Welcome to the ultimate guide for navigating the Australian property landscape in 2025. If you’ve typed “real estate for sale” into your search bar recently, you’re part of a massive cohort of Australians trying to decipher one of the most complex and talked-about markets in the world. Is 2025 the year to buy, sell, or hold? Will the relentless price growth continue, or are we on the brink of a correction?

- Live Australian Real Estate Market Snapshot

- The Big Picture: Australia’s National Real Estate Forecast for 2025

- The Economic Levers: Key Drivers Shaping the 2025 Property Market

- Capital City Deep Dive: A State-by-State Real Estate Forecast

- A Segmented Outlook: What the 2025 Forecast Means for YOU

- The Role of Technology and Trends in 2025

- Conclusion: Your 2025 Real Estate Strategy

Here, we’re cutting through the noise. We’ve synthesized reports from leading economists, analysed market fundamentals, and broken down the forecasts to give you a clear, actionable roadmap. Whether you’re eyeing real estate in NSW, seeking advice from top real estate agents, or exploring commercial real estate opportunities, this is your definitive resource for the year ahead.

Live Australian Real Estate Market Snapshot

(On a live blog, this section would be powered by a data feed and update daily. The data below is illustrative of what would be featured.)

- Last Updated: [Current Date]

- National Median Dwelling Value: $772,120 (Up 0.6% this month)

- National Auction Clearance Rate (Last Week): 68.5%

- RBA Official Cash Rate: 4.35%

- Quarterly CPI Inflation: 3.6%

- Top Performing Capital City (Rolling 28 Days): Perth Real Estate (+1.8%)

- Current Rental Vacancy Rate (National): 1.1%

The Big Picture: Australia’s National Real Estate Forecast for 2025

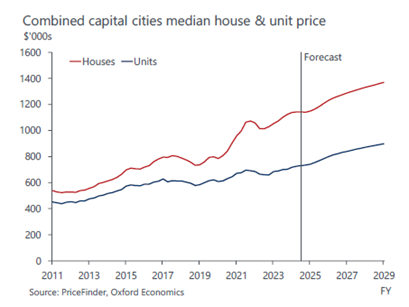

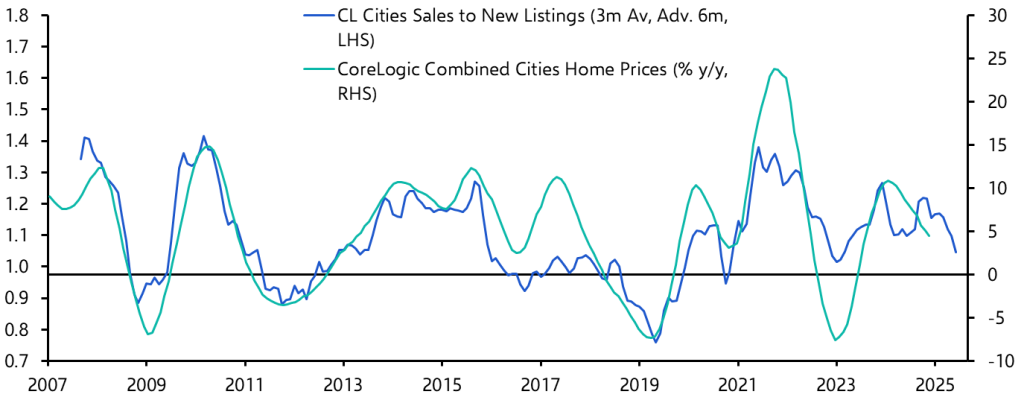

After a period of unprecedented volatility—a pandemic boom, the sharpest interest rate hiking cycle in a generation, and a surprising rebound—the national market enters 2025 at a crossroads. The consensus among leading economists isn’t a dramatic crash or an explosive boom, but rather a year of moderation and divergence.

