Introduction: The Australian Dream and First-Time Homebuyers

In the ever-evolving landscape of real estate Australia, the dream of owning a home remains a cornerstone of financial security and personal achievement. For many, especially first-time homebuyers, navigating the complex world of real estate for sale, real estate agents, and government incentives can be overwhelming. With property prices fluctuating in major cities like Sydney, Melbourne, Brisbane, Perth, and Adelaide, understanding the support available is more crucial than ever.

- Introduction: The Australian Dream and First-Time Homebuyers

- First Home Owner Grant (FHOG)

- First Home Guarantee (FHBG)

- First Home Super Saver Scheme (FHSSS)

- Stamp Duty Concessions and Exemptions

- Family Home Guarantee

- Regional First Home Buyer Guarantee

- Shared Equity Schemes

- State-Based Grants and Incentives

- HomeBuilder Grant (Legacy Program)

- Affordable Housing Initiatives

- How to Maximize Your Benefits

- Frequently Asked Questions

- Conclusion: Your Path to Homeownership

- Source Links

As of today, October 15, 2025, the Australian property market continues to show resilience, with real estate news reporting steady demand in both metropolitan and regional areas. Whether you’re searching for real estate NSW, real estate QLD, or real estate Victoria, knowing which government programs can help you get a foot on the property ladder is essential.

In this comprehensive guide, we’ll explore the 10 government programs for first-time homebuyers you need to know about, providing up-to-date information, practical tips, and expert insights. We’ll also weave in the most relevant real estate keywords to ensure this post is fully SEO-optimized for your search needs.

First Home Owner Grant (FHOG)

What is the FHOG?

The First Home Owner Grant (FHOG) is a national scheme funded by the states and territories and administered under their own legislation. It provides a one-off grant to first-time homebuyers purchasing or building a new residential property.

How Much Can You Get?

The amount varies by state:

- NSW: Up to $10,000 for new homes valued up to $750,000 (NSW Government)

- VIC: Up to $10,000 for new homes valued up to $750,000 (VIC Government)

- QLD: Up to $30,000 for new homes valued under $750,000 (QLD Government)

- WA: Up to $10,000 (WA Government)

- SA: Up to $15,000 (SA Government)

- TAS: Up to $30,000 (TAS Government)

- ACT: No longer available, replaced by stamp duty concessions (ACT Government)

Who is Eligible?

- Must be a first-time homebuyer

- Must be an Australian citizen or permanent resident

- Must live in the home for a continuous period (usually 6-12 months)

- Must not have previously owned residential property in Australia

Why is FHOG Important?

With real estate for sale prices at record highs, the FHOG can be a crucial boost for first-time buyers, especially in competitive markets like real estate Sydney and melbourne real estate.

First Home Guarantee (FHBG)

What is the First Home Guarantee?

The First Home Guarantee (FHBG), formerly known as the First Home Loan Deposit Scheme, is a federal initiative that allows eligible first-time buyers to purchase a home with as little as a 5% deposit, with the government guaranteeing up to 15% of the property’s value.

Key Features

- No need for Lenders Mortgage Insurance (LMI)

- Available for new and existing homes

- Property price caps apply, varying by region (NHFIC)

2025 Updates

As of October 2025, the scheme has expanded to include more places, with 35,000 spots available annually. The property price caps have also been adjusted to reflect current market conditions.

Eligibility

- Australian citizens or permanent residents

- First-time buyers

- Singles earning up to $125,000 or couples up to $200,000 per year

Why Consider FHBG?

With real estate agents reporting increased competition, the FHBG can help buyers enter the market sooner, especially in high-demand areas like real estate QLD and real estate Victoria.

First Home Super Saver Scheme (FHSSS)

What is the FHSSS?

The First Home Super Saver Scheme (FHSSS) allows first-time buyers to make voluntary contributions to their superannuation fund and later withdraw these funds to purchase their first home.

How Does It Work?

- Contribute up to $15,000 per year, $50,000 in total

- Withdraw contributions plus associated earnings for a home deposit

- Tax benefits: contributions are taxed at 15%, withdrawals taxed at marginal rate less a 30% offset (ATO)

2025 Updates

The maximum releasable amount increased to $50,000, making it more attractive for those saving for a deposit.

Who Should Use FHSSS?

Ideal for buyers in real estate commercial sectors or those with irregular income, as it offers flexibility and tax advantages.

Stamp Duty Concessions and Exemptions

What is Stamp Duty?

Stamp duty is a state government tax on property transactions. For first-time buyers, this can be a significant cost.

State-by-State Breakdown

- NSW: Full exemption for homes up to $800,000, concessions up to $1,000,000 (NSW Revenue)

- VIC: Exemption for homes up to $600,000, concessions up to $750,000 (VIC SRO)

- QLD: Concessions for homes up to $550,000 (QLD Government)

- WA, SA, TAS, ACT, NT: Varying concessions and exemptions

2025 Updates

Some states, like NSW, are trialing annual property taxes as an alternative to upfront stamp duty, providing more flexibility for buyers.

Why is This Important?

With domain real estate and sold real estate listings showing rising prices, saving on stamp duty can make a significant difference in affordability.

Family Home Guarantee

What is the Family Home Guarantee?

The Family Home Guarantee supports single parents with at least one dependent child to buy a home with as little as a 2% deposit, with the government guaranteeing up to 18% of the property’s value.

Key Features

- Available for both first-time and previous homeowners (if they do not currently own property)

- 5,000 places available each year (NHFIC)

Eligibility

- Single parents with at least one dependent

- Australian citizens or permanent residents

- Income cap: $125,000 per year

Why is This Program Unique?

