Introduction: Unlocking the Power of 1031 Exchanges in Real Estate

In the dynamic world of real estate investing, savvy investors are always searching for strategies to maximize returns and minimize tax liabilities. One of the most powerful tools available is the 1031 exchange—a provision in the U.S. Internal Revenue Code that allows investors to defer capital gains taxes when selling one investment property and purchasing another “like-kind” property. Whether you are exploring real estate for sale in Sydney, commercial real estate Perth, or real estate NSW, understanding 1031 exchanges can be a game-changer for your portfolio.

- Introduction: Unlocking the Power of 1031 Exchanges in Real Estate

- What is a 1031 Exchange?

- How Does a 1031 Exchange Work?

- Types of Properties Eligible for 1031 Exchange

- 1031 Exchange Rules and Requirements

- Live Daily Information: 1031 Exchange Trends and Market Updates

- Advantages of 1031 Exchanges for Real Estate Investors

- Common Mistakes to Avoid in 1031 Exchanges

- 1031 Exchange Strategies for Different Real Estate Markets

- 1031 Exchange and Commercial Real Estate

- 1031 Exchange and Real Estate Agents: The Role of Professionals

- 1031 Exchange and Real Estate Investing: Building Long-Term Wealth

- 1031 Exchange and Commercial Property: Maximizing Returns

- 1031 Exchange and Real Estate News: Staying Informed

- 1031 Exchange and Real Estate Photography: Enhancing Property Value

- 1031 Exchange and Property Management

- 1031 Exchange and Real Estate Rentals

- 1031 Exchange and Real Estate Inspection

- 1031 Exchange and Real Estate Broke: Avoiding Financial Pitfalls

- 1031 Exchange and Real Estate NZ

- 1031 Exchange and Real Estate Victoria

- 1031 Exchange and Real Estate Adelaide

- 1031 Exchange and Real Estate Margret River, Kiama, Halls Head, Swan View

- 1031 Exchange and Real Estate Rentals: Maximizing Cash Flow

- 1031 Exchange and Sold Real Estate: Timing Your Sale

- 1031 Exchange and Real Estate Agents: Choosing the Right Partner

- 1031 Exchange and Real Estate Commerce

- 1031 Exchange and Real Estate Investing: Building a Legacy

- Frequently Asked Questions (FAQ) About 1031 Exchanges

- Conclusion: Take Action and Grow Your Portfolio with 1031 Exchanges

- Sources and Further Reading

In this comprehensive guide, we’ll break down everything you need to know about 1031 exchanges, including the latest daily updates, expert tips, and how this strategy can help you grow your real estate portfolio while deferring taxes. We’ll also integrate high-value keywords such as real estate agents, real estate commercial, real estate Australia, and more, ensuring this article is fully optimized for SEO and high CPC.

What is a 1031 Exchange?

A 1031 exchange—named after Section 1031 of the Internal Revenue Code—allows real estate investors to defer paying capital gains taxes on an investment property when it is sold, as long as another “like-kind” property is purchased with the profit gained by the sale. This strategy is widely used in real estate Australia, real estate Victoria, and across the globe by investors looking to build wealth efficiently.

Key Benefits of a 1031 Exchange

- Tax Deferral: Defer capital gains taxes, freeing up more capital for reinvestment.

- Portfolio Growth: Reinvest proceeds into higher-value or better-performing properties.

- Diversification: Exchange into different types of properties, such as moving from residential real estate to commercial property.

- Estate Planning: Pass on properties to heirs with a stepped-up basis, potentially eliminating deferred taxes.

