will cost between $400 – $1,000. This inspection is your best defense against buying a property with hidden, expensive problems.

- Loan Application/Establishment Fees: Some lenders charge fees to set up your mortgage.

Pro Tip: Look into government assistance like the First Home Owner Grant (FHOG) or the First Home Guarantee, which can significantly reduce these upfront barriers.

Source Link: Check your eligibility for first home buyer schemes here: Australian Government – First Home Guarantee

Step 4: The Golden Ticket – Mortgage Pre-Approval

Mortgage pre-approval is a conditional approval from a lender for a specific loan amount. It’s your “golden ticket” to house hunting seriously.

- Why It’s Essential:

- It sets your budget: You know exactly how much you can spend.

- It shows you’re a serious buyer: Real estate agents will take you more seriously. In a competitive market, a pre-approved buyer has a significant advantage.

- It speeds up the process: When you find the perfect place, you can make an offer with confidence.

To get pre-approved, you’ll need to provide payslips, bank statements, tax returns, and details of your assets and liabilities. You can go directly to a bank or use a mortgage broker. A good broker can compare hundreds of loans to find one that suits your situation, which is invaluable when navigating the complex world of finance and commerce.

Phase 2: The Great Australian Property Hunt – Finding ‘The One’

With pre-approval in hand, the exciting part begins! This is where you transition from a dreamer to a serious contender in the property market.

Step 5: Defining Your ‘Must-Haves’ vs. ‘Nice-to-Haves’

Create a detailed checklist. Be specific. This will help you filter listings and avoid wasting time on unsuitable properties.

- Location:

- Suburb(s): Consider proximity to work, family, public transport, schools, and amenities. Are you looking for the vibrant city life of real estate Brisbane or a quieter spot like Swan View?

- Street: Do you want a quiet cul-de-sac or a main road?

- Property Type:

- House, townhouse, unit/apartment?

- New build or established home?

- Features (Must-Haves):

- Number of bedrooms and bathrooms.

- Parking (garage, carport, on-street).

- A backyard for the kids/pets.

- An office space for remote work.

- Features (Nice-to-Haves):

- Swimming pool.

- Modern kitchen.

- Ensuite bathroom.

- North-facing living areas.

This list will be your north star, keeping you focused during your search for real estate for sale.

Step 6: Assembling Your A-Team: The Real Estate Agent

You’ll be dealing with many real estate agents during your search. It’s crucial to understand their role. The agent you meet at an open home is the seller’s agent. Their legal duty is to get the best possible price and terms for their client, the vendor.

However, you can also engage a buyer’s agent. This is a licensed professional you hire to work exclusively for you. They can find properties (including off-market opportunities), evaluate them, and negotiate the purchase on your behalf. If you’re time-poor or buying in an unfamiliar area like real estate Margaret River or real estate Kiama while living elsewhere, a buyer’s agent can be a game-changer.

Building a good rapport with local agents from agencies like Ray White, Elders Real Estate, or even boutique firms like Turner Real Estate or Kevin Hicks Real Estate can also give you an edge. Let them know you’re a serious, pre-approved buyer. They might just call you before a property hits the market.

Step 7: Mastering the Online Search and Beyond

Your primary tools will be the major real estate portals. Set up saved searches with your criteria on sites like:

- Domain.com.au

- Realestate.com.au

Source Links:

These platforms are essential for finding real estate rentals and properties for sale across the country, from real estate Perth to real estate Cairns. Use the filters to narrow down your search. Look at the “sold” section to get a feel for what properties are actually selling for in your target suburbs. This is where you’ll find the most up-to-date real estate news and market trends.

Don’t limit yourself to online. Drive around your preferred suburbs. Look for “For Sale” signs. Sometimes the best finds are the ones you stumble upon.

Step 8: The Power of the Inspection – Become a Property Detective

This is where you put your emotions aside and critically assess a property. Don’t just wander through dreamily. Be methodical.

- First Impressions (The Walk-Up): Check the condition of the fence, driveway, roof, and gutters. How is the streetscape?

- Inside the Property:

- Smell: Is there a musty or damp smell? This can indicate mould or rising damp.

- Look Up and Down: Check ceilings and cornices for water stains or cracks. Look at the floors – are they level?

- Functionality: Open and close doors and windows. Turn on taps to check water pressure. Flush the toilets.

- Layout: Does the floor plan work for your lifestyle? Imagine your furniture in the space.

- Storage: Is there enough? Check cupboards, wardrobes, and any garage or shed space.

- Outside:

- Drainage: Does the land slope away from the house?