With real estate rentals and real estate rent prices soaring, this program provides a pathway to stability for single-parent families.

Regional First Home Buyer Guarantee

What is the Regional First Home Buyer Guarantee?

Launched to address housing affordability in regional areas, this scheme allows eligible buyers to purchase a home in regional Australia with a 5% deposit, with the government guaranteeing up to 15%.

Key Features

- 10,000 places per year

- Applies to regional areas as defined by the Australian Bureau of Statistics (NHFIC)

2025 Updates

Expanded eligibility to include more regional postcodes, including popular areas like real estate Margaret River, real estate Kiama, and Halls Head Real Estate.

Why Consider Regional Buying?

With gold coast real estate and real estate Cairns markets booming, regional areas offer more affordable entry points and lifestyle benefits.

Shared Equity Schemes

What are Shared Equity Schemes?

Shared equity schemes involve the government or a third party co-purchasing a share of your home, reducing the amount you need to borrow.

State-Based Examples

- VIC Homebuyer Fund: Government contributes up to 25% of the purchase price (VIC Government)

- WA Keystart Shared Ownership: Government shares ownership, reducing deposit and loan requirements (Keystart)

2025 Updates

More states are considering similar programs, with real estate news reporting pilot schemes in SA real estate and real estate Perth.

Who Should Consider Shared Equity?

Ideal for buyers struggling with deposit requirements or those looking at commercial property or real estate investing.

State-Based Grants and Incentives

NSW

- First Home Buyer Choice: Option to pay annual property tax instead of stamp duty (NSW Revenue)

- First Home Owner Grant: As above

VIC

- First Home Owner Grant

- Stamp Duty Concessions

- Homebuyer Fund

QLD

- First Home Owner Grant

- Stamp Duty Concessions

WA

- First Home Owner Grant

- Keystart Loans

SA

- First Home Owner Grant

- Affordable Housing Initiatives

TAS

- First Home Owner Grant

- Stamp Duty Concessions

ACT

- Home Buyer Concession Scheme

NT

- First Home Owner Grant

- Home Buyer Initiative

Why State-Based Incentives Matter

With elders real estate, ray white real estate, and professionals real estate agencies reporting increased demand, state-based incentives can be the difference between renting and owning.

HomeBuilder Grant (Legacy Program)

What Was the HomeBuilder Grant?

The HomeBuilder Grant was a federal program providing $25,000 grants for building or substantially renovating homes. While the program closed in 2021, some applications are still being processed, and similar state-based programs may emerge.

2025 Updates

Some states have introduced their own building grants, especially in growth corridors like real estate Brisbane and real estate Adelaide.

Why Mention HomeBuilder?

Understanding past programs helps buyers anticipate future opportunities and navigate the real estate au market more effectively.

Affordable Housing Initiatives

What Are Affordable Housing Initiatives?

These are government-led programs aimed at increasing the supply of affordable homes, often through partnerships with developers and not-for-profits.

Examples

- National Housing Finance and Investment Corporation (NHFIC): Funds affordable housing projects (NHFIC)

- State-based affordable housing programs: Vary by region

2025 Updates

With real estate commercial and real estate rentals in high demand, affordable housing initiatives are expanding, especially in real estate Sydney and real estate Perth.

Why Consider Affordable Housing?

For those priced out of traditional markets, these initiatives offer a viable path to homeownership.

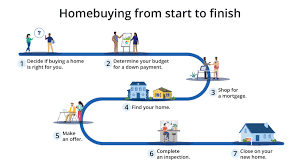

How to Maximize Your Benefits

Step 1: Research Your Eligibility

Use government websites and consult with real estate agents to determine which programs you qualify for.

Step 2: Combine Programs

Many buyers can combine grants, concessions, and guarantees for maximum benefit. For example, use the FHOG, stamp duty concessions, and the FHBG together.

Step 3: Work with Professionals

Engage a property manager, real estate agent, or mortgage broker to guide you through the process.

Step 4: Stay Informed

Follow real estate news and subscribe to updates from agencies like Ray White, Turner Real Estate, and Kevin Hicks Real Estate.

Step 5: Inspect and Negotiate

Attend property inspections and negotiate with sellers, leveraging your government-backed position.

Frequently Asked Questions

Can I Use Multiple Government Programs?

Yes, in most cases, you can combine grants, concessions, and guarantees, but always check eligibility criteria.

Are These Programs Available for Investment Properties?

Most programs are for owner-occupiers, not for real estate investing or commercial property.

How Do I Apply?

Applications are usually made through your lender or directly with state revenue offices.

What If I Buy with a Partner?

Eligibility is assessed on a household basis; both must be first-time buyers for most programs.

Do I Need a Real Estate Agent?

While not mandatory, working with a real estate agent or property manager can simplify the process.

Conclusion: Your Path to Homeownership

The journey to homeownership in Australia is filled with challenges, but also with unprecedented support for first-time buyers. Whether you’re eyeing real estate for sale in Sydney, Melbourne, Brisbane, or regional gems like Margaret River and Kiama, understanding and leveraging government programs can make your dream a reality.

As the real estate Australia market continues to evolve, staying informed and proactive is key. Consult with trusted real estate agents, monitor real estate news, and explore every available incentive. With the right strategy, you can secure your place in the property market and build a brighter future.

For the latest updates, always refer to official government sources and reputable agencies like Domain Real Estate, Ray White Real Estate, and Elders Real Estate.