Most major financial institutions are forecasting modest price growth for real estate Australia-wide, in the low-to-mid single digits. The era of 20%+ annual gains is firmly in the rearview mirror. Instead, the story of 2025 will be one of specific micro-markets. The performance of real estate in Sydney will likely differ significantly from that of Adelaide real estate, driven by local factors of supply, demand, and affordability.

Key takeaway: Expect a more “normalised” market, where careful asset selection, diligent research, and expert advice from a qualified real estate agent will be more critical than ever.

Sources for National Forecasts:

- CoreLogic Australia: https://www.corelogic.com.au/news-research

- NAB Economics Property Insights: https://business.nab.com.au/category/reports/property-reports/

- Westpac Economic Research: https://www.westpac.com.au/about-westpac/media/reports/

The Economic Levers: Key Drivers Shaping the 2025 Property Market

To understand where the market is going, we must first understand the forces pulling and pushing it. These are the macroeconomic factors that will dictate the direction of real estate news headlines throughout 2025.

Interest Rates: The RBA’s Cautious Dance

The single biggest factor influencing the market over the past two years has been the Reserve Bank of Australia’s (RBA) cash rate. The rapid tightening cycle effectively put a ceiling on borrowing capacity. For 2025, the narrative is shifting.

- Economist Consensus: Most economists predict that the RBA’s next move will be a cut, not a hike. The timing, however, is a matter of intense debate. Some predict cuts as early as late 2024, while others believe the RBA will hold steady until mid-to-late 2025 to ensure inflation is well and truly under control.

- Impact on Borrowers: Even a small cut of 0.25% can significantly boost buyer confidence and borrowing power. This could inject fresh energy into the market, particularly among first-home buyers and those looking to upgrade. However, the high cost of living will continue to be a handbrake.

- What to Watch: Keep a close eye on the quarterly CPI (Consumer Price Index) data. This is the primary inflation metric the RBA uses to guide its decisions.

The Great Imbalance: Population Growth vs. Housing Supply

This is the fundamental pressure cooker of Australian real estate.

- Demand Side: Australia is experiencing record levels of net overseas migration. This influx of students, skilled workers, and returning expats creates immediate and significant demand for housing, especially for real estate rentals. This demand underpins both rental prices and entry-level property values.

- Supply Side: The construction industry is facing a perfect storm of high material costs, labour shortages, and developer financing challenges. The number of new housing completions is struggling to keep pace with population growth, leading to a chronic undersupply. This isn’t just a city problem; it’s affecting regional hubs from the Gold Coast real estate market to real estate Margaret River.

This structural imbalance is the primary reason most economists are not predicting a price crash. There are simply too many people needing a place to live and not enough homes being built. This is a core theme for anyone involved in real estate investing.

Affordability and Employment: The Household Tug-of-War

While the supply/demand dynamic pushes prices up, affordability acts as a natural ceiling.

- Wage Growth: Wages are rising, but for many, they haven’t kept pace with the combined increase in property prices and the cost of living. This stretches household budgets thin and limits the amount people can borrow.

- The Mortgage Cliff: Many borrowers who fixed their mortgages at record-low rates during the pandemic have now transitioned to much higher variable rates. The financial resilience of these households will be a key indicator of market stability in 2025.

- Employment: Australia’s labour market remains remarkably tight, with low unemployment. As long as people feel secure in their jobs, they are more likely to make long-term financial commitments like purchasing property. A significant rise in unemployment is the biggest “black swan” risk to the market.

Capital City Deep Dive: A State-by-State Real Estate Forecast

The national average is just that—an average. The real story unfolds in the diverse markets of our capital cities. Whether you’re a seasoned investor or searching for your first home, understanding these local nuances is key.

Sydney Real Estate: A Tale of Two Tiers

The real estate Sydney market is expected to remain a two-tiered beast. Premium, well-located properties in the Eastern Suburbs, North Shore, and Inner West are likely to see continued, albeit modest, growth, driven by cashed-up buyers and a lack of available stock. However, the outer suburban and high-density apartment markets may face headwinds as affordability constraints and cost-of-living pressures bite hardest. Finding value will require looking at infrastructure upgrades and changing demographics.

- Prediction: Modest growth (2-4%).

- Key Driver: Strong demand for premium property vs. affordability caps in the broader market.

- Opportunity: Look for suburbs with new transport links or lifestyle appeal that are currently undervalued compared to their neighbours.

Melbourne Real Estate: The Gradual Thaw

Melbourne real estate has been more subdued than Sydney’s, still recovering from longer lockdowns and a larger supply of new housing stock in previous years. However, the fundamentals are improving. Overseas migration is surging back, returning vibrancy to the CBD and inner suburbs. The gap in median price between Sydney and Melbourne could see investors and interstate migrants turn their attention south.

- Prediction: Stable to moderate growth (1-3%).

- Key Driver: Return of overseas migration and relative affordability compared to Sydney.

- Watch Out For: Potential oversupply in the high-rise apartment market could keep price growth for units muted.

Brisbane Real Estate & QLD’s Enduring Appeal

The real estate Brisbane market, along with the broader real estate QLD landscape, has been a star performer. The drivers are clear: strong interstate migration, significant infrastructure investment leading up to the 2032 Olympics, and a desirable lifestyle. While the blistering pace of growth has to slow, the underlying demand remains robust. The Gold Coast real estate market, in particular, continues to attract both lifestyle buyers and investors.

- Prediction: Moderate growth, potentially outperforming Sydney and Melbourne (4-6%).

- Key Driver: Sustained migration, infrastructure boom, and relative affordability.

- Opportunity: The “ripple effect” will push growth into surrounding regions and satellite cities.

Perth Real Estate: The Western Powerhouse

If there’s one market economists are universally bullish on, it’s real estate Perth. It combines strong economic fundamentals from the resources sector, the highest rental yields of any capital city, and the most affordable median house price. A decade of underperformance has left it with significant room for growth, and both east-coast investors and new migrants are taking notice. From Halls Head real estate in the south to Swan View in the east, the market is hot.

- Prediction: Strongest growth among capitals (5-8%).

- Key Driver: Extreme affordability, high rental yields, and a strong state economy.

- Note: The market is moving fast. Working with a proactive property manager or agent is crucial for securing a property.

Adelaide Real Estate: The Quiet Achiever

The SA real estate market, particularly Adelaide real estate, continues to defy expectations. It has become a haven for those priced out of the eastern states, offering a fantastic lifestyle at a fraction of the cost. Its resilience is underpinned by a stable economy, defence industry investment, and a tightly held housing supply. Agencies like Turner Real Estate have reported consistent buyer interest even as other markets have cooled.

- Prediction: Steady, resilient growth (3-5%).

- Key Driver: Affordability, lifestyle appeal, and a low-volume, tightly held market.

Beyond the Capitals: Regional Markets and Niche Opportunities

The regional boom of the pandemic has settled, but the appeal remains. Areas that offer a commutable distance to a capital city or have strong local economies and lifestyle drivers will continue to perform well.

- Lifestyle Havens: Markets like real estate Kiama (NSW) or real estate Margaret River (WA) will always command premium prices due to their unique appeal.

- Regional Centres: Places with diverse economies like Cairns or Geelong are solid bets. The real estate Cairns market, for instance, benefits from tourism and its role as a key northern hub.

- Affordable Pockets: For investors chasing yield, looking at smaller regional towns can be a strategy. One might even find opportunities in areas as niche as Real Estate Broke in the Hunter Valley, though hyper-local knowledge is essential. Even established regional agencies like Kevin Hicks Real Estate in Victoria’s Goulburn Valley are reporting solid, sustainable market conditions.

A Segmented Outlook: What the 2025 Forecast Means for YOU

The forecast impacts different players in the market in unique ways. Let’s break it down.

For the Investor: Navigating Commercial and Residential Real Estate Investing

Real estate investing in 2025 is a game of precision, not speculation.

- Residential Property: The undersupply of rental properties makes residential a strong play. The focus will be on rental yield. Perth, Adelaide, and Brisbane offer the most attractive yields. A good property manager is non-negotiable to navigate tight tenancy laws and maximise returns. Your goal is to find properties where the rent can service the mortgage and costs, with capital growth as the long-term bonus.

- Commercial Property: The world of commerce and commercial real estate is more complex.

- Industrial: Logistics, warehousing, and data centres remain the top performers, fueled by the growth of e-commerce.

- Office: The “flight to quality” continues. Premium, green-certified office buildings in prime locations are in demand, while older, B-grade stock is struggling with high vacancies. The commercial real estate Perth market is seeing a resurgence due to the strong state economy.

- Retail: Non-discretionary retail (supermarkets, medical centres) is resilient. Discretionary and “high street” retail face ongoing challenges from online competition.

For the First Home Buyer: Hurdles and Opportunities

It’s still tough out there, but 2025 may offer a window of opportunity.

- The Hurdles: The deposit hurdle remains the biggest challenge. Saving a 20% deposit on a median-priced home is a monumental task.

- The Opportunities:

- Government Schemes: Make full use of schemes like the First Home Guarantee.

- Softer Market: A less frantic market means less competition, more time for due diligence (like a building inspection), and more negotiating power.

- Rent-vesting: Consider buying an affordable investment property in a high-growth area like Perth or Brisbane while continuing to rent where you live.

For the Seller: Timing the Market with Your Real Estate Agent

If you’re looking to achieve a sold real estate sign on your lawn, preparation is everything.

- Don’t Wait for the “Perfect” Peak: Trying to time the absolute peak of the market is a fool’s errand. A better strategy is to sell when it suits your personal circumstances.

- Presentation is Paramount: In a balanced market, buyers are pickier. Investing in cosmetic updates, decluttering, and professional real estate photography can add tens of thousands to your final sale price.

- Choose the Right Agent: This is critical. You need an experienced local expert from a reputable agency, whether it’s a major network like Ray White real estate or a trusted local like Holdsworth real estate. Interview multiple real estate agents, check their recent sales in your area, and understand their marketing strategy. The top real estate agent isn’t just an order-taker; they are a strategist, negotiator, and advisor.

The Role of Technology and Trends in 2025

The real estate industry is constantly evolving. In 2025, expect to see:

- AI in Real Estate: AI-powered tools will become more common for property valuations, market analysis, and even writing property descriptions.

- Virtual and Augmented Reality: Virtual tours and digital staging are no longer gimmicks but essential marketing tools.

- Sustainability: Energy efficiency ratings (EER) and sustainable features (solar panels, water tanks) will increasingly influence property values as running costs become a bigger factor for buyers.

Conclusion: Your 2025 Real Estate Strategy

Navigating the 2025 Australian property market requires a clear-eyed, strategic approach. The frantic, “buy-anything” sentiment of the boom years is gone, replaced by a more considered, value-driven environment.

Key Takeaways:

- Modest Growth: Expect national prices to grow modestly, led by Perth, Brisbane, and Adelaide.

- Supply is King: The chronic housing undersupply will continue to put a floor under prices.

- Rates are Pivotal: The timing of the RBA’s first rate cut will be the biggest single catalyst for market sentiment.

- Local Knowledge Wins: The market is fragmenting. Success depends on understanding the specific dynamics of your target city, suburb, and even street. This is where consulting with top-tier professionals, from Elders Real Estate in a rural town to a specialist in real estate NZ if you’re looking across the ditch, becomes invaluable.

Whether you’re looking at real estate au domains like Domain Real Estate or engaging with a local expert, the message is the same: do your research, understand your finances, and think long-term. 2025 won’t be a year for wild speculation, but for the informed and prepared, it will be a year of significant opportunity.