- Pests: Look for signs of termites like mud tubes or damaged timber.

- Structure: Check for major cracks in brickwork or foundations.

Take photos and notes. After seeing a dozen properties, they all start to blur together. A great real estate photography portfolio can make a place look perfect, but your own photos will remind you of the reality.

If you like the property, this is when you book a professional building and pest inspection. This is a non-negotiable step before making an unconditional offer.

Phase 3: Making Your Move – From Offer to Acceptance

You’ve found it. “The One.” Your heart is racing. Now it’s time to act, but with a cool head.

Step 9: Research, Research, Research: Due Diligence is Non-Negotiable

Before you put a number on paper, you need to become an expert on this specific property and its location.

- Comparable Sales: Ask the agent for a list of recent, comparable sales in the area. This is how you’ll justify your offer price. You are looking for recently sold real estate that is similar in size, condition, and location.

- Check the Title: Your conveyancer will do a title search to ensure there are no easements, caveats, or other restrictions on the property you’re not aware of.

- Council and Zoning: Check the local council’s website for any planned developments nearby (like new apartment blocks or highways) that could affect the property’s value or your enjoyment of it. This is especially important for those looking at commercial real estate Perth or other high-growth corridors.

- Strata Report (for Apartments/Townhouses): If buying into a strata scheme, you MUST get a strata report. This details the financial health of the body corporate, any upcoming special levies for major works (like replacing the roof or lift), and any history of disputes. A poorly managed strata can be a financial nightmare.

Step 10: Crafting a Winning Offer

There are two main ways to buy property in Australia: private treaty or auction.

- Private Treaty (or Private Sale): This is the most common method. You make a formal written offer to the agent, who presents it to the vendor.

- Your Offer: It should be in writing and include the price, your desired settlement period (e.g., 30, 60, or 90 days), and any conditions.

- Conditions: Common conditions include “subject to finance” (meaning the sale is conditional on your loan getting final approval) and “subject to a satisfactory building and pest inspection.”

- Cooling-Off Period: Most states (like real estate Victoria and NSW) have a statutory cooling-off period (e.g., 3-5 business days) where you can withdraw from the sale, though you may forfeit a small part of your deposit (e.g., 0.25% of the purchase price).

- Auction: This is a public sale where the property is sold to the highest bidder.

- No Cooling-Off Period: If you are the winning bidder, the sale is final and unconditional. You cannot back out.

- All Due Diligence Must Be Done Beforehand: You must have your building and pest inspection done and your finance formally approved before you bid.

- Deposit is Due Immediately: You will need to pay the 10% deposit on the day.

Your strategy will depend on the property and the market. A strong, clean offer (with fewer conditions) is more attractive to a seller, but don’t waive your crucial protections unless you are 100% confident.

Step 11: Engaging the Professionals: Conveyancers and Solicitors

Once your offer is accepted, it’s time for the legal machinery to kick into gear. You’ll need a solicitor or a licensed conveyancer. Their job is to:

- Review the Contract of Sale for any red flags.

- Conduct all necessary searches (title, council, etc.).

- Liaise with your bank and the vendor’s legal representative.

- Prepare the legal documents for settlement.

- Ensure the transfer of title is done correctly.

Don’t skimp here. A good legal representative is worth their weight in gold.

Step 12: Securing Formal (Unconditional) Loan Approval

Your pre-approval was a great start, but now the lender needs to approve the specific property you’re buying. They will conduct their own valuation to ensure the property is adequate security for the loan amount.

You will need to provide them with the signed Contract of Sale. The bank will review everything and, once satisfied, will issue a formal letter of unconditional approval. This is a huge milestone! Only once you have this can you safely make your offer unconditional regarding finance.

Phase 4: The Final Countdown – From Contract to Keys in Hand

The hard part is over, but there are still a few critical steps to complete before you can pop the champagne. This period is known as the “settlement period.”

Step 13: Signing and Exchanging the Contract of Sale

Once negotiations are complete and finance is approved, you and the seller will sign identical copies of the Contract of Sale. These are then formally “exchanged,” at which point the contract becomes legally binding on both parties.

Step 14: Paying the Deposit

At the time of exchange, you will be required to pay the full deposit (usually 10% of the purchase price, less any initial holding deposit you may have paid). This money is not paid directly to the seller. It is held in the trust account of the real estate agent (like a Ray White Real Estate office) or one of the solicitors until settlement day.

Step 15: The Pre-Settlement Inspection

In the week leading up to settlement, you have the right to a final inspection of the property. This is your chance to ensure:

- The property is in the same condition as when you last inspected it.