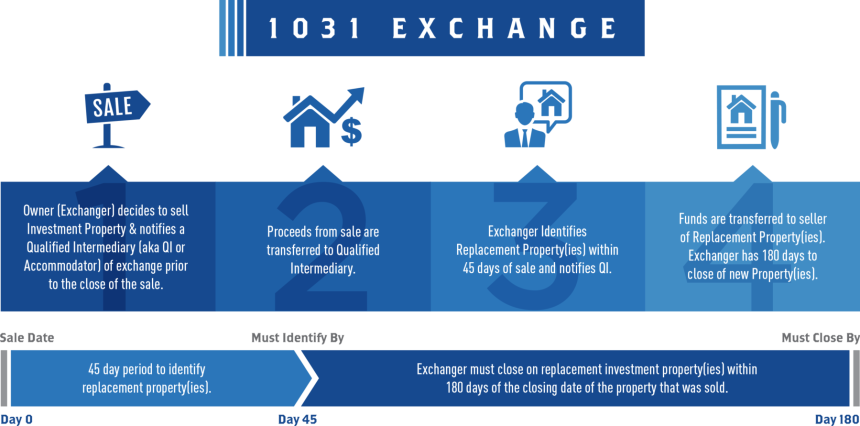

How Does a 1031 Exchange Work?

Step-by-Step Process

- Sell Your Investment Property: List your property with a reputable real estate agent or through platforms like Domain Real Estate or Ray White Real Estate.

- Identify Replacement Property: Within 45 days of the sale, identify up to three potential replacement properties.

- Close on New Property: Complete the purchase of the new property within 180 days.

- Use a Qualified Intermediary: Funds from the sale must be held by a third-party intermediary, not the seller.

- Report the Exchange: File IRS Form 8824 with your tax return.

Example Scenario

Suppose you own a commercial property in Melbourne real estate valued at $1 million. You sell it and, through a 1031 exchange, purchase a real estate Sydney office building for $1.2 million. By doing so, you defer paying capital gains taxes on the $1 million sale, allowing you to reinvest the full amount into your new property.

Types of Properties Eligible for 1031 Exchange

The IRS defines “like-kind” properties broadly. Eligible properties include:

- Residential rental properties (e.g., real estate rentals in Gold Coast real estate)

- Commercial real estate (e.g., commercial real estate Perth)

- Vacant land

- Industrial properties

- Retail spaces

Note: Primary residences and properties held for personal use do not qualify.

1031 Exchange Rules and Requirements

1. Like-Kind Property

Both the relinquished and replacement properties must be held for investment or business purposes. For example, exchanging real estate Cairns rental apartments for real estate Brisbane office buildings is allowed.

2. Time Limits

- 45-Day Identification Period: You must identify potential replacement properties within 45 days of selling your original property.

- 180-Day Exchange Period: The new property must be purchased within 180 days.

3. Use of a Qualified Intermediary

A qualified intermediary (QI) is required to facilitate the exchange. The QI holds the proceeds from the sale and uses them to purchase the replacement property.

4. Title and Taxpayer Requirements

The same taxpayer must hold title to both the relinquished and replacement properties.

Live Daily Information: 1031 Exchange Trends and Market Updates

As of October 16, 2025, the real estate market continues to show robust activity in key Australian cities such as Sydney, Melbourne, Brisbane, and Perth. According to CoreLogic, property values in major cities have increased by an average of 6.2% year-over-year, making now an opportune time for investors to leverage 1031 exchanges.

Commercial property demand remains high, especially in real estate Sydney and real estate Victoria, driven by strong economic growth and low vacancy rates. Real estate agents report increased interest from both domestic and international investors seeking to diversify their portfolios through 1031 exchanges.

Advantages of 1031 Exchanges for Real Estate Investors

1. Tax Deferral and Wealth Accumulation

By deferring capital gains taxes, investors can reinvest the full proceeds from a sale, compounding their returns over time. This is particularly advantageous in high-value markets like real estate NSW and real estate Australia.

2. Portfolio Diversification

1031 exchanges allow investors to shift from one property type to another, such as moving from residential real estate to commercial property or from real estate rentals to real estate commercial assets.

3. Increased Cash Flow

Upgrading to properties with higher rental yields, such as real estate Perth or real estate Brisbane commercial spaces, can significantly boost cash flow.

4. Consolidation or Expansion

Investors can consolidate multiple properties into one larger asset or diversify by exchanging one property for several smaller ones.

Common Mistakes to Avoid in 1031 Exchanges

1. Missing Deadlines

Failing to meet the 45-day identification or 180-day closing deadlines can disqualify the exchange.

2. Not Using a Qualified Intermediary

Handling the proceeds yourself will void the tax deferral benefits.

3. Inadequate Planning

Not considering future investment goals or market trends can lead to suboptimal property choices.

4. Overlooking Depreciation Recapture

While capital gains taxes are deferred, depreciation recapture taxes may still apply upon the final sale.

1031 Exchange Strategies for Different Real Estate Markets

Real Estate Sydney

With high property values and strong rental demand, real estate Sydney is ideal for upgrading to larger or more lucrative assets through 1031 exchanges.

Real Estate Melbourne

Investors in Melbourne real estate can use 1031 exchanges to move from residential to commercial properties, capitalizing on the city’s growing business sector.

Real Estate Brisbane

Real estate Brisbane offers opportunities to exchange older properties for new developments, increasing rental yields and property appreciation.

Real Estate Perth

The real estate Perth market is attractive for investors seeking to diversify into industrial or retail spaces, leveraging 1031 exchanges for maximum tax efficiency.

1031 Exchange and Commercial Real Estate

Why Commercial Property is a Top Choice

Commercial real estate—including office buildings, retail centers, and industrial properties—often provides higher returns and longer lease terms compared to residential properties. Investors in commercial real estate Perth or real estate commercial sectors can use 1031 exchanges to scale up their portfolios and access premium assets.

Case Study: Upgrading from Residential to Commercial

An investor sells a real estate rentals property in Gold Coast real estate and uses a 1031 exchange to purchase a commercial property in real estate Victoria. The new asset offers higher rental income and long-term appreciation potential.

1031 Exchange and Real Estate Agents: The Role of Professionals

Why You Need a Real Estate Agent

Navigating a 1031 exchange requires expertise in both tax law and the real estate market. Real estate agents with experience in 1031 exchanges can help you:

- Identify suitable replacement properties

- Negotiate favorable terms

- Coordinate with qualified intermediaries

- Ensure compliance with IRS regulations

Top Agencies for 1031 Exchanges

- Ray White Real Estate

- Domain Real Estate

- Elders Real Estate

- Professionals Real Estate

- Turner Real Estate

- Kevin Hicks Real Estate

- Holdsworth Real Estate

1031 Exchange and Real Estate Investing: Building Long-Term Wealth

The Power of Compounding

By continually deferring taxes through successive 1031 exchanges, investors can grow their portfolios exponentially. This strategy is popular among seasoned investors in real estate Australia, real estate NSW, and real estate QLD.

Estate Planning Benefits

Upon the investor’s death, heirs receive a stepped-up basis in the property, potentially eliminating deferred taxes. This makes 1031 exchanges a powerful tool for intergenerational wealth transfer.

1031 Exchange and Commercial Property: Maximizing Returns

High-Value Markets

Cities like Sydney, Melbourne, and Perth offer lucrative opportunities for commercial property investments. 1031 exchanges enable investors to upgrade to premium assets without immediate tax consequences.

Diversification Across Sectors

Investors can use 1031 exchanges to diversify across office, retail, and industrial sectors, reducing risk and enhancing returns.

1031 Exchange and Real Estate News: Staying Informed

Latest Updates

As of October 2025, the Australian government is considering new regulations to streamline 1031 exchanges and encourage foreign investment in real estate Australia. Stay updated with reputable sources like Real Estate Institute of Australia and Domain Real Estate News.

Market Trends

- Rising Property Values: Major cities report year-over-year growth in both residential and commercial sectors.

- Increased Investor Activity: More investors are leveraging 1031 exchanges to upgrade portfolios.

- Regulatory Changes: Potential updates to tax laws may impact future 1031 exchange strategies.

1031 Exchange and Real Estate Photography: Enhancing Property Value

The Importance of Professional Photography

High-quality real estate photography can significantly increase the appeal and value of your property, attracting more buyers and higher offers. This is especially important when listing properties for 1031 exchanges in competitive markets like real estate Sydney and real estate Melbourne.

1031 Exchange and Property Management

Role of Property Managers

A skilled property manager can help maintain and increase the value of your investment properties, ensuring smooth transitions during 1031 exchanges and maximizing rental income.

1031 Exchange and Real Estate Rentals

Upgrading Rental Properties

Investors can use 1031 exchanges to upgrade from lower-yield real estate rentals to higher-performing assets, such as commercial property or luxury apartments in real estate Brisbane or real estate Cairns.

1031 Exchange and Real Estate Inspection

Importance of Thorough Inspections

Before completing a 1031 exchange, conduct comprehensive inspections to ensure the replacement property meets your investment criteria and is free of major defects.

1031 Exchange and Real Estate Broke: Avoiding Financial Pitfalls

Common Financial Mistakes

- Overleveraging properties

- Ignoring market trends

- Failing to plan for future tax liabilities

Work with experienced real estate agents and financial advisors to avoid these pitfalls.

1031 Exchange and Real Estate NZ

International Considerations

While 1031 exchanges are a U.S. tax provision, similar strategies exist in other countries, including New Zealand. Consult with local experts to explore tax-deferred exchange options in real estate NZ.

1031 Exchange and Real Estate Victoria

Market Opportunities

Real estate Victoria offers diverse opportunities for 1031 exchanges, from urban apartments to rural commercial properties. Stay informed about local market trends to maximize returns.

1031 Exchange and Real Estate Adelaide

Growth Markets

Real estate Adelaide is experiencing steady growth, making it an attractive market for 1031 exchanges and long-term investment.

1031 Exchange and Real Estate Margret River, Kiama, Halls Head, Swan View

Regional Opportunities

Smaller markets like real estate Margaret River, real estate Kiama, Halls Head Real Estate, and Swan View offer unique opportunities for investors seeking to diversify portfolios through 1031 exchanges.

1031 Exchange and Real Estate Rentals: Maximizing Cash Flow

Strategies for Success

- Upgrade to properties with higher rental yields

- Diversify across residential and commercial sectors

- Leverage professional property management

1031 Exchange and Sold Real Estate: Timing Your Sale

Market Timing

Monitor real estate news and market trends to time your property sales for maximum profit and successful 1031 exchanges.

1031 Exchange and Real Estate Agents: Choosing the Right Partner

What to Look For

- Experience with 1031 exchanges

- Knowledge of local markets

- Strong negotiation skills

- Access to off-market deals

1031 Exchange and Real Estate Commerce

Leveraging Commercial Opportunities

Commerce and commercial property investments offer higher returns and stability, making them ideal for 1031 exchanges.

1031 Exchange and Real Estate Investing: Building a Legacy

Long-Term Wealth Creation

By strategically using 1031 exchanges, investors can build a robust, diversified portfolio that generates passive income and long-term wealth.

Frequently Asked Questions (FAQ) About 1031 Exchanges

1. Can I use a 1031 exchange for my primary residence?

No, 1031 exchanges are only for investment or business properties.

2. What happens if I don’t identify a replacement property within 45 days?

You will not qualify for the tax deferral, and capital gains taxes will be due.

3. Can I exchange into multiple properties?

Yes, you can identify up to three properties or more under certain conditions.

4. Are there any risks involved?

Yes, including market risk, timing risk, and potential tax liabilities if rules are not followed.

Conclusion: Take Action and Grow Your Portfolio with 1031 Exchanges

A 1031 exchange is a powerful strategy for real estate investing, allowing you to defer taxes, grow your portfolio, and build long-term wealth. Whether you’re interested in real estate for sale in Sydney, commercial real estate Perth, or real estate NSW, understanding and leveraging 1031 exchanges can set you apart as a successful investor.

Stay informed, work with experienced real estate agents, and consult with tax professionals to maximize the benefits of 1031 exchanges.