- All appliances and inclusions listed in the contract are present and in working order.

- The previous occupants have moved out and removed all their rubbish.

If you find an issue (e.g., a hole in the wall that wasn’t there before, a broken oven), you must raise it with your solicitor immediately. They can negotiate a solution with the vendor’s solicitor before settlement proceeds.

Step 16: Settlement Day (Closing Day)!

This is the day you officially become the owner of the property. You generally don’t need to attend settlement yourself. Your solicitor, your bank’s representative, and the vendor’s representatives will meet to complete the transaction.

- Your bank will draw down your home loan and transfer the funds to the seller.

- The title of the property is transferred into your name.

- The keys are released to you by the real estate agent.

Once your solicitor calls to say “Congratulations, you’ve settled!” you can go to the agent’s office and pick up the keys to your new home. It’s an incredible feeling.

Navigating Different Markets: A Quick Word on Specialities

While this checklist covers the residential process, the world of real estate Australia is diverse.

A Note on Commercial Real Estate

If you’re looking at real estate commercial properties, the principles of due diligence are even more critical. You’ll need to investigate leases, tenant quality, zoning for business use, and potential yields. The process involves more complex financial analysis and legal scrutiny. It’s a different ballgame from buying a home.

Considering Real Estate Investing?

For those looking at property as a form of real estate investing, your focus shifts. You’ll be less concerned with emotional appeal and more focused on the numbers:

- Rental Yield: What is the potential rental income versus the property’s cost?

- Vacancy Rates: How easy will it be to find tenants in this area?

- Depreciation: Can you claim tax deductions?

- Property Manager: You’ll likely need to hire a professional property manager to handle tenants, rent collection, and maintenance. This is a crucial role for a successful investment.

Whether it’s an investment property in real estate nz or a local buy, the fundamentals of research and financial discipline remain the same.

Your Live Dashboard: Daily Resources for the Savvy Buyer

The property market moves fast. To stay on top of the latest real estate news, here are your go-to daily resources:

- Interest Rates: Keep an eye on the official cash rate from the Reserve Bank of Australia. This influences the mortgage rates offered by lenders.

- Source Link: RBA – Cash Rate Target

- Property Listings: Check Domain and REA daily. New listings appear all the time, and good properties can be snapped up quickly. Setting up alerts is key.

- Market News & Data: CoreLogic provides excellent daily insights and data on property values across Australia.

- Source Link: CoreLogic News

Congratulations, Homeowner!

The journey to homeownership is a marathon, not a sprint. It requires patience, diligence, and a great team of professionals. From the initial search for real estate for sale to the final inspection and settlement, each step is a building block toward your goal.

This checklist might seem overwhelming, but by breaking it down and tackling it one phase at a time, you can navigate the process with confidence. You can avoid common pitfalls, like a Real Estate Broke situation from overextending, and make informed decisions.

Whether you’re working with a major agency like the Professionals Real Estate or a local expert like Halls Head Real Estate, this guide empowers you to be an active, knowledgeable participant in your own success story.

Welcome home.

Frequently Asked Questions (FAQ) about Buying Real Estate in Australia

What’s the difference between a real estate agent and a buyer’s agent?

A standard real estate agent (or seller’s agent) is contracted by the property owner (the vendor) to sell their home for the highest possible price. Their legal and fiduciary duty is to the seller. A buyer’s agent is a licensed professional you hire to represent your interests. They help you find, evaluate, and negotiate the purchase of a property, working exclusively for you, the buyer.

How long does the home buying process take in Australia?

The timeline can vary significantly, but a general estimate is 3 to 6 months. This includes 1-2 months for initial financial preparation and pre-approval, 1-3 months for property searching and making an offer, and a settlement period of 30-90 days after the contract is signed. A hot market in places like real estate Sydney can speed up the search phase, while complex financing can extend it.

Is it better to buy at auction or through private treaty?

Neither is inherently “better”; they suit different buyers and market conditions. Private treaty offers more flexibility, allowing for negotiations and conditions like “subject to finance.” It’s generally less stressful for first-home buyers. Auctions are transparent and definitive but require you to have all your due diligence (inspections, finance) completed beforehand. They are unconditional, meaning there’s no backing out once the hammer falls.

What is the first step I should take if I want to buy a property?

The very first step, before you even start looking at listings for real estate for sale, is to speak with a bank or a mortgage broker. Getting a clear understanding of your borrowing capacity and obtaining a mortgage pre-approval is the essential foundation. This sets your realistic budget and makes you a credible buyer in the eyes of real estate